- Israel

- /

- Household Products

- /

- TASE:SANO1

Discovering 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic indicators signal varying degrees of strength, investors are keenly observing the potential within small-cap stocks. In this climate, identifying promising opportunities involves looking for companies with strong fundamentals that can thrive despite broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Realia Business | 38.02% | 10.17% | 1.26% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Betsson (OM:BETS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Betsson AB (publ) is a company that invests in and manages online gaming businesses across various regions including the Nordic countries, Latin America, Western Europe, Central and Eastern Europe, Central Asia, and internationally, with a market cap of SEK20.13 billion.

Operations: Betsson's primary revenue stream is from its Casinos & Resorts segment, generating €1.05 billion.

Betsson, a smaller player in the gaming industry, demonstrates robust financial health with its interest payments well covered by EBIT at 13.8x and more cash than total debt. Despite a slight dip in net income to €42.9 million for Q3 2024 from €47.7 million the previous year, sales rose to €280.1 million from €237.6 million, indicating potential growth momentum. The company trades at nearly 69% below its estimated fair value and boasts high-quality past earnings, suggesting it might be undervalued relative to peers while maintaining profitability with positive free cash flow trends over recent years.

- Take a closer look at Betsson's potential here in our health report.

Examine Betsson's past performance report to understand how it has performed in the past.

AuGroup (SHENZHEN) Cross-Border Business (SEHK:2519)

Simply Wall St Value Rating: ★★★★★★

Overview: AuGroup (SHENZHEN) Cross-Border Business Co., Ltd. is engaged in cross-border trade operations and logistics services, with a market capitalization of approximately HK$5.38 billion.

Operations: AuGroup generates revenue primarily from sales of goods (CN¥7.03 billion) and logistics services (CN¥2.42 billion).

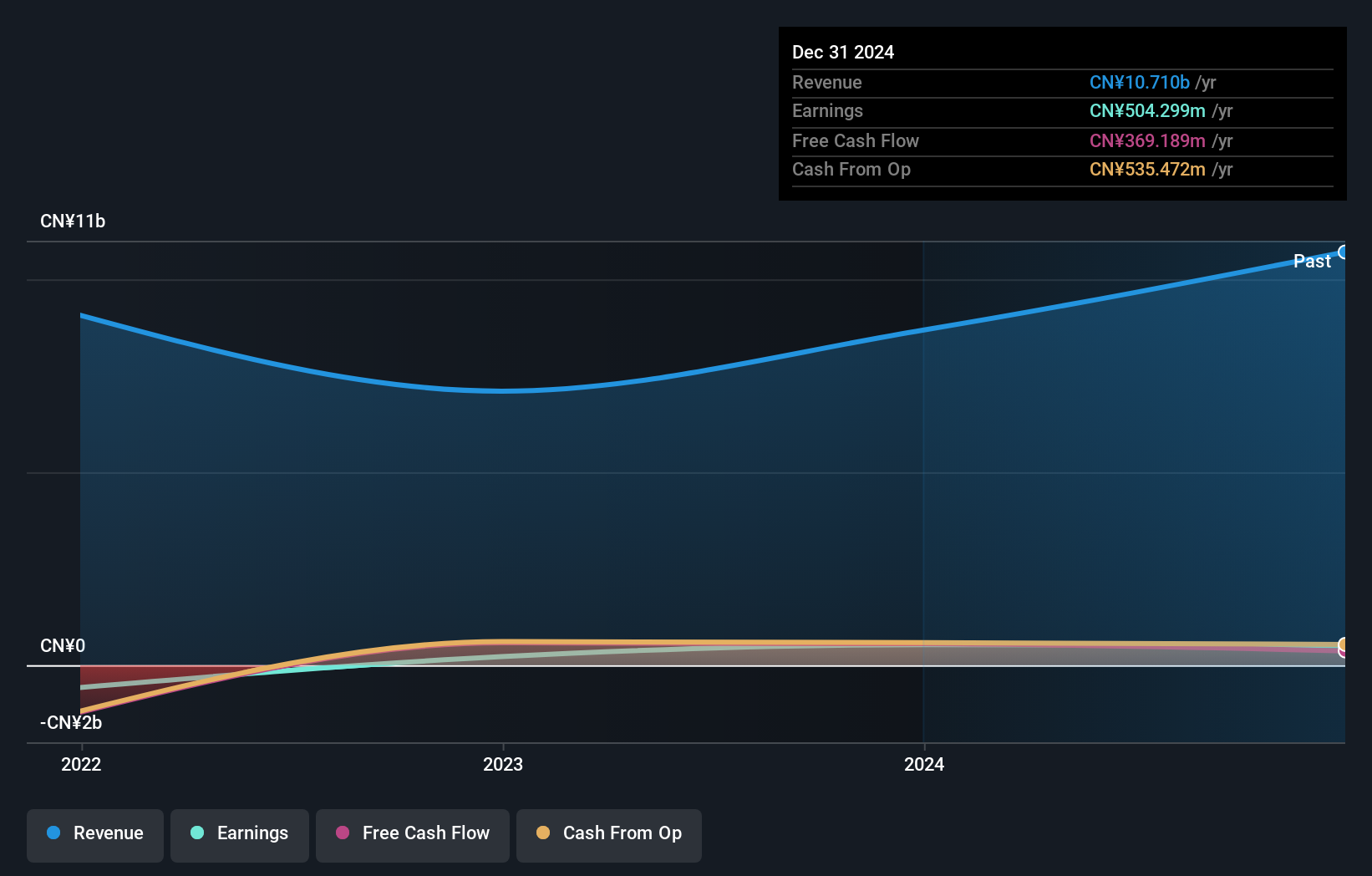

AuGroup (SHENZHEN) Cross-Border Business, a promising player in its sector, recently completed an IPO raising HKD 466.36 million. The company reported impressive earnings growth of 142.9% last year, significantly outpacing the Specialty Retail industry's -23.8%. With sales reaching CNY 8.68 billion from CNY 7.1 billion the previous year and net income climbing to CNY 532 million from CNY 219 million, AuGroup demonstrates robust financial health. Its debt-to-equity ratio improved to 29.2% over five years, and interest payments are well-covered by EBIT at a multiple of 11.6x, indicating strong operational efficiency and financial stability.

Sano Bruno's Enterprises (TASE:SANO1)

Simply Wall St Value Rating: ★★★★★★

Overview: Sano Bruno's Enterprises Ltd is a global manufacturer and seller of laundry, home care, cleaning and hygiene products, kitchen accessories, air fresheners, insecticides, and paper products with a market capitalization of ₪3.92 billion.

Operations: Sano Bruno's Enterprises generates revenue primarily from household cleaning and maintenance products, contributing ₪1.23 billion, followed by toiletries and cosmetics at ₪452.85 million, and paper products at ₪372.37 million.

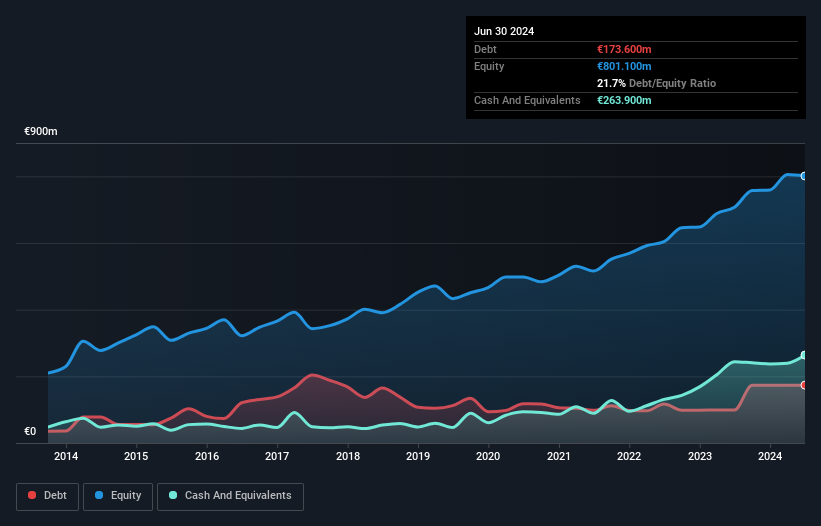

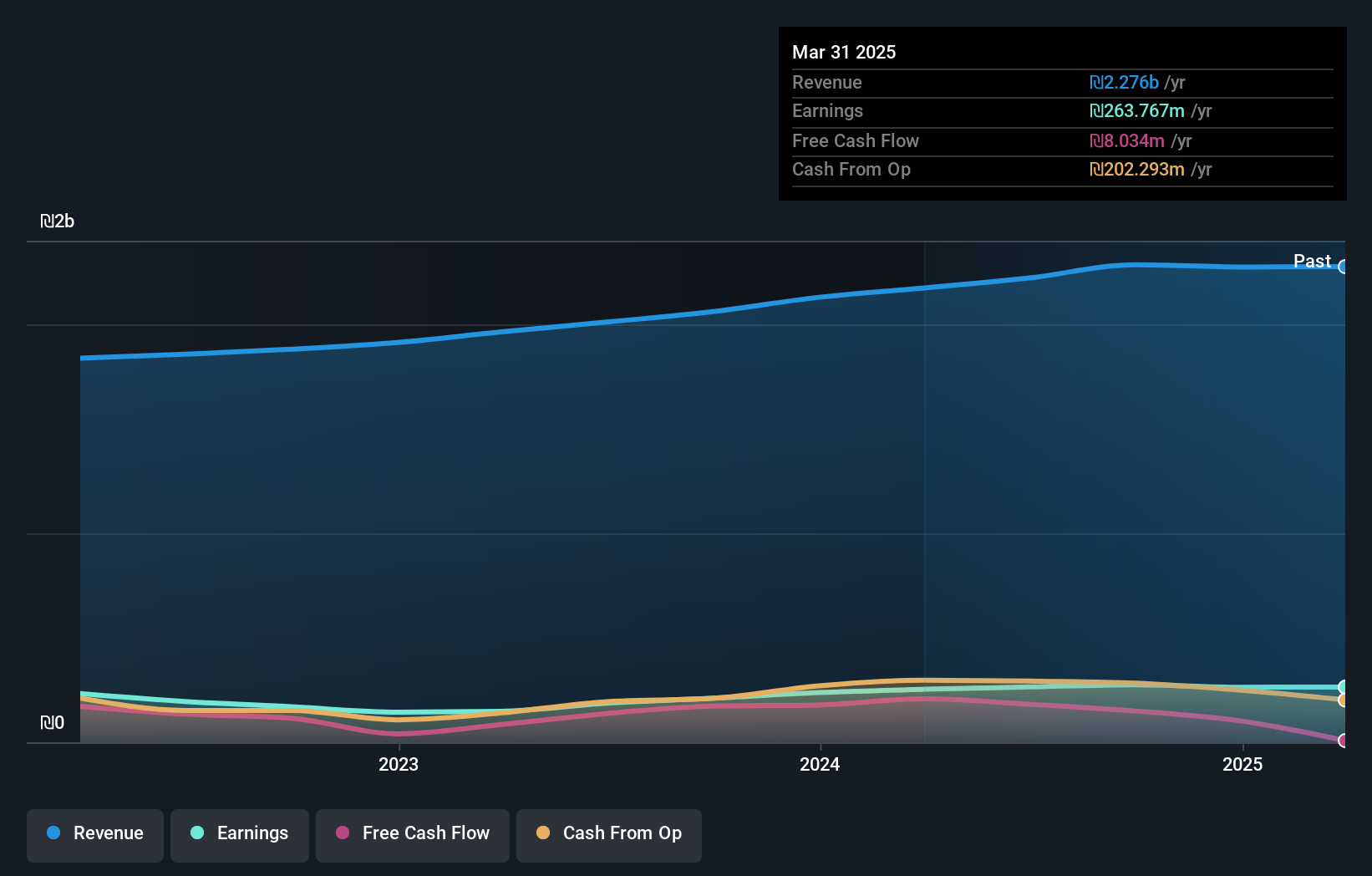

Sano Bruno's Enterprises, a promising player in the household products sector, has shown robust performance with earnings growth of 30.6% over the past year, outpacing industry averages. The company is trading at 61.6% below its estimated fair value, suggesting potential for significant upside. Its debt-to-equity ratio impressively decreased from 1.1 to 0.02 over five years, highlighting improved financial health and more cash than total debt indicates sound liquidity management. Recent results reveal sales of ILS 605 million for Q3 and net income of ILS 68 million, reflecting solid operational efficiency and increased profitability compared to last year’s figures.

- Dive into the specifics of Sano Bruno's Enterprises here with our thorough health report.

Gain insights into Sano Bruno's Enterprises' past trends and performance with our Past report.

Key Takeaways

- Investigate our full lineup of 4665 Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:SANO1

Sano Bruno's Enterprises

Engages in the manufacture and sale of laundry products, home care products, cleaning and hygiene products, kitchen accessories, air fresheners, insecticides, and paper products worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives