- Sweden

- /

- Consumer Services

- /

- OM:ACAD

We Think Some Shareholders May Hesitate To Increase AcadeMedia AB (publ)'s (STO:ACAD) CEO Compensation

Key Insights

- AcadeMedia to hold its Annual General Meeting on 30th of November

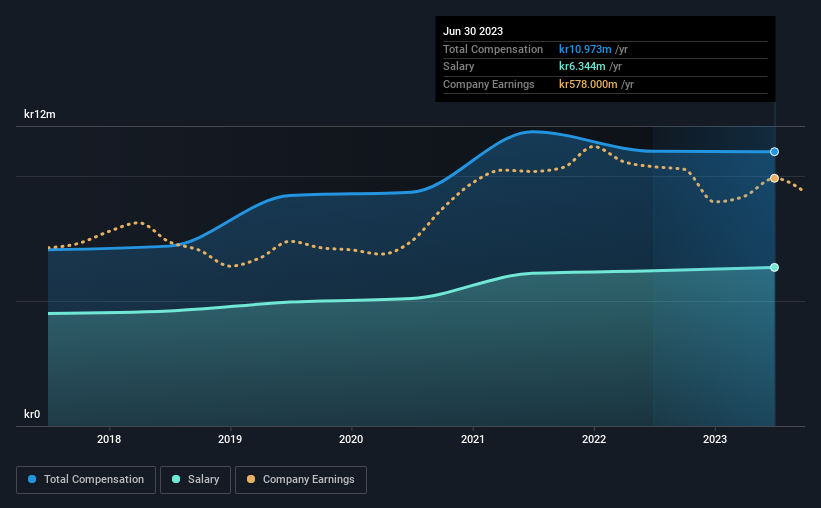

- Total pay for CEO Marcus Strömberg includes kr6.34m salary

- The overall pay is 107% above the industry average

- AcadeMedia's three-year loss to shareholders was 30% while its EPS grew by 2.2% over the past three years

In the past three years, the share price of AcadeMedia AB (publ) (STO:ACAD) has struggled to grow and now shareholders are sitting on a loss. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 30th of November. They could also influence management through voting on resolutions such as executive remuneration. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for AcadeMedia

Comparing AcadeMedia AB (publ)'s CEO Compensation With The Industry

According to our data, AcadeMedia AB (publ) has a market capitalization of kr5.5b, and paid its CEO total annual compensation worth kr11m over the year to June 2023. That is, the compensation was roughly the same as last year. We note that the salary of kr6.34m makes up a sizeable portion of the total compensation received by the CEO.

For comparison, other companies in the Sweden Consumer Services industry with market capitalizations ranging between kr2.1b and kr8.4b had a median total CEO compensation of kr5.3m. Hence, we can conclude that Marcus Strömberg is remunerated higher than the industry median. Furthermore, Marcus Strömberg directly owns kr8.2m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr6.3m | kr6.2m | 58% |

| Other | kr4.6m | kr4.8m | 42% |

| Total Compensation | kr11m | kr11m | 100% |

On an industry level, around 62% of total compensation represents salary and 38% is other remuneration. Our data reveals that AcadeMedia allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at AcadeMedia AB (publ)'s Growth Numbers

AcadeMedia AB (publ) has seen its earnings per share (EPS) increase by 2.2% a year over the past three years. In the last year, its revenue is up 9.2%.

We're not particularly impressed by the revenue growth, but it is good to see modest EPS growth. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has AcadeMedia AB (publ) Been A Good Investment?

The return of -30% over three years would not have pleased AcadeMedia AB (publ) shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for AcadeMedia that investors should be aware of in a dynamic business environment.

Switching gears from AcadeMedia, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ACAD

AcadeMedia

Operates as an independent education provider in Sweden, Norway, the Netherlands, and Germany.

Undervalued with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026