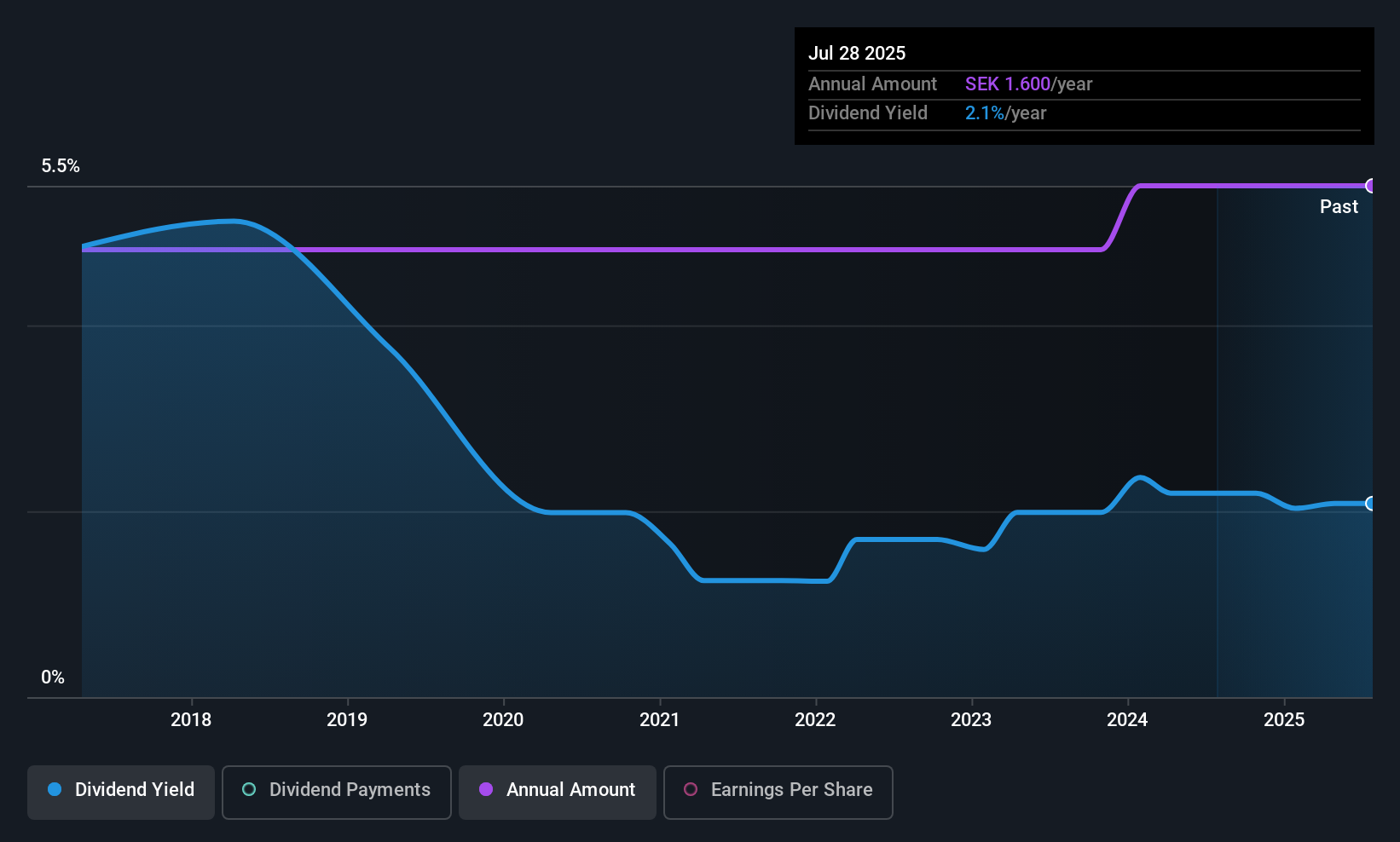

The board of Creades AB (STO:CRED A) has announced that it will pay a dividend on the 3rd of November, with investors receiving SEK0.40 per share. This means that the annual payment will be 2.1% of the current stock price, which is in line with the average for the industry.

Creades' Projected Earnings Seem Likely To Cover Future Distributions

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Based on the last payment, Creades was paying only paying out a fraction of earnings, but the payment was a massive 168% of cash flows. The business might be trying to strike a balance between returning cash to shareholders and reinvesting back into the business, but this high of a payout ratio could definitely force the dividend to be cut if the company runs into a bit of a tough spot.

EPS is set to fall by 6.3% over the next 12 months if recent trends continue. If the dividend continues along recent trends, we estimate the payout ratio could be 19%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Check out our latest analysis for Creades

Creades Doesn't Have A Long Payment History

Even though the company has been paying a consistent dividend for a while, we would like to see a few more years before we feel comfortable relying on it. Since 2016, the dividend has gone from SEK1.40 total annually to SEK1.60. This means that it has been growing its distributions at 1.5% per annum over that time. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth May Be Hard To Come By

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. In the last five years, Creades' earnings per share has shrunk at approximately 6.3% per annum. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

The Dividend Could Prove To Be Unreliable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Creades' payments, as there could be some issues with sustaining them into the future. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We don't think Creades is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 2 warning signs for Creades (of which 1 is potentially serious!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CRED A

Creades

A private equity and venture capital investment firm specializing in early, mid & late venture, emerging growth, middle market, growth capital and buyout investments.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives