- Sweden

- /

- Consumer Services

- /

- OM:ACAD

The Bull Case For AcadeMedia (OM:ACAD) Could Change Following Major Expansion of German Preschool Capacity – Learn Why

Reviewed by Sasha Jovanovic

- AcadeMedia recently announced plans to add just over 500 new preschool places across seven new units in Germany, expanding its presence in a market with a significant preschool shortage.

- This expansion builds on the company's established strategy of organic growth in high-demand regions and increases its development pipeline to up to 2,500 new preschool places.

- We'll examine how this substantial boost in planned preschool capacity influences AcadeMedia's investment case and future growth outlook in Germany.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

AcadeMedia Investment Narrative Recap

To be a shareholder in AcadeMedia, you must believe in the company's ability to deliver steady growth by expanding in markets with persistent education needs while navigating the operational and regulatory complexities that come with international growth. The recent announcement of over 500 new preschool places in Germany adds scale in a key target market but does not materially affect the most immediate catalyst, ongoing profit margin improvements across new and existing units. The fundamental risk remains tied to managing operational complexity and regulatory challenges as international expansion continues. Of the company’s latest updates, the March 2025 announcement setting the goal to reach 200 preschools and 15,000 places in Germany stands out. This milestone, combined with the September expansion, aligns directly with the company's top catalyst: diversifying revenues through disciplined international growth in segments facing supply shortages and high demand. However, against this growth, investors should be aware of the increasing operational complexity and regulatory hurdles that come with scaling across borders...

Read the full narrative on AcadeMedia (it's free!)

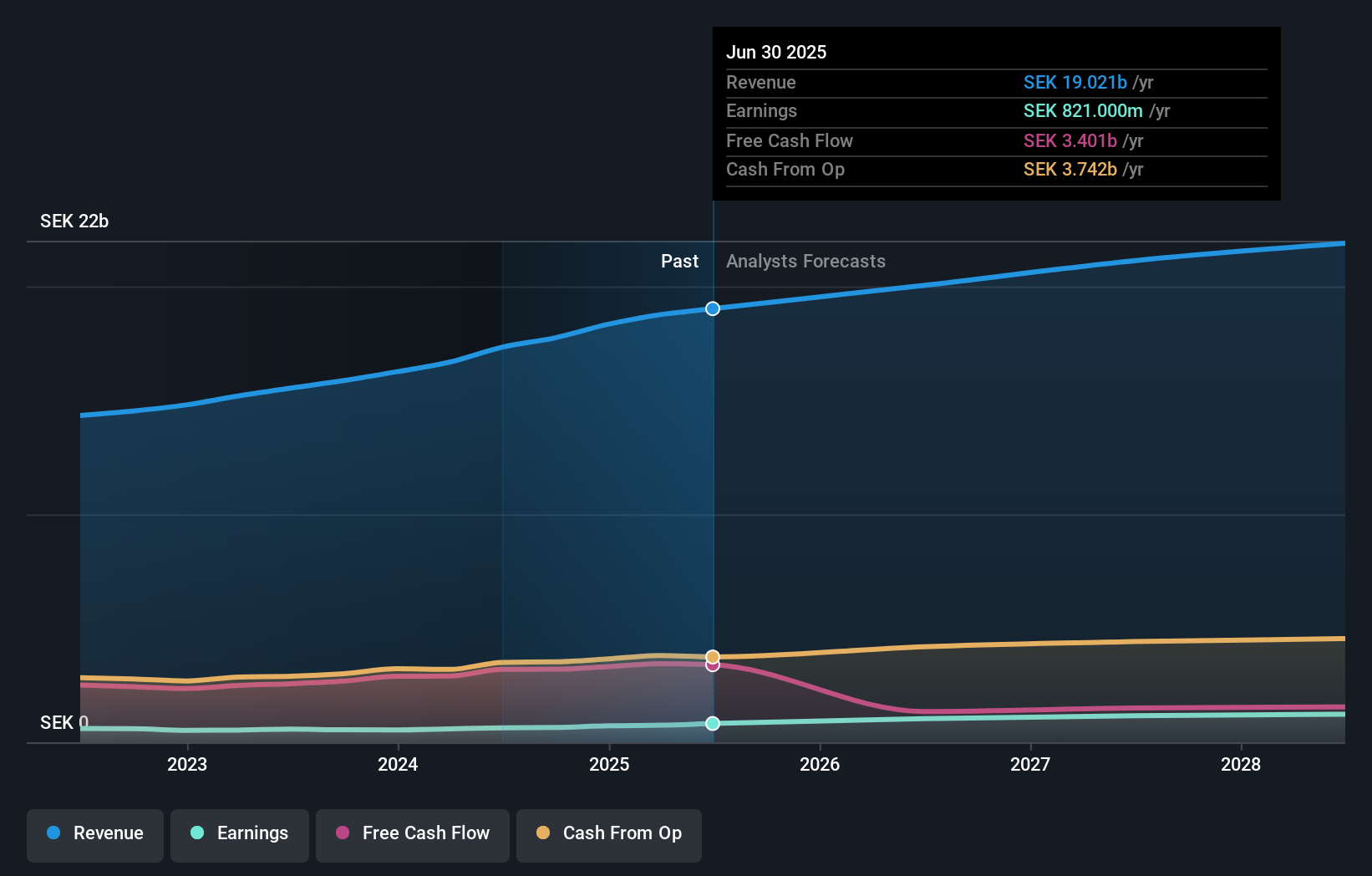

AcadeMedia's outlook anticipates SEK21.9 billion in revenue and SEK1.2 billion in earnings by 2028. This implies annual revenue growth of 4.8% and a SEK379 million increase in earnings from the current level of SEK821 million.

Uncover how AcadeMedia's forecasts yield a SEK115.00 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for AcadeMedia ranging from SEK115 to SEK161.83. With expansion plans driving long-term growth expectations, your own view on Germany's regulatory environment could shift your perspective on the company’s future.

Explore 2 other fair value estimates on AcadeMedia - why the stock might be worth as much as 67% more than the current price!

Build Your Own AcadeMedia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AcadeMedia research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free AcadeMedia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AcadeMedia's overall financial health at a glance.

No Opportunity In AcadeMedia?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ACAD

AcadeMedia

Operates as an independent education provider in Sweden, Norway, the Netherlands, and Germany.

Undervalued with solid track record.

Market Insights

Community Narratives