Exploring Undervalued Small Caps With Insider Activity In December 2024

Reviewed by Simply Wall St

As global markets experience mixed performances, with major indices like the S&P 500 reaching new highs while the Russell 2000 sees a decline, investors are closely watching economic indicators such as job growth and Federal Reserve policies that could impact small-cap stocks. In this environment of fluctuating market sentiment and sector-specific gains and losses, identifying promising small-cap stocks requires careful consideration of factors like insider activity, which can provide insights into potential undervaluation opportunities.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Primaris Real Estate Investment Trust | 13.4x | 3.6x | 40.70% | ★★★★★☆ |

| Maharashtra Seamless | 11.7x | 2.0x | 25.35% | ★★★★★☆ |

| Calfrac Well Services | 11.7x | 0.2x | 36.22% | ★★★★★☆ |

| Nexus Industrial REIT | 12.9x | 3.2x | 26.67% | ★★★★★☆ |

| Avia Avian | 15.1x | 3.5x | 17.96% | ★★★★☆☆ |

| Optima Health | NA | 1.2x | 38.60% | ★★★★☆☆ |

| Semen Indonesia (Persero) | 18.8x | 0.6x | 34.65% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| European Residential Real Estate Investment Trust | NA | 2.4x | -207.54% | ★★★☆☆☆ |

| Tilray Brands | NA | 1.4x | -72.88% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

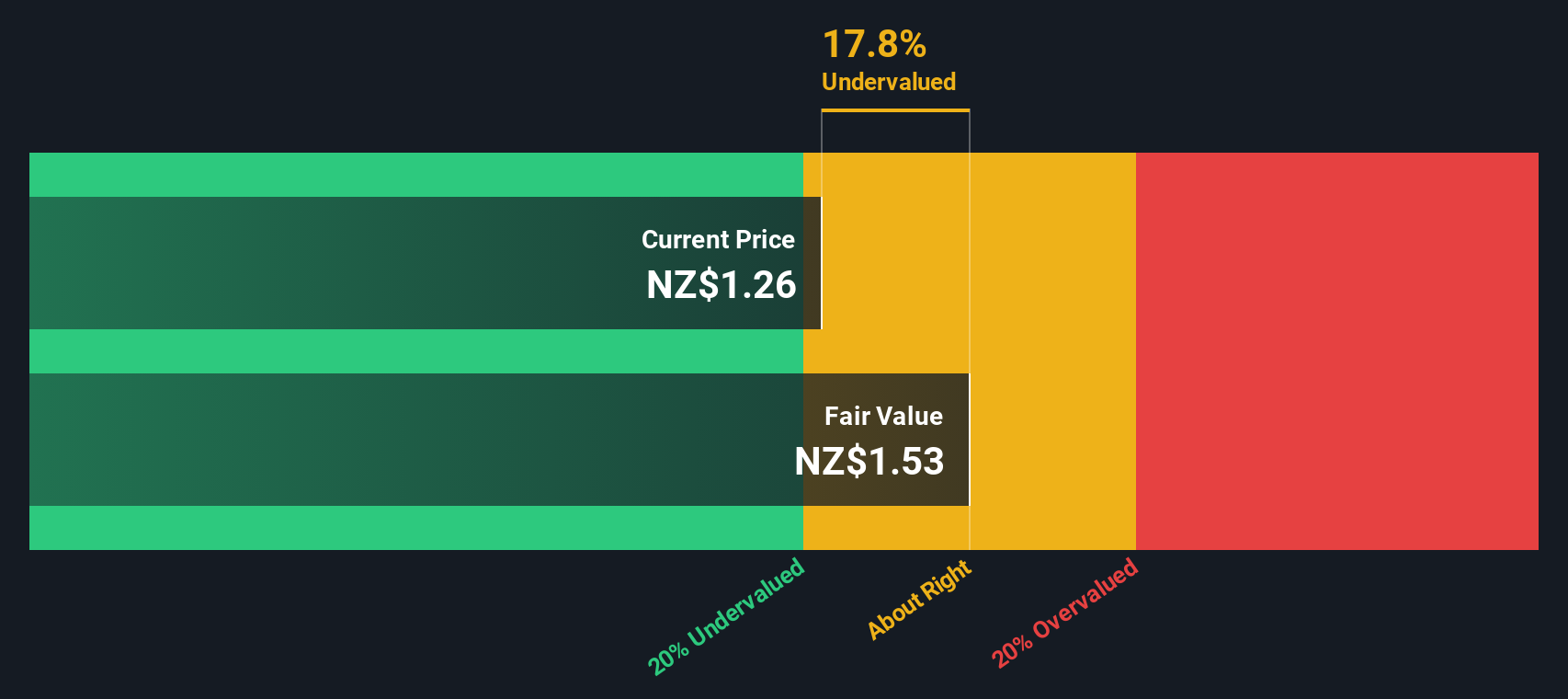

Precinct Properties NZ & Precinct Properties Investments (NZSE:PCT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Precinct Properties NZ & Precinct Properties Investments is a New Zealand-based real estate company primarily engaged in investment properties, flexible space, hotel and hospitality, and investment management, with a market capitalization of approximately NZ$1.88 billion.

Operations: Precinct Properties generates revenue primarily from investment properties, contributing NZ$210.30 million, alongside smaller streams such as flexible space and hotel and hospitality. The company has experienced fluctuations in net income margin, with recent periods showing negative margins, indicating challenges in profitability. Gross profit margin has seen a gradual decline from 71.96% to 63.43% over the analyzed period, reflecting increasing costs relative to revenue growth.

PE: -86.5x

Precinct Properties, a player in the property sector, currently exhibits potential for investors interested in smaller companies. Despite its reliance on external borrowing as a funding source, which carries inherent risks, the company is poised for growth with projected earnings increasing by 31.95% annually. Recent insider confidence is evident from share purchases over the past months. Additionally, their NZ$75 million green bond offering underscores an alignment with sustainable investment trends. While dropped from a major index recently, future prospects remain optimistic given these dynamics.

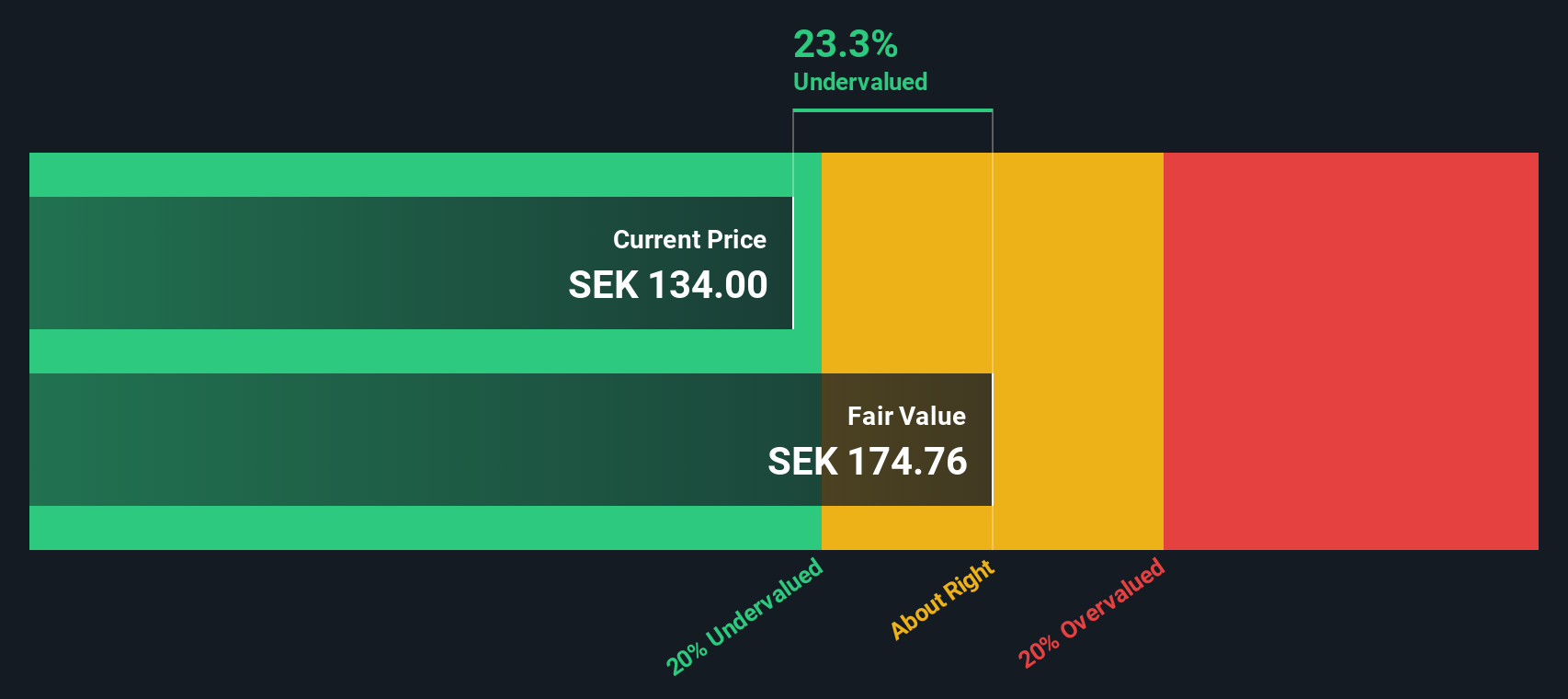

Kambi Group (OM:KAMBI)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kambi Group is a company that provides managed sports betting services, with a market capitalization of €0.35 billion.

Operations: The company generates revenue primarily from managed sports betting services, with recent figures showing €176.25 million. Operating expenses have consistently been a significant component of the cost structure, with general and administrative expenses being a major part of these costs. Over time, the gross profit margin has shown variability but recently stood at 98.44%.

PE: 17.1x

Kambi Group is making strides with recent agreements, including a multi-year deal with Wind Creek Hospitality to power their new sportsbook in Illinois and a partnership with ZenSports for expansion across US markets. Despite a drop in profit margins from 13.1% to 9%, the company anticipates earnings growth of 8.59% annually. Insider confidence is evident as Erik Logdberg purchased 10,000 shares valued at €1 million, marking a significant increase in their holdings by nearly 19%.

- Delve into the full analysis valuation report here for a deeper understanding of Kambi Group.

Assess Kambi Group's past performance with our detailed historical performance reports.

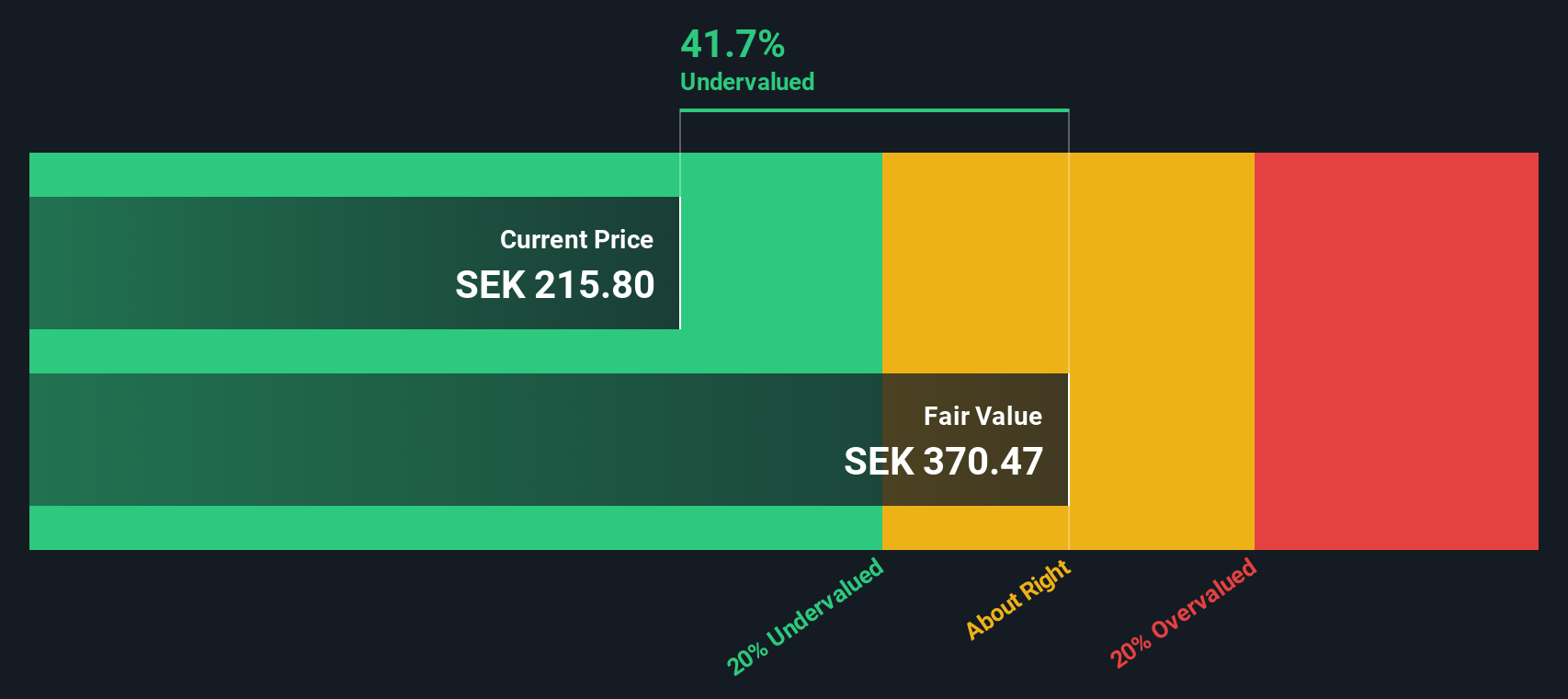

Lindab International (OM:LIAB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lindab International is a company focused on developing, manufacturing, and distributing ventilation and building products, with a market cap of SEK 15.54 billion.

Operations: Lindab International's primary revenue streams are from its Profile Systems and Ventilation Systems segments, with the latter contributing significantly more to overall revenue. Over recent periods, the company has experienced a declining trend in net income margin, which was 6.02% as of September 2024. The company's cost structure is largely driven by COGS and operating expenses, including significant allocations to sales and marketing activities.

PE: 26.9x

Lindab International, a player in the construction and ventilation industry, is exploring acquisitions while restructuring for profitability. They reported a dip in Q3 net income to SEK 158 million from SEK 239 million last year. Despite this, insider confidence is evident as their Chair acquired 7,400 shares worth approximately SEK 1.8 million recently. The company aims for growth through strategic investments and digitalization amidst higher-risk external borrowing funding its operations.

Turning Ideas Into Actions

- Get an in-depth perspective on all 183 Undervalued Small Caps With Insider Buying by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LIAB

Lindab International

Manufactures and sells products and solutions for ventilation systems in Sweden, Denmark, Germany, France, the United Kingdom, Norway, Ireland, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.