- Sweden

- /

- Diversified Financial

- /

- OM:INVE A

Is the Surge in Quarterly Profitability Shifting the Investment Case for Investor (OM:INVE A)?

Reviewed by Sasha Jovanovic

- Investor AB released its third-quarter and nine-month 2025 earnings, reporting SEK 16,271 million in sales and quarterly net income of SEK 59.83 billion, a very large increase compared to last year.

- An interesting detail is that while net income rose very sharply in the quarter, the nine-month figure declined compared to the prior year period.

- We’ll explore how the exceptional jump in quarterly profitability shapes Investor AB’s investment narrative going forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

What Is Investor's Investment Narrative?

To believe in Investor AB as a shareholder, one needs to have conviction in its portfolio approach to Swedish and international investments, its capability to deliver value even through market setbacks, and its strength in deploying capital efficiently. The recent surge in third-quarter net income, jumping to SEK 59.83 billion, may bring new attention to near-term catalysts, especially around asset valuations, portfolio rebalancing, and capital allocation decisions. However, with net income for the nine-month period still trailing the prior year, the most critical debate remains whether this exceptional quarterly result reflects a sustainable trend or a one-off event. Previous risks, like forecast earnings declines and revenue contraction, must now be reassessed for their relevance after the quarter’s sharp outperformance, even as structural concerns such as index removal and leadership changes persist. The net effect is that while short-term sentiment could improve, longer-term catalysts and risks are being re-weighted. On the other hand, board turnover remains a risk worth following.

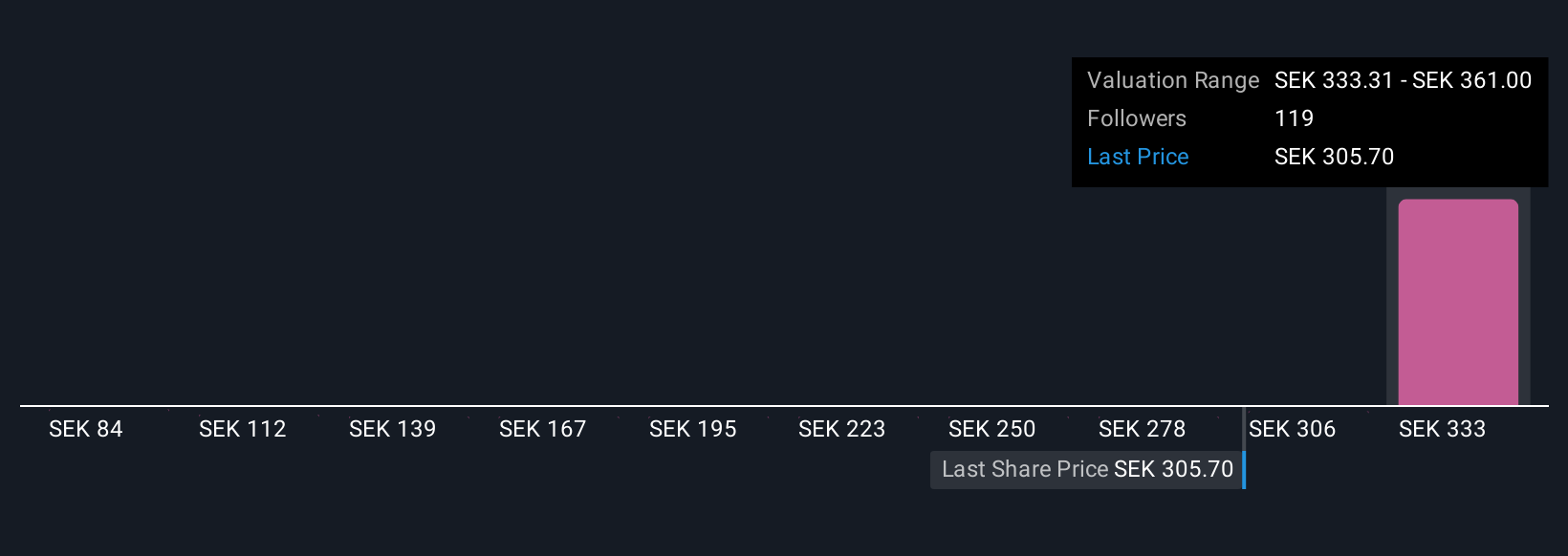

Investor's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 14 other fair value estimates on Investor - why the stock might be worth less than half the current price!

Build Your Own Investor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Investor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Investor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Investor's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:INVE A

Investor

A private equity firm specializing in mature, middle market, buyouts and growth capital investments.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives