Undiscovered European Gems With Potential To Watch In March 2025

Reviewed by Simply Wall St

As European markets grapple with the implications of U.S. trade tariffs and fluctuating monetary policies, the pan-European STOXX Europe 600 Index recently ended 1.23% lower, reflecting broader concerns about economic growth and policy uncertainties. In this environment, investors may find value in identifying stocks that demonstrate resilience and adaptability to navigate these challenges, making them potential gems worth watching amidst market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 410.88% | 4.14% | 7.22% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

AQ Group (OM:AQ)

Simply Wall St Value Rating: ★★★★★★

Overview: AQ Group AB (publ) is a company that manufactures and sells components and systems for industrial customers across Sweden, other European countries, and internationally, with a market capitalization of approximately SEK16.17 billion.

Operations: AQ Group AB generates revenue primarily from its Component segment, contributing SEK7.75 billion, and the System segment, which adds SEK1.49 billion. The company's market capitalization stands at approximately SEK16.17 billion.

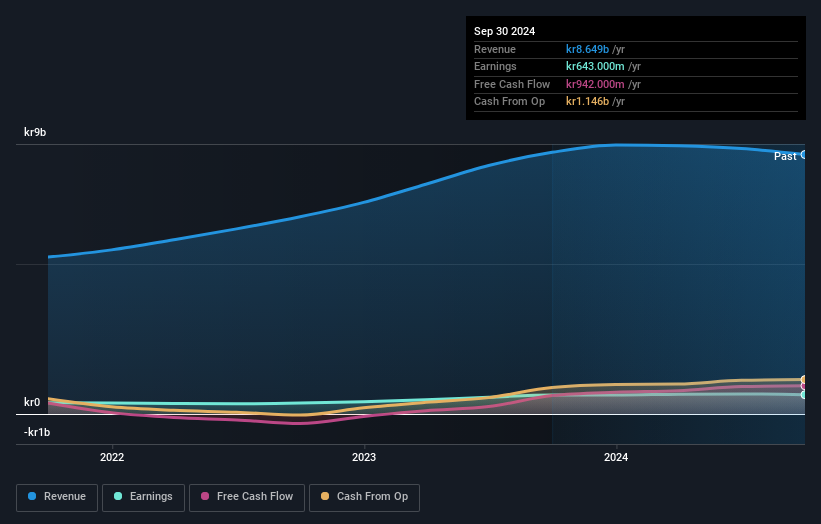

AQ Group, a promising player in the European market, has demonstrated notable resilience with earnings growth of 5.2% over the past year, outpacing the electrical industry's -23.9%. The company’s debt-to-equity ratio impressively decreased from 30.2% to 14.4% over five years, highlighting improved financial health. Recent earnings revealed a net income increase to SEK 155 million from SEK 134 million year-over-year, despite sales dipping slightly to SEK 8.55 billion annually from SEK 8.97 billion previously. With strategic acquisitions and an EBIT interest coverage of 56 times, AQ is poised for expansion in electrification and med-tech sectors while maintaining high-quality earnings.

SkiStar (OM:SKIS B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SkiStar AB (publ) owns and operates Alpine ski resorts in Sweden and Norway, with a market capitalization of approximately SEK13.33 billion.

Operations: SkiStar generates revenue primarily from its Alpine ski resorts in Sweden and Norway. The company focuses on multiple income streams, including lift passes, accommodation, ski rentals, and retail operations. It is important to note that SkiStar's financial performance is influenced by seasonal variations inherent in the ski industry.

SkiStar, a notable player in the European alpine ski resort scene, has shown robust financial health with earnings growing 15.4% annually over five years and a debt-to-equity ratio dropping from 47.6% to 18%. The company's EBIT covers interest payments at a solid 5.8 times, indicating strong profitability. Recent earnings reflect positive momentum with net income rising to SEK 928 million from SEK 817 million year-over-year for the second quarter. SkiStar's shares trade slightly below fair value estimates, reflecting potential investment appeal amidst strategic expansions in infrastructure and retail segments aimed at enhancing customer experiences across its resorts in Sweden and Norway.

Steyr Motors (XTRA:4X0)

Simply Wall St Value Rating: ★★★★★★

Overview: Steyr Motors AG specializes in manufacturing and selling diesel engines for commercial and military vehicles globally, with a market capitalization of €369.20 million.

Operations: The company's revenue is primarily derived from the sale of diesel engines for both commercial and military vehicles on a global scale. It operates with a market capitalization of €369.20 million, focusing on expanding its reach in these sectors.

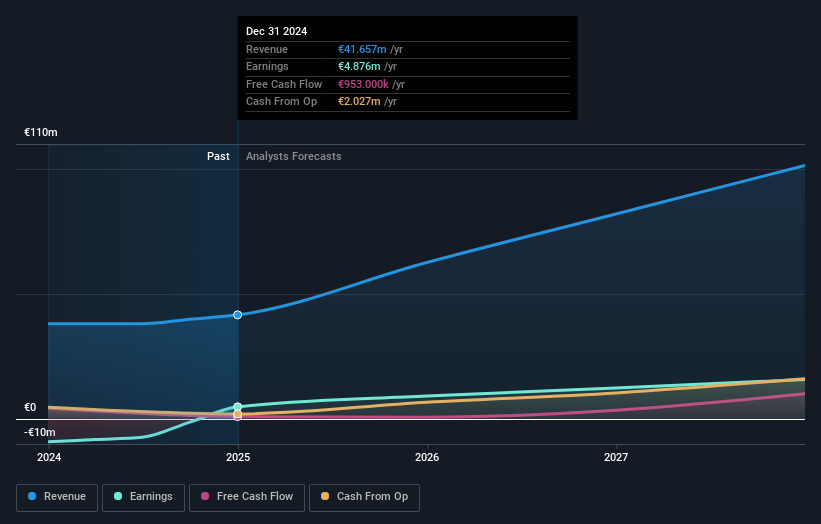

Steyr Motors, a niche player in the engine manufacturing sector, has recently drawn attention due to its strategic expansion and growth prospects. The company became profitable this year and forecasts earnings growth of 34% annually. Trading at roughly 53% below its estimated fair value, Steyr seems positioned for potential appreciation. Recent developments include a significant framework agreement with a Brazilian client and new distribution deals across Asia and the Americas, reflecting confidence in its innovative technology. Additionally, Mutares SE plans to reduce its stake amid strong demand for Steyr shares but will remain a major shareholder.

- Dive into the specifics of Steyr Motors here with our thorough health report.

Assess Steyr Motors' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Access the full spectrum of 356 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:4X0

Steyr Motors

Manufactures and sells diesel engines for commercial and military vehicles worldwide.

Exceptional growth potential with flawless balance sheet.