- Sweden

- /

- Capital Markets

- /

- OM:CASE

Case Group AB (publ) (STO:CASE) Soars 38% But It's A Story Of Risk Vs Reward

Despite an already strong run, Case Group AB (publ) (STO:CASE) shares have been powering on, with a gain of 38% in the last thirty days. Unfortunately, despite the strong performance over the last month, the full year gain of 5.3% isn't as attractive.

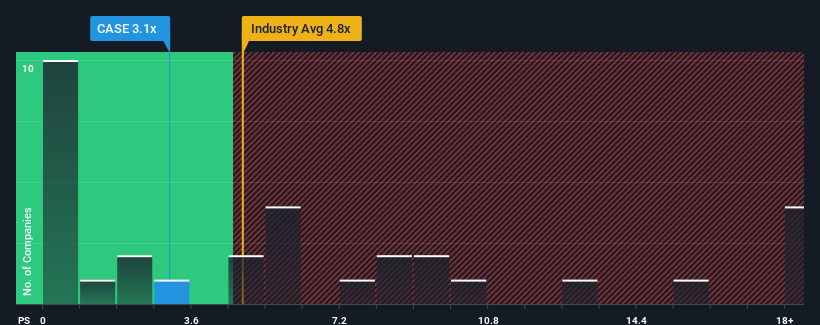

Although its price has surged higher, Case Group's price-to-sales (or "P/S") ratio of 3.1x might still make it look like a buy right now compared to the Capital Markets industry in Sweden, where around half of the companies have P/S ratios above 4.8x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Case Group

How Has Case Group Performed Recently?

Case Group certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. Those who are bullish on Case Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Case Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Case Group's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 128% last year. The strong recent performance means it was also able to grow revenue by 70% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 19% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, we find it intriguing that Case Group's P/S falls short of its industry peers. It may be that most investors are not convinced the company can maintain recent growth rates.

The Bottom Line On Case Group's P/S

The latest share price surge wasn't enough to lift Case Group's P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Case Group currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

Plus, you should also learn about these 5 warning signs we've spotted with Case Group (including 3 which are concerning).

If you're unsure about the strength of Case Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CASE

Case Group

Provides wealth management services for private clients in Sweden.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives