- Sweden

- /

- Consumer Finance

- /

- OM:HOFI

3 Undervalued Small Caps In Global With Recent Insider Buying

Reviewed by Simply Wall St

In recent weeks, global markets have been navigating a complex landscape marked by escalating geopolitical tensions in the Middle East and fluctuating trade policies, leading to declines in smaller-cap indexes like the S&P MidCap 400 and Russell 2000. Despite these challenges, positive economic indicators such as improved small business optimism and consumer sentiment suggest potential opportunities within the small-cap sector. In this environment, identifying stocks with strong fundamentals and insider confidence can be particularly appealing for investors looking to capitalize on market volatility.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Nexus Industrial REIT | 6.5x | 2.9x | 20.15% | ★★★★★☆ |

| AKVA group | 17.1x | 0.8x | 49.95% | ★★★★★☆ |

| Tristel | 28.0x | 3.9x | 13.01% | ★★★★☆☆ |

| Information Services | 21.8x | 2.4x | 48.75% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.8x | 38.06% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.6x | 37.90% | ★★★★☆☆ |

| Italmobiliare | 11.4x | 1.5x | -206.30% | ★★★☆☆☆ |

| Fuller Smith & Turner | 11.8x | 0.9x | -30.65% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.7x | 1.8x | 9.99% | ★★★☆☆☆ |

| AInnovation Technology Group | NA | 2.3x | 47.59% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

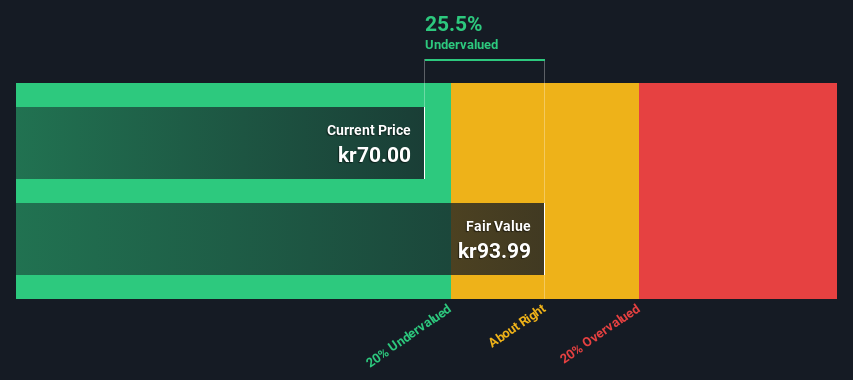

Hoist Finance (OM:HOFI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hoist Finance is a financial services company specializing in the acquisition and management of non-performing loan portfolios, with a market capitalization of approximately SEK 2.19 billion.

Operations: Hoist Finance generates revenue primarily from its unsecured and secured segments, with a notable emphasis on unsecured assets. The company has experienced fluctuations in its net income margin, which reached 20.63% as of March 2025, indicating variability in profitability over time. Operating expenses are a significant component of costs, with general and administrative expenses being a considerable portion.

PE: 9.4x

Hoist Finance, a smaller company in the financial sector, recently saw insider confidence with Lars Wollung purchasing 518,270 shares for SEK 36.98 million between July and December 2024. Despite high debt levels and reliance on external borrowing, they reported Q1 2025 net income of SEK 203 million. The company completed a share repurchase program worth SEK 99.93 million last year and approved a dividend of SEK 2 per share in May 2025, indicating potential growth prospects amidst challenges.

- Delve into the full analysis valuation report here for a deeper understanding of Hoist Finance.

Assess Hoist Finance's past performance with our detailed historical performance reports.

Stendörren Fastigheter (OM:STEF B)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Stendörren Fastigheter is a Swedish real estate company focused on the acquisition, development, and management of industrial and commercial properties, with a market capitalization of approximately SEK 4.33 billion.

Operations: The company generates revenue primarily from its real estate segment, with a recent figure of SEK 927 million. Over time, the gross profit margin has shown variability, reaching as high as 79.83%. Operating expenses are a significant part of the cost structure, recently recorded at SEK 89 million. Non-operating expenses have also impacted net income margins significantly in various periods.

PE: 19.0x

Stendörren Fastigheter, a company with a focus on real estate, recently showcased insider confidence through share purchases in the past quarter. Despite interest payments not being well covered by earnings and reliance on external borrowing for funding, the firm has forecasted earnings growth of 20.05% annually. Recent strategic moves include issuing SEK 500 million in senior unsecured green notes and completing a SEK 300 million follow-on equity offering. These actions highlight their proactive approach to managing debt while expanding operations through acquisitions and new leases, positioning them for potential future growth within the sector.

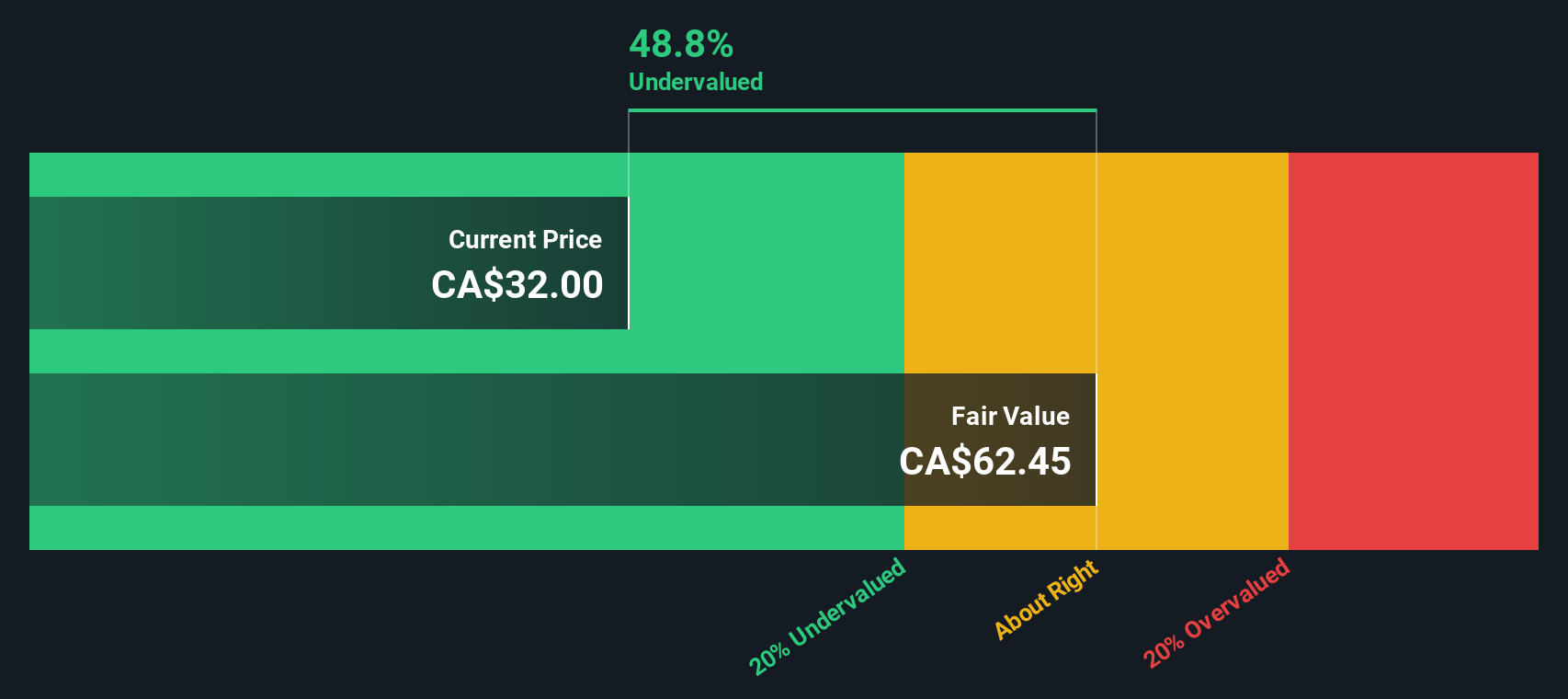

Information Services (TSX:ISC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Information Services is a company that provides registry operations, services, and technology solutions with a market cap of CA$0.38 billion.

Operations: The company's revenue streams are primarily from Registry Operations, Services, and Technology Solutions. Over recent periods, the gross profit margin has shown a general trend around 74% to 76%, reflecting the company's ability to manage costs relative to its revenue. Operating expenses include significant allocations for General & Administrative expenses and D&A, impacting net income margins which have varied between approximately 8% and 19%.

PE: 21.8x

Information Services, a smaller company in its sector, is navigating a dynamic landscape with recent strategic moves. The company announced a share repurchase program to buy back up to 929,007 Class A shares by June 2026. This move reflects insider confidence in the company's prospects. Despite high debt levels and reliance on external borrowing, ISC's revenue is projected to grow at 9.4% annually. Recent earnings showed improvement with net income rising to CAD 7.49 million for Q1 2025 from CAD 0.423 million last year, indicating potential growth opportunities ahead despite financial risks associated with its funding structure.

- Navigate through the intricacies of Information Services with our comprehensive valuation report here.

Gain insights into Information Services' past trends and performance with our Past report.

Turning Ideas Into Actions

- Explore the 174 names from our Undervalued Global Small Caps With Insider Buying screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hoist Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HOFI

Hoist Finance

A credit market company, engages in the loan acquisition and management operations in Europe.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives