- Sweden

- /

- Consumer Durables

- /

- OM:DUNI

Discovering Undiscovered Gems in Sweden This September 2024

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's recent rate cut, smaller-cap indices like the Russell 2000 have shown resilience, despite remaining below their all-time highs. This broader market sentiment presents a unique opportunity for investors to explore lesser-known stocks in Sweden that might benefit from these shifting economic conditions. In this environment, identifying promising stocks often involves looking for companies with strong fundamentals and growth potential that can capitalize on favorable market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| Firefly | NA | 16.04% | 32.29% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Svolder | NA | -22.68% | -24.17% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 30.31% | -9.00% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Clas Ohlson (OM:CLAS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Clas Ohlson AB (publ) is a retail company that sells hardware, electrical, multimedia, home, and leisure products in Sweden, Norway, Finland, and internationally with a market cap of SEK10.71 billion.

Operations: Clas Ohlson AB (publ) generates revenue primarily from its retail segment, amounting to SEK10.66 billion. The company's net profit margin stands at 4.2%.

Clas Ohlson has shown impressive performance, with earnings growing by 282% over the past year, significantly outpacing the Specialty Retail industry’s 21%. The company repurchased shares in 2024 and is debt-free, compared to a debt-to-equity ratio of 6.5% five years ago. Recent financial results highlight a net income of SEK 145.8 million for Q1 FY2024 versus a net loss of SEK 26.4 million last year. Additionally, it trades at good value relative to peers and industry standards.

- Unlock comprehensive insights into our analysis of Clas Ohlson stock in this health report.

Gain insights into Clas Ohlson's past trends and performance with our Past report.

Duni (OM:DUNI)

Simply Wall St Value Rating: ★★★★★★

Overview: Duni AB (publ) develops, manufactures, and sells concepts and products for the serving, take-away, and packaging of meals in Sweden and internationally with a market cap of SEK4.87 billion.

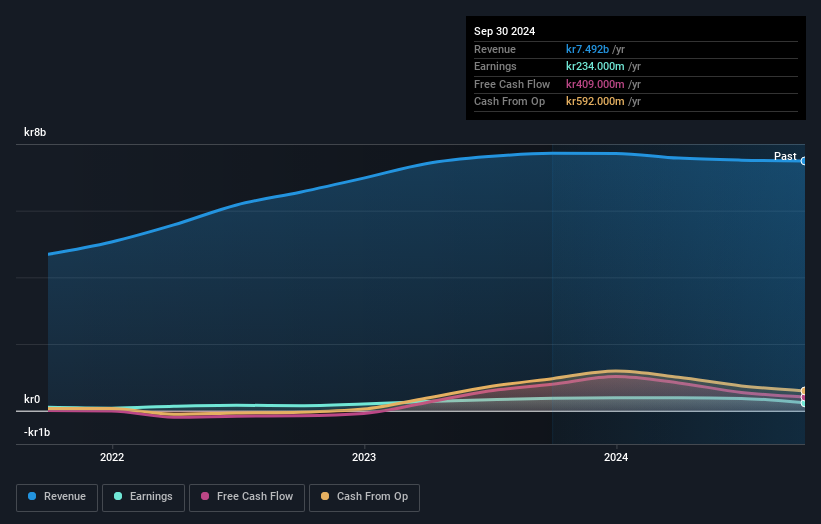

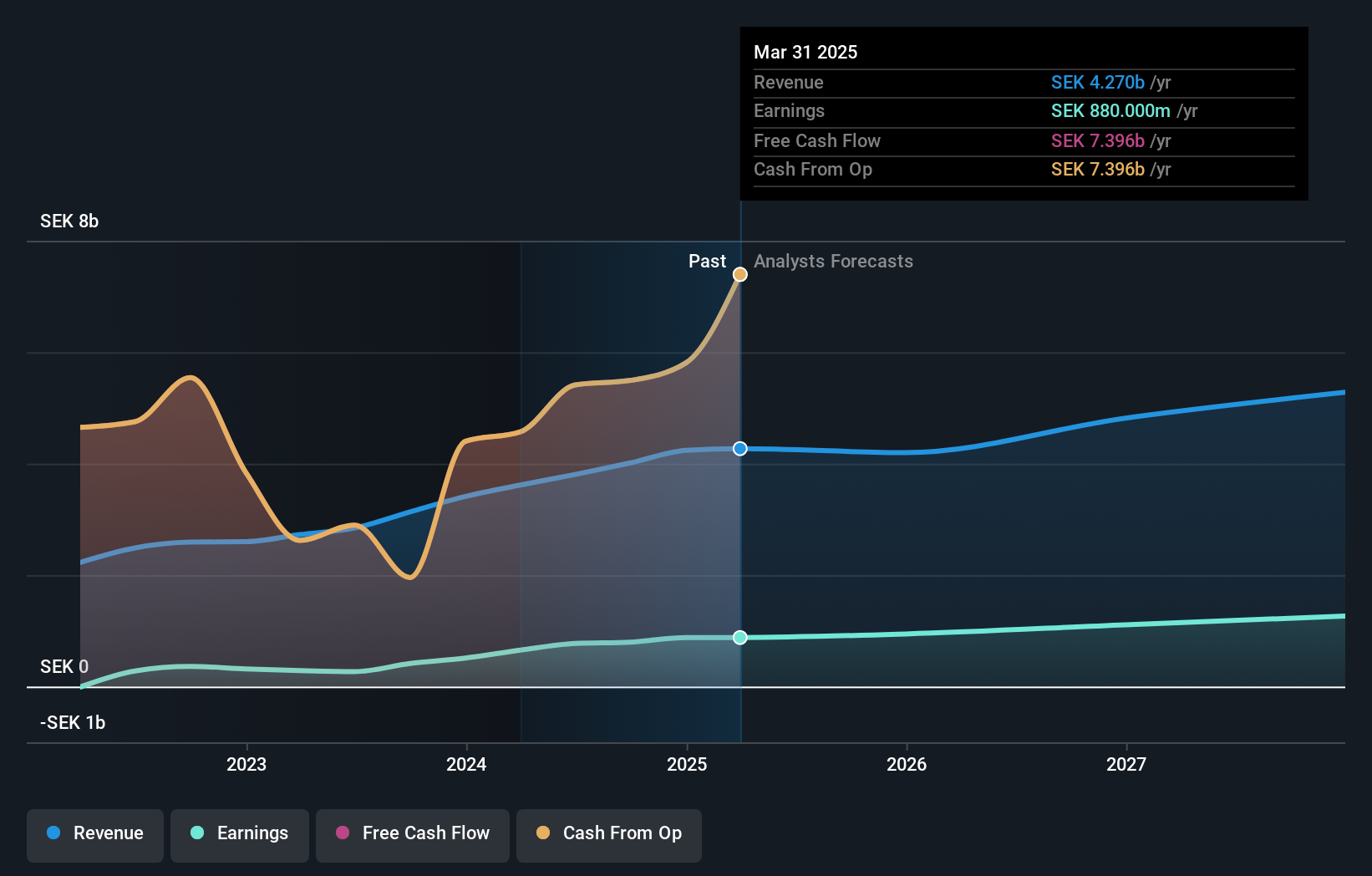

Operations: Duni generates revenue primarily from dining solutions (SEK 4.52 billion) and food packaging solutions (SEK 3.05 billion).

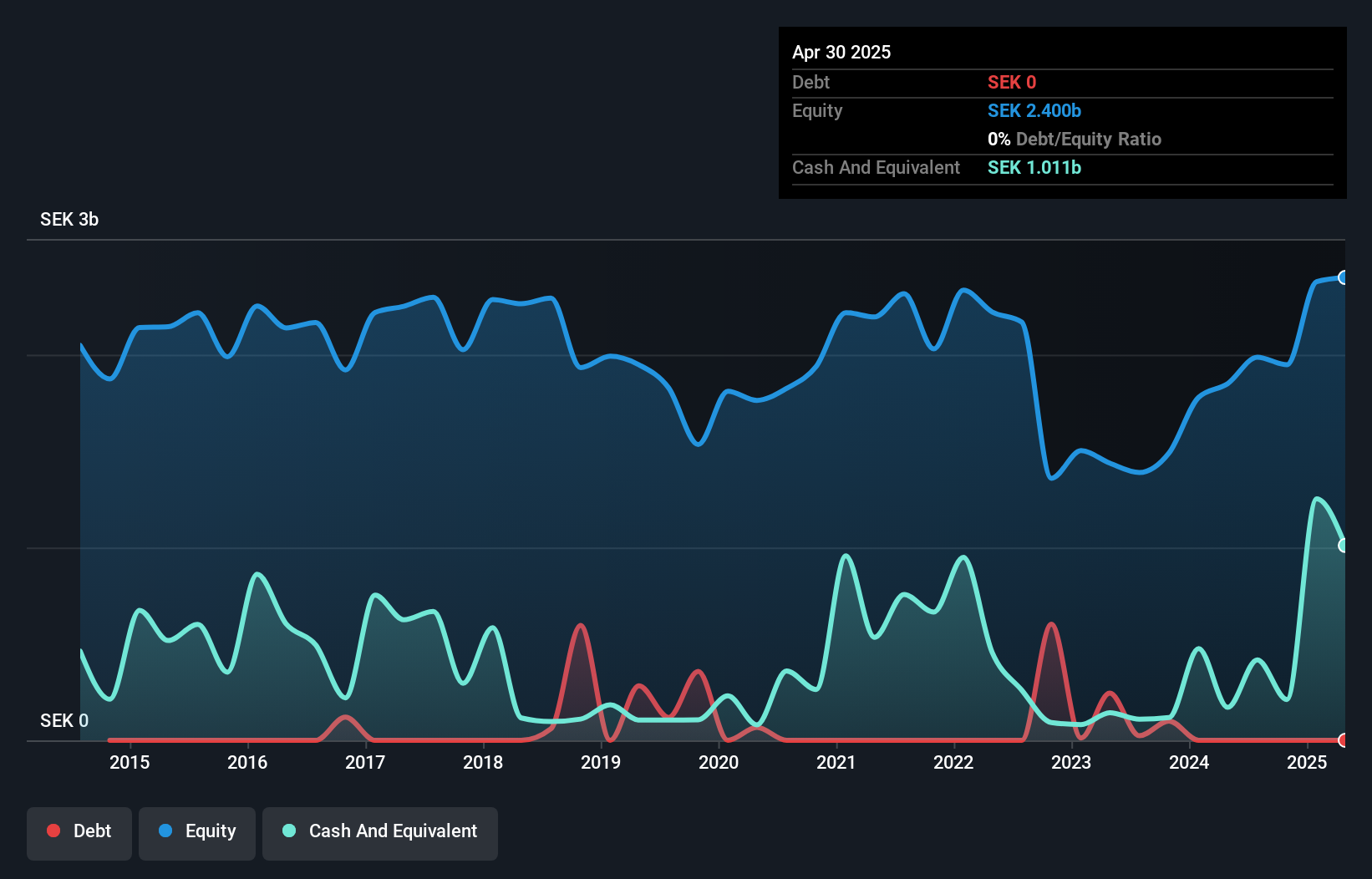

Duni's debt to equity ratio has improved from 60.7% to 29.3% in five years, reflecting strong financial management. The company’s EBIT covers interest payments 11.2 times, indicating robust earnings quality. Trading at 54.7% below its estimated fair value, Duni shows potential for undervaluation gains. Recent plans to establish a new warehouse hub in Meppen, Germany aim to enhance logistics efficiency and competitiveness by partnering with CEVA Logistics, affecting around 220 employees by 2026.

- Click here and access our complete health analysis report to understand the dynamics of Duni.

Review our historical performance report to gain insights into Duni's's past performance.

Hoist Finance (OM:HOFI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hoist Finance AB (publ) is a credit market company specializing in loan acquisition and management across Europe, with a market cap of SEK7.60 billion.

Operations: Hoist Finance generates revenue primarily from its unsecured loan segment (SEK2.86 billion) and secured loans (SEK821 million). The company also reports group items contributing SEK255 million to its total revenue.

Hoist Finance, a notable player in the Swedish financial sector, has shown impressive growth with earnings surging by 210.8% over the past year. The company’s net debt to equity ratio stands at 96.8%, which is high but has improved from 136.1% five years ago. Recently, Hoist issued SEK 1.25 billion in bonds and expanded its savings offerings to Ireland and Austria under HoistSpar, diversifying its funding sources further.

Make It Happen

- Discover the full array of 58 Swedish Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:DUNI

Duni

Develops, manufactures, and sells concepts and products for the serving, take-away, and packaging of meals in Sweden, Poland and internationally.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives