- Sweden

- /

- Trade Distributors

- /

- OM:OEM B

Discovering Three Undiscovered Gems In Sweden

Reviewed by Simply Wall St

As global markets respond to anticipated interest rate cuts and European indices show positive momentum, Sweden's Riksbank has also reduced borrowing costs, signaling a favorable environment for small-cap stocks. In this context, identifying undiscovered gems in Sweden can be particularly rewarding for investors seeking opportunities in a shifting economic landscape. A good stock in these conditions often exhibits strong fundamentals, growth potential, and resilience to market fluctuations—qualities that align well with the current trend of easing monetary policies and improving investor sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In Sweden

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Softronic | NA | 3.58% | 7.41% | ★★★★★★ |

| Duni | 29.33% | 10.78% | 22.98% | ★★★★★★ |

| Bahnhof | NA | 9.02% | 15.02% | ★★★★★★ |

| AB Traction | NA | 5.38% | 5.19% | ★★★★★★ |

| Firefly | NA | 15.90% | 31.36% | ★★★★★★ |

| Creades | NA | -28.54% | -27.09% | ★★★★★★ |

| Byggmästare Anders J Ahlström Holding | NA | 33.57% | -9.00% | ★★★★★★ |

| Linc | NA | 56.01% | 0.54% | ★★★★★★ |

| AQ Group | 7.30% | 14.89% | 22.26% | ★★★★★★ |

| Solid Försäkringsaktiebolag | NA | 7.64% | 28.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

engcon (OM:ENGCON B)

Simply Wall St Value Rating: ★★★★★☆

Overview: engcon AB (publ) designs, produces, and sells excavator tools globally, with a market cap of SEK17.49 billion.

Operations: The company generates revenue primarily from the sale of construction machinery and equipment, totaling SEK1.54 billion. Its net profit margin stands at 14.3%.

Engcon reported SEK 450 million in Q2 sales, down from SEK 508 million a year ago, with net income at SEK 55 million compared to SEK 83 million. The company’s profit margin dropped to 9.9% from last year's 18%. Despite negative earnings growth of -60.6%, their EBIT covers interest payments by over 20 times, and they maintain a satisfactory net debt to equity ratio of 8.5%. Future earnings are forecasted to grow nearly 44% annually.

- Click to explore a detailed breakdown of our findings in engcon's health report.

Understand engcon's track record by examining our Past report.

Hoist Finance (OM:HOFI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hoist Finance AB (publ) is a credit market company that specializes in loan acquisition and management operations across Europe, with a market cap of approximately SEK6.61 billion.

Operations: Revenue streams for Hoist Finance AB (publ) include SEK 2.86 billion from unsecured loans and SEK 821 million from secured loans, with additional contributions of SEK 255 million from group items.

Hoist Finance, a notable player in consumer finance, has seen its earnings grow by 210.8% over the past year, outpacing the industry average of -2.1%. The company's net debt to equity ratio stands at 96.8%, which is high but has improved from 136.1% five years ago. Recently, Hoist launched its HoistSpar savings offering in Ireland and Austria, expanding its retail deposit base across Europe. Additionally, it commenced a share repurchase program worth SEK 100 million to enhance shareholder value and manage capital structure effectively.

- Take a closer look at Hoist Finance's potential here in our health report.

Gain insights into Hoist Finance's historical performance by reviewing our past performance report.

OEM International (OM:OEM B)

Simply Wall St Value Rating: ★★★★★★

Overview: OEM International AB (publ), together with its subsidiaries, provides products and systems for industrial applications, with a market cap of SEK17.16 billion.

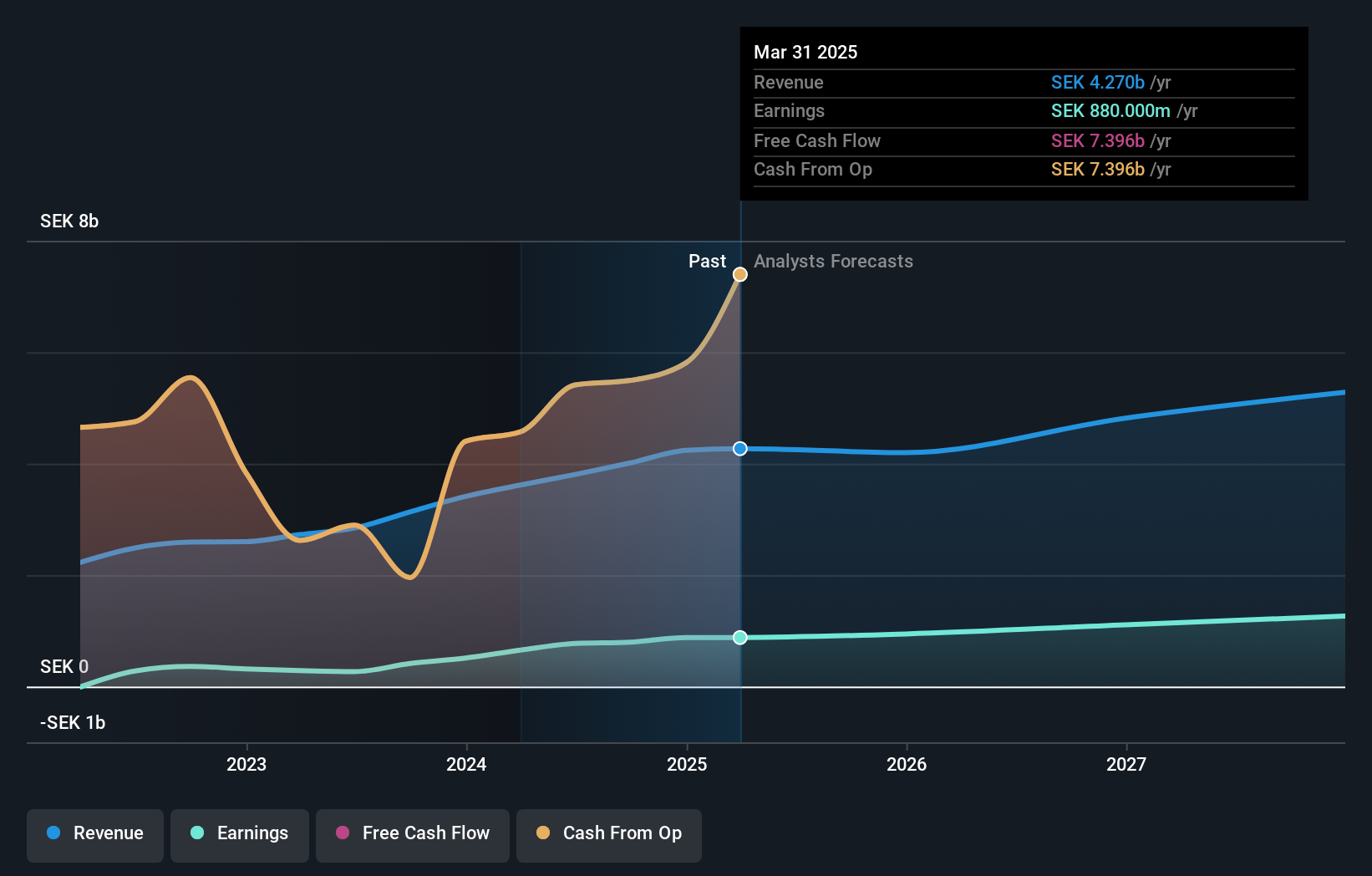

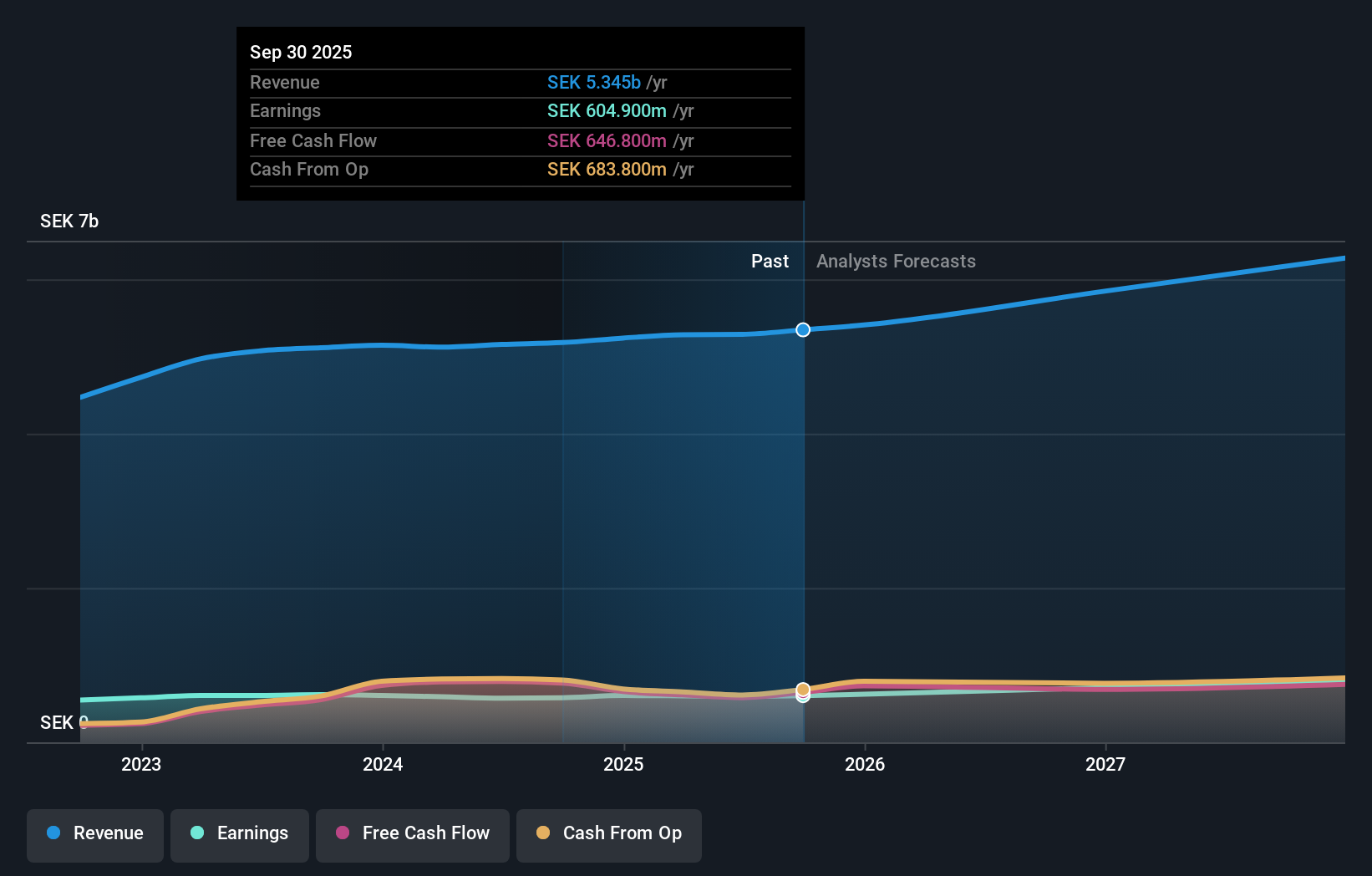

Operations: The company generates revenue primarily from Sweden (SEK3.28 billion), Finland, The Baltic States, and China (SEK1.05 billion), and Denmark, Norway, the British Isles, and East Central Europe (SEK1.20 billion). Segment adjustments amount to SEK136.10 million while eliminations are -SEK504.60 million.

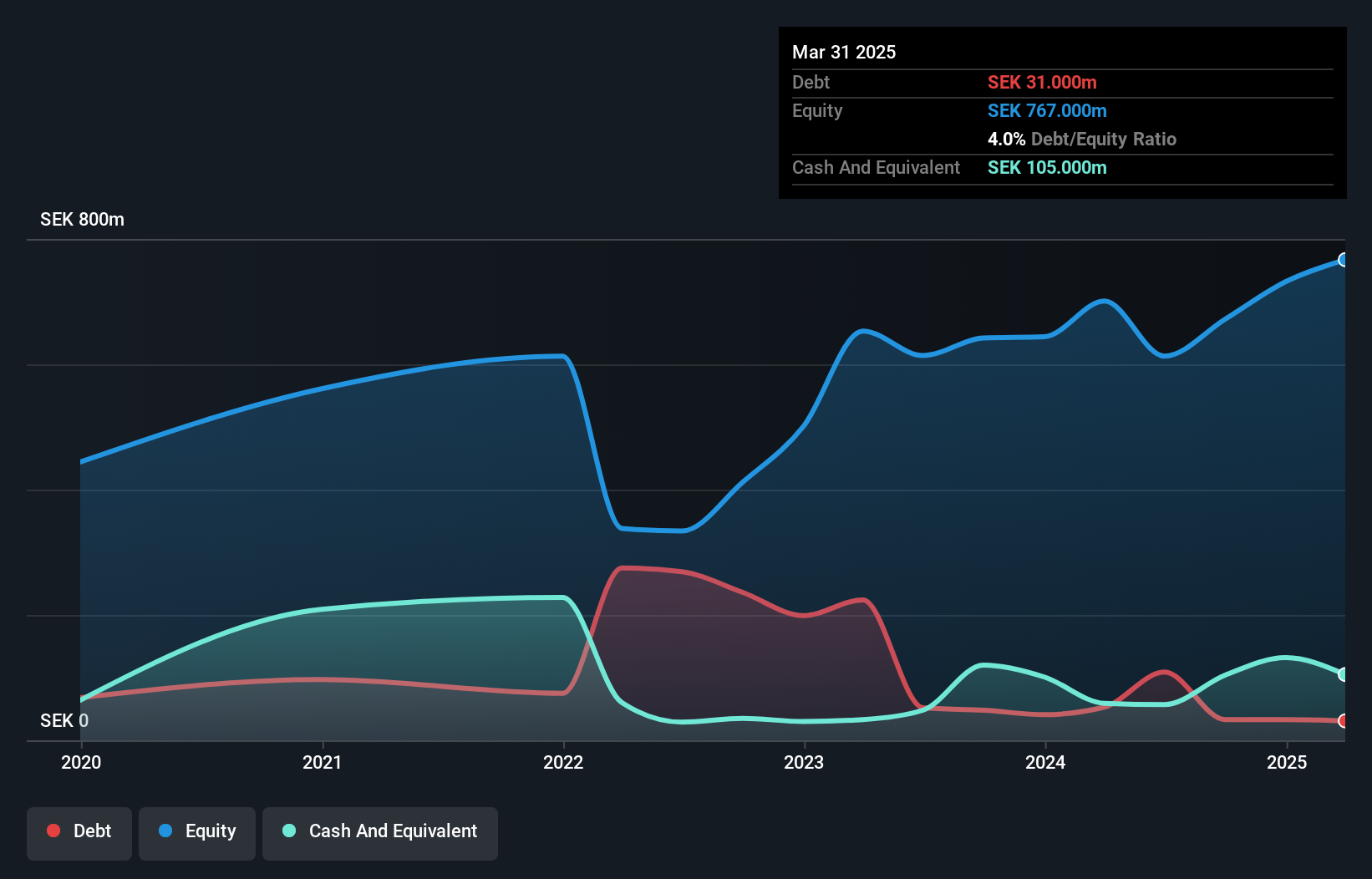

OEM International has shown a significant reduction in its debt to equity ratio from 29.7% to 2% over the past five years, indicating improved financial health. Despite trading at 59.4% below its estimated fair value, the company has more cash than total debt and is profitable with high-quality earnings. However, it reported negative earnings growth of -5.9% last year and experienced significant insider selling recently. For Q2 2024, OEM's sales reached SEK 1,331 million with net income at SEK 139 million compared to SEK 157 million a year ago.

- Click here to discover the nuances of OEM International with our detailed analytical health report.

Examine OEM International's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Reveal the 55 hidden gems among our Swedish Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:OEM B

OEM International

Provides products and systems for industrial applications.

Flawless balance sheet average dividend payer.