Last Update 02 Sep 25

Fair value Increased 21%Despite lower consensus revenue growth forecasts, AcadeMedia's future P/E multiple has expanded significantly, driving the consensus analyst price target up from SEK95.00 to SEK115.00.

What's in the News

- Board proposed an ordinary dividend increase to SEK 2.25 (1.75) per share.

- Preliminary guidance anticipates Q4 net sales of SEK 5,120 million (4,856).

Valuation Changes

Summary of Valuation Changes for AcadeMedia

- The Consensus Analyst Price Target has significantly risen from SEK95.00 to SEK115.00.

- The Future P/E for AcadeMedia has significantly risen from 7.80x to 10.58x.

- The Consensus Revenue Growth forecasts for AcadeMedia has significantly fallen from 6.5% per annum to 4.8% per annum.

Key Takeaways

- International expansion and diversified offerings reduce reliance on Swedish public funding, providing revenue stability and positioning for growth in new European markets.

- Quality improvements, digital investments, and disciplined financial management support continued margin expansion, enhanced profitability, and greater shareholder returns.

- Intensifying regulatory scrutiny, shifting demographics, and reliance on international acquisitions and Adult Education all pose risks to AcadeMedia's revenue stability and margin growth.

Catalysts

About AcadeMedia- Operates as an independent education provider in Sweden, Norway, the Netherlands, and Germany.

- AcadeMedia's continued international expansion-particularly in Germany, the Netherlands, and potential new markets like the UK and Poland-diversifies revenue streams away from reliance on Swedish public funding, positioning the company to benefit from demographic growth, migration, and urbanization in Central and Western Europe; this is expected to drive sustained increases in top-line revenue and revenue stability.

- Ongoing investment in quality improvement, digital platforms, and teacher training programs, as highlighted by improvements in early reading outcomes and the adoption of innovative teaching methods, can enhance operational efficiency and margin expansion over time, lifting future profitability and earnings.

- Structural trends in upskilling and lifelong learning, together with persistently high unemployment rates in Sweden, support robust growth and margin expansion in Adult Education and Vocational segments, underpinning both short-term and long-term revenue and EBIT growth.

- Margin improvement potential remains in the Preschool and International segment, particularly as recently acquired Touhula in Finland is integrated and performance is brought toward group levels over the next two years; this provides a clear pathway for further group margin expansion and higher net earnings.

- Management's strong balance sheet discipline, demonstrated by low leverage even after acquisitions and dividend payouts, enables continued M&A-driven growth and return of capital to shareholders through buybacks or redemption programs, which should support EPS growth and close the valuation gap.

AcadeMedia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AcadeMedia's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.3% today to 5.6% in 3 years time.

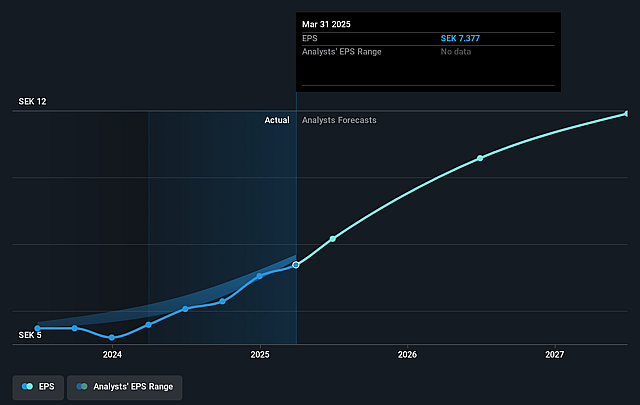

- Analysts expect earnings to reach SEK 1.2 billion (and earnings per share of SEK 12.4) by about September 2028, up from SEK 821.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.6x on those 2028 earnings, down from 11.4x today. This future PE is lower than the current PE for the GB Consumer Services industry at 19.7x.

- Analysts expect the number of shares outstanding to decline by 2.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.48%, as per the Simply Wall St company report.

AcadeMedia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying political and regulatory scrutiny in Sweden, with multiple government proposals under review (profit inquiry, school voucher inquiry, and sector transparency), could introduce profit constraints, compliance requirements, or funding changes over the coming years, potentially pressuring AcadeMedia's long-term net margins and revenue stability.

- Demographic challenges mentioned in mature markets, including slowing birth rates, may lead to reduced student populations over time, limiting organic topline revenue growth across key geographies.

- Company's international expansion strategy, emphasizing acquisitions in Germany, the Netherlands, Finland, Poland, and the UK, exposes AcadeMedia to higher integration risks, operational complexity, and unfamiliar regulatory environments, which could result in increased costs or disrupt earnings.

- High reliance on Adult Education segment's growth, which is currently supported by historically high unemployment rates in Sweden, creates earnings vulnerability should labor markets improve, reducing enrollment volumes and segment margins.

- Margin improvements remain dependent on successfully integrating lower-margin acquisitions like Touhula in Finland and executing cost control across new geographies; failure to do so could prevent AcadeMedia from reaching margin targets and impact long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK115.0 for AcadeMedia based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK21.9 billion, earnings will come to SEK1.2 billion, and it would be trading on a PE ratio of 10.6x, assuming you use a discount rate of 7.5%.

- Given the current share price of SEK94.7, the analyst price target of SEK115.0 is 17.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.