Axfood AB (publ) (STO:AXFO) has announced that it will pay a dividend of SEK4.25 per share on the 25th of September. This takes the dividend yield to 3.0%, which shareholders will be pleased with.

Check out our latest analysis for Axfood

Axfood's Dividend Is Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. The last payment made up 75% of earnings, but cash flows were much higher. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Looking forward, earnings per share is forecast to rise by 24.0% over the next year. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 65% which would be quite comfortable going to take the dividend forward.

Axfood Has A Solid Track Record

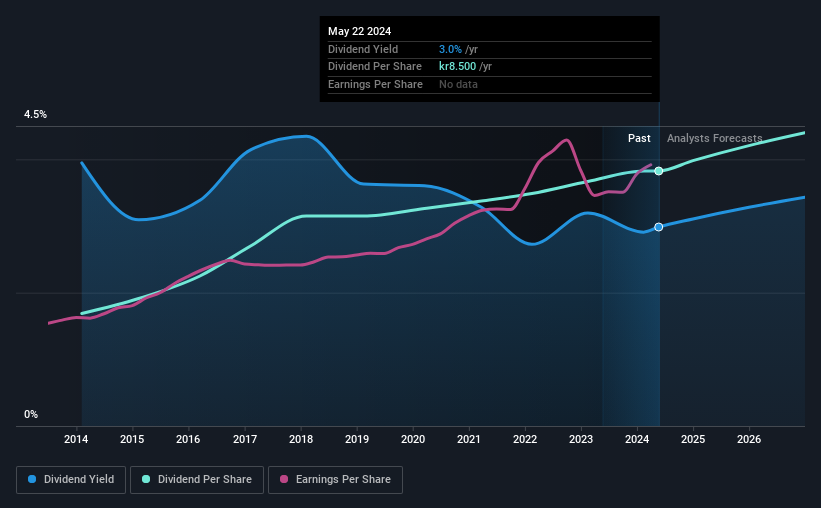

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The dividend has gone from an annual total of SEK3.75 in 2014 to the most recent total annual payment of SEK8.50. This works out to be a compound annual growth rate (CAGR) of approximately 8.5% a year over that time. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

The Dividend Has Growth Potential

Investors could be attracted to the stock based on the quality of its payment history. We are encouraged to see that Axfood has grown earnings per share at 8.6% per year over the past five years. EPS has been growing at a reasonable rate, although with most of the profits being paid out to shareholders, growth prospects could be more limited in the future.

In Summary

Overall, this is a reasonable dividend, and it being raised is an added bonus. The payments look pretty sustainable with good earnings coverage and a reasonable track record. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 5 analysts we track are forecasting for Axfood for free with public analyst estimates for the company. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AXFO

Axfood

Engages in the food retail and wholesale businesses primarily in Sweden.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives