Nilörngruppen's (STO:NIL B) Dividend Will Be Increased To SEK1.50

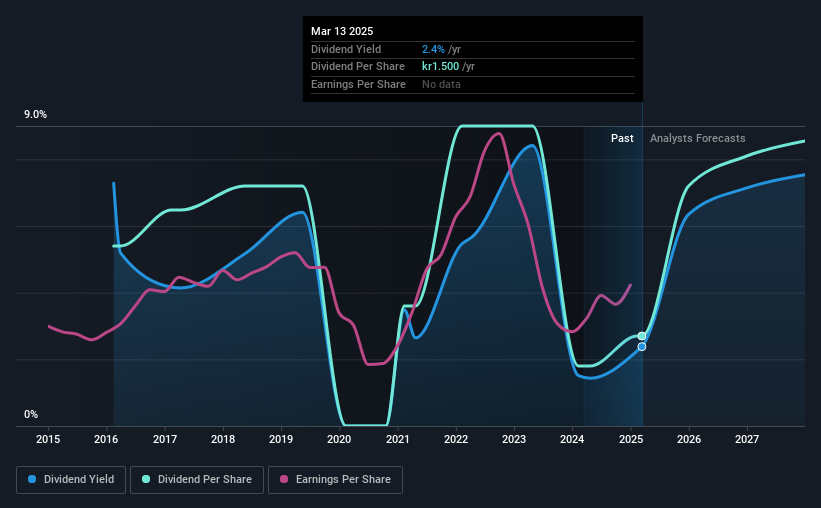

The board of Nilörngruppen AB (STO:NIL B) has announced that it will be paying its dividend of SEK1.50 on the 21st of May, an increased payment from last year's comparable dividend. This will take the dividend yield to an attractive 2.4%, providing a nice boost to shareholder returns.

Check out our latest analysis for Nilörngruppen

Nilörngruppen's Payment Could Potentially Have Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. However, prior to this announcement, Nilörngruppen's dividend was comfortably covered by both cash flow and earnings. This means that most of what the business earns is being used to help it grow.

Over the next year, EPS is forecast to expand by 50.7%. If the dividend continues along recent trends, we estimate the payout ratio will be 19%, which is in the range that makes us comfortable with the sustainability of the dividend.

Nilörngruppen's Dividend Has Lacked Consistency

It's comforting to see that Nilörngruppen has been paying a dividend for a number of years now, however it has been cut at least once in that time. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. The dividend has gone from an annual total of SEK3.00 in 2016 to the most recent total annual payment of SEK1.50. This works out to be a decline of approximately 7.4% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth May Be Hard To Achieve

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. However, Nilörngruppen has only grown its earnings per share at 4.5% per annum over the past five years. While growth may be thin on the ground, Nilörngruppen could always pay out a higher proportion of earnings to increase shareholder returns.

Our Thoughts On Nilörngruppen's Dividend

Overall, this is a reasonable dividend, and it being raised is an added bonus. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 2 warning signs for Nilörngruppen that investors should know about before committing capital to this stock. Is Nilörngruppen not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Nilörngruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NIL B

Nilörngruppen

Engages in the production and sale of labels, packaging products, and accessories for the fashion and apparel industries in Sweden, the rest of Europe, and Asia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026