- Sweden

- /

- Capital Markets

- /

- OM:OODA

Positive Sentiment Still Eludes EPTI AB (STO:EPTI) Following 29% Share Price Slump

To the annoyance of some shareholders, EPTI AB (STO:EPTI) shares are down a considerable 29% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 86% loss during that time.

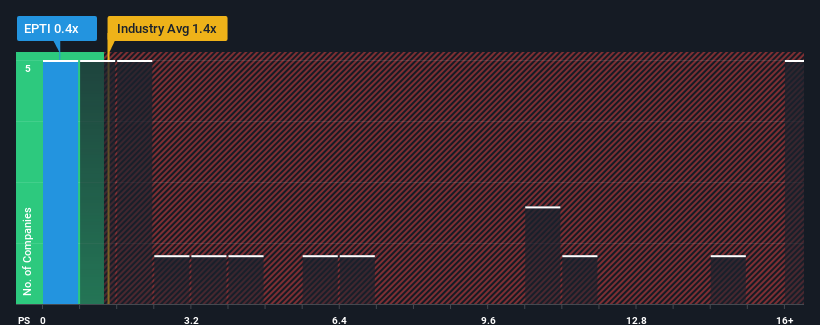

Since its price has dipped substantially, EPTI may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Capital Markets industry in Sweden have P/S ratios greater than 1.4x and even P/S higher than 12x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for EPTI

What Does EPTI's P/S Mean For Shareholders?

Recent times have been quite advantageous for EPTI as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on EPTI will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on EPTI's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For EPTI?

The only time you'd be truly comfortable seeing a P/S as low as EPTI's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 110%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 52%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that EPTI's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On EPTI's P/S

EPTI's recently weak share price has pulled its P/S back below other Capital Markets companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of EPTI revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

There are also other vital risk factors to consider and we've discovered 4 warning signs for EPTI (3 are concerning!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if oodash Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:OODA

oodash Group

Focuses on artificial intelligence (AI) and software-as-a-service (SaaS) primarily in business intelligence and data security.

Flawless balance sheet moderate.

Market Insights

Community Narratives