- Sweden

- /

- Hospitality

- /

- OM:RAKE

Optimism for Raketech Group Holding (STO:RAKE) has grown this past week, despite three-year decline in earnings

Raketech Group Holding PLC (STO:RAKE) shareholders have seen the share price descend 14% over the month. But at least the stock is up over the last three years. Arguably you'd have been better off buying an index fund, because the gain of 21% in three years isn't amazing.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for Raketech Group Holding

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last three years, Raketech Group Holding failed to grow earnings per share, which fell 6.7% (annualized).

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Given this situation, it makes sense to look at other metrics too.

It may well be that Raketech Group Holding revenue growth rate of 17% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

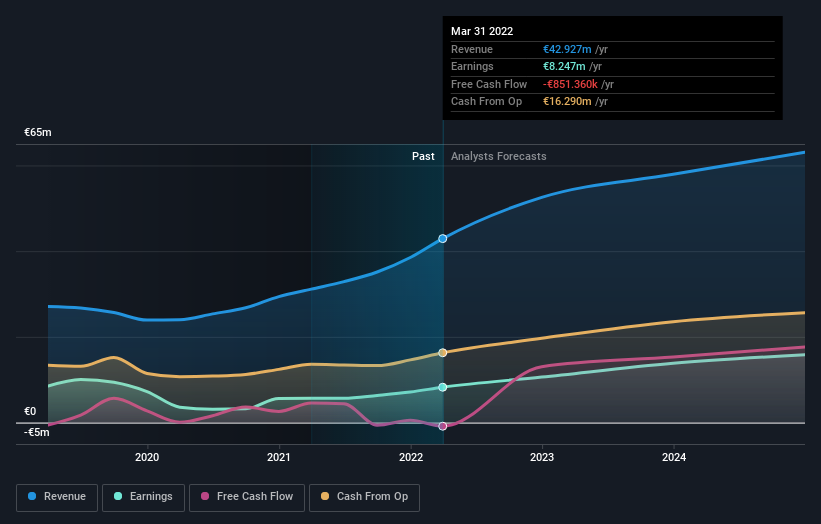

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Raketech Group Holding has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Raketech Group Holding in this interactive graph of future profit estimates.

A Different Perspective

Pleasingly, Raketech Group Holding's total shareholder return last year was 9.2%. So this year's TSR was actually better than the three-year TSR (annualized) of 7%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Raketech Group Holding better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with Raketech Group Holding .

Of course Raketech Group Holding may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:RAKE

Raketech Group Holding

Operates as an affiliate and performance marketing company worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives