- Sweden

- /

- Hospitality

- /

- OM:SKIS B

Exploring 3 Undiscovered Gems In The European Market

Reviewed by Simply Wall St

As the European markets experience a positive upswing, with the pan-European STOXX Europe 600 Index climbing 3.44% amid easing tariff concerns and economic growth in the eurozone doubling its previous rate, investors are increasingly turning their attention to small-cap stocks that may have been overlooked. In this environment of renewed optimism and rising indices, identifying promising companies requires a keen eye for those with strong fundamentals and potential for growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 5.17% | -13.11% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine Société coopérative (ENXTPA:CIV)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine Société coopérative is a financial institution offering banking services in France, with a market capitalization of €467.27 million.

Operations: The primary revenue stream for Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine comes from its retail banking segment, generating €264.58 million.

Caisse régionale de Crédit Agricole Mutuel d'Ille-et-Vilaine, a cooperative bank with €20.9B in assets and €2.4B equity, is trading at 24.8% below its estimated fair value, suggesting potential undervaluation. Its robust financial health is reflected in total deposits of €17.5B against loans of €17.4B and an appropriate bad loan ratio of 1.4%. The company also boasts a sufficient allowance for bad loans at 122% and has seen earnings grow by 6.2%, outpacing the industry growth rate of 3.3%. With primarily low-risk funding sources, it presents a stable investment profile.

Cloetta (OM:CLA B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cloetta AB (publ) is a confectionery company with a market capitalization of approximately SEK8.23 billion.

Operations: Cloetta generates revenue primarily from two segments: packaged branded goods, contributing SEK6.22 billion, and pick & mix, generating SEK2.39 billion.

Cloetta, a small player in the confectionery sector, has seen its debt to equity ratio improve from 63.8% to 44.6% over five years, indicating stronger financial health. The company’s interest payments are comfortably covered by EBIT at 5.2 times, reflecting solid operational efficiency. Trading at a significant discount of 54.6% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. Despite earnings growth of 9.2% not surpassing the industry average last year, Cloetta's profitability and positive free cash flow provide a stable foundation for future growth prospects in this competitive market segment.

- Take a closer look at Cloetta's potential here in our health report.

Gain insights into Cloetta's historical performance by reviewing our past performance report.

SkiStar (OM:SKIS B)

Simply Wall St Value Rating: ★★★★☆☆

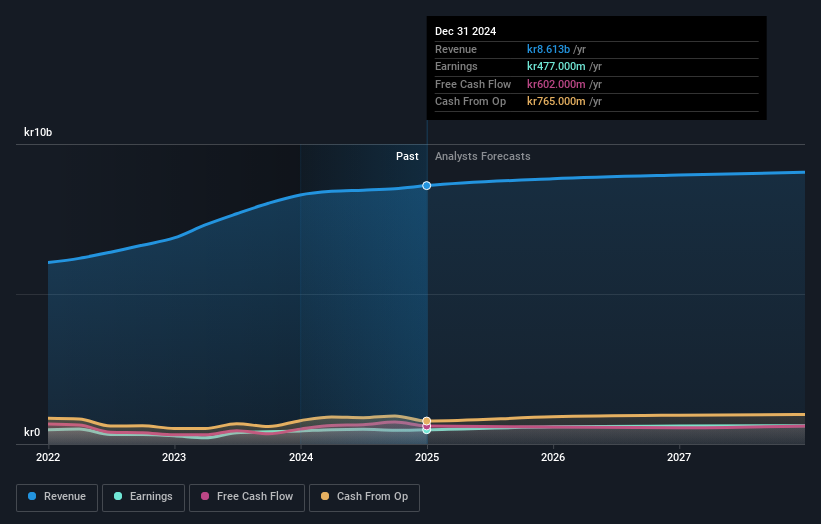

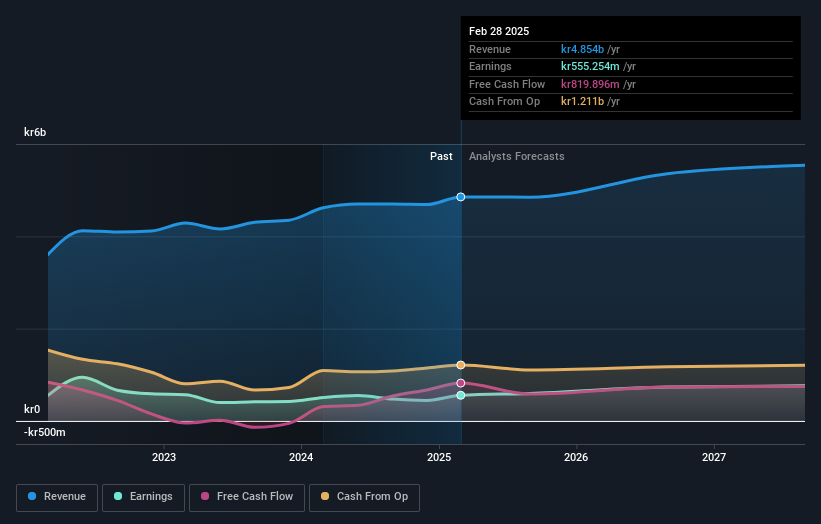

Overview: SkiStar AB (publ) is a company that owns and operates Alpine ski resorts in Sweden and Norway, with a market capitalization of approximately SEK 13.39 billion.

Operations: The primary revenue streams for SkiStar are the operation of mountain resorts, generating SEK 4.11 billion, and hotel operations, contributing SEK 550.92 million. Additionally, property development and exploitation add SEK 233.75 million to its revenue mix.

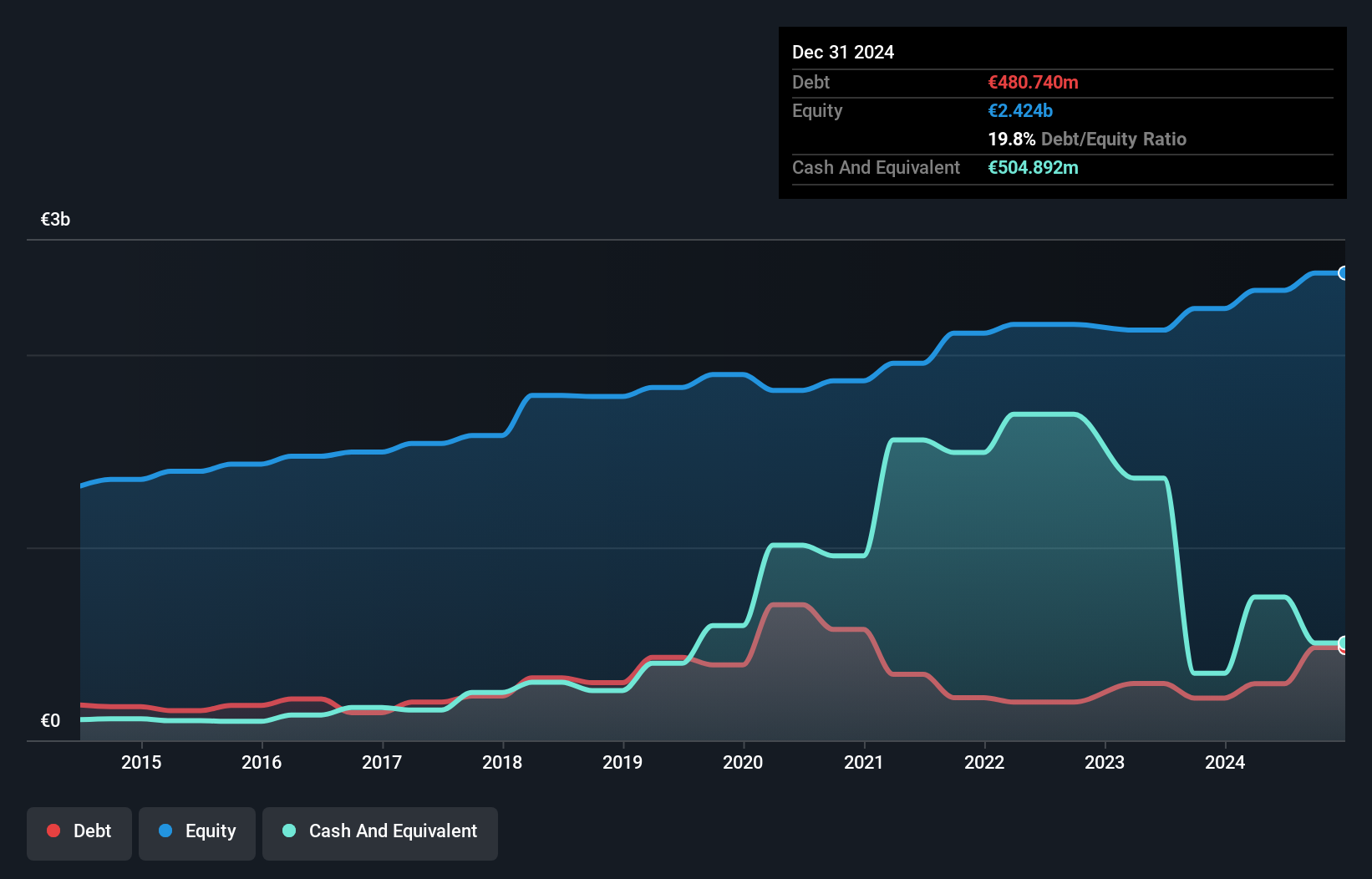

SkiStar is making significant strides in enhancing its ski resorts in Sweden and Norway, with investments aimed at boosting capacity and improving customer experience. The company's debt to equity ratio has impressively decreased from 47.6% to 18% over five years, reflecting a strong financial position. Its earnings have grown by 15.4% annually over the past five years, showcasing robust performance despite not outpacing the hospitality industry last year. Trading slightly below fair value estimates, SkiStar's interest payments are well covered by EBIT at 5.8 times coverage, indicating solid operational efficiency amidst ongoing expansion efforts in Trysil and Åre.

Where To Now?

- Reveal the 336 hidden gems among our European Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SKIS B

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives