European Equities Estimated Below Intrinsic Value In September 2025

Reviewed by Simply Wall St

As European markets navigate a landscape of mixed performances, with the pan-European STOXX Europe 600 Index ending slightly lower amid recent monetary policy decisions, investors are keenly evaluating opportunities that may arise from these shifting dynamics. In this context, identifying stocks estimated to be undervalued can be particularly appealing, as they offer potential for growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.24 | SEK85.35 | 49.3% |

| Trifork Group (CPSE:TRIFOR) | DKK88.20 | DKK170.57 | 48.3% |

| Rheinmetall (XTRA:RHM) | €1912.00 | €3794.92 | 49.6% |

| Prosegur Cash (BME:CASH) | €0.706 | €1.38 | 48.8% |

| Hanza (OM:HANZA) | SEK109.40 | SEK215.01 | 49.1% |

| Green Oleo (BIT:GRN) | €0.775 | €1.51 | 48.7% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.76 | 49.6% |

| cyan (XTRA:CYR) | €2.26 | €4.39 | 48.5% |

| Atea (OB:ATEA) | NOK144.20 | NOK278.86 | 48.3% |

| adidas (XTRA:ADS) | €185.25 | €369.56 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

New Wave Group (OM:NEWA B)

Overview: New Wave Group AB (publ) designs, acquires, and develops brands and products in the corporate, sports, gifts, and home furnishings sectors across various international markets with a market cap of SEK14.77 billion.

Operations: The company's revenue segments are comprised of Corporate at SEK4.73 billion, Sports & Leisure at SEK4.03 billion, and Gifts & Home Furnishings at SEK853.50 million.

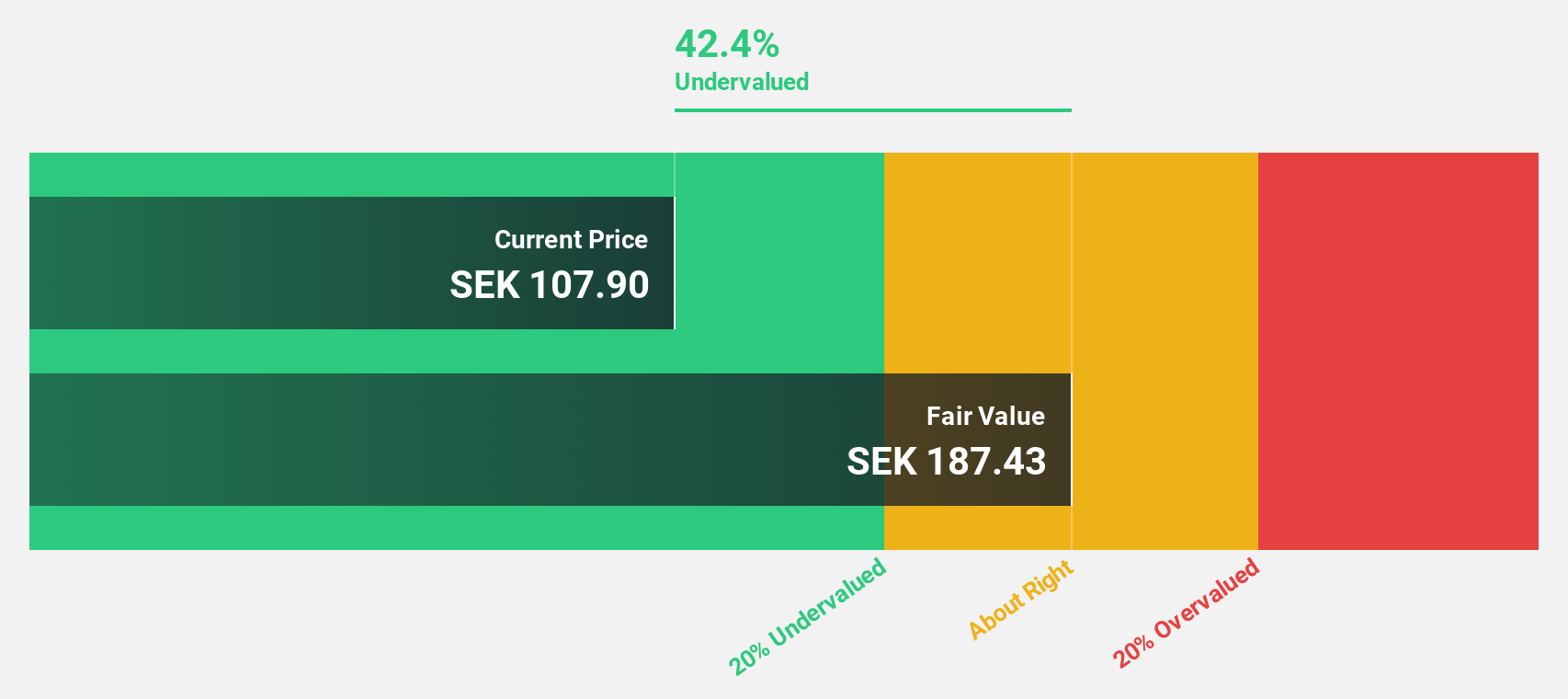

Estimated Discount To Fair Value: 40.7%

New Wave Group AB is trading at SEK 111.3, significantly below its estimated fair value of SEK 187.68, indicating it may be undervalued based on cash flows. Despite a recent dip in net income from SEK 210 million to SEK 167 million for Q2 2025, the company's earnings are projected to grow significantly over the next three years. However, its return on equity is forecasted to remain low at 15.7%, and it has an unstable dividend track record.

- The analysis detailed in our New Wave Group growth report hints at robust future financial performance.

- Navigate through the intricacies of New Wave Group with our comprehensive financial health report here.

Rosenbauer International (WBAG:ROS)

Overview: Rosenbauer International AG provides systems for preventive firefighting and disaster protection technology globally, with a market cap of €477.36 million.

Operations: The company's revenue is derived from several geographic segments, including Europe (€663.40 million), the Americas (€373.00 million), Asia-Pacific (€170.82 million), and the Middle East & Africa (€144.06 million), along with a contribution from Preventive Fire Protection at €24.82 million.

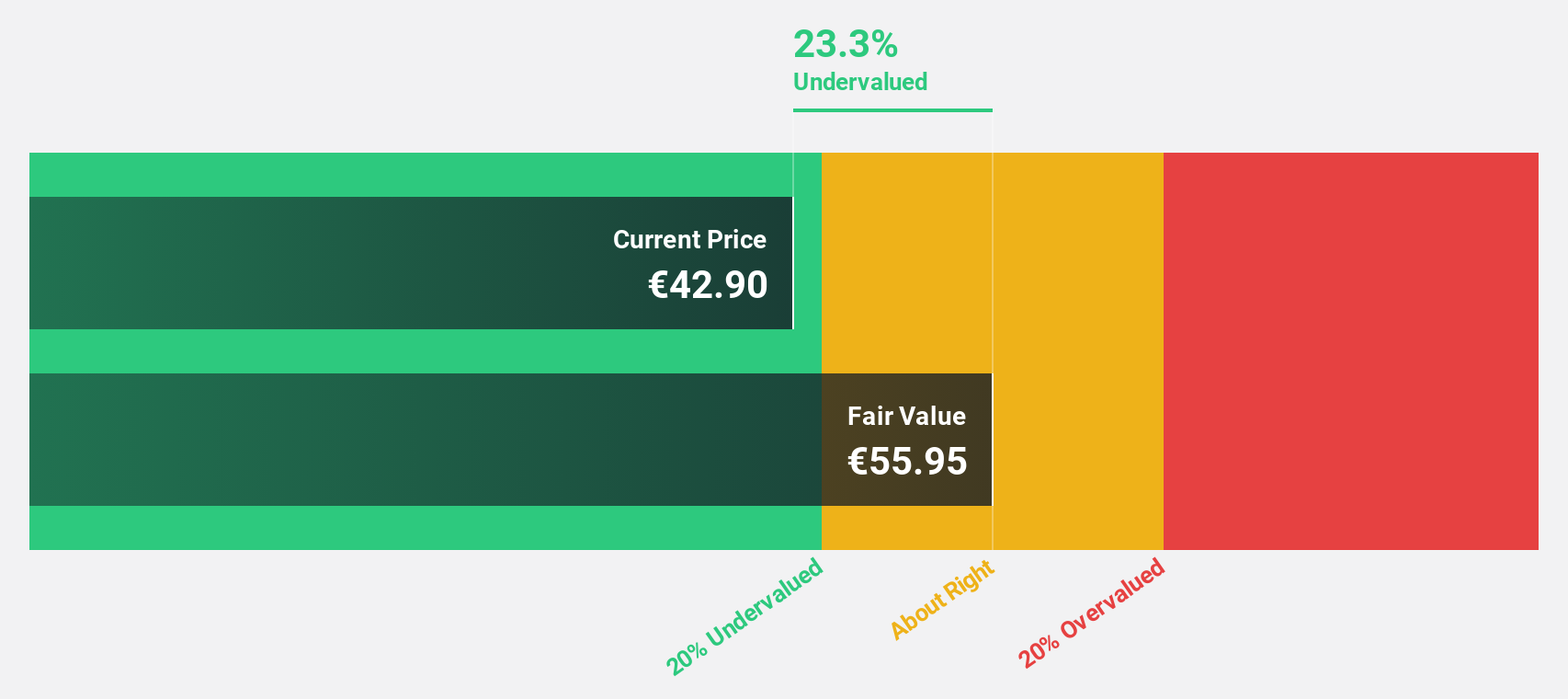

Estimated Discount To Fair Value: 16%

Rosenbauer International is trading at €46.8, below its estimated fair value of €55.69, highlighting potential undervaluation based on cash flows. Despite a significant earnings growth forecast of 51.7% annually over the next three years, recent financials show challenges with a net loss of €19.78 million for Q2 2025 and shareholder dilution. Revenue growth is expected to outpace the Austrian market at 6.7% per year, although interest payments are not well covered by earnings currently.

- Upon reviewing our latest growth report, Rosenbauer International's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Rosenbauer International stock in this financial health report.

SBO (WBAG:SBO)

Overview: SBO AG is a global manufacturer and seller of steel products, with a market cap of €417.62 million.

Operations: The company's revenue segments consist of €318.24 million from Energy Equipment and €320.90 million from Precision Technology, with a deduction of €113.12 million for SBO-Holding & Consolidation.

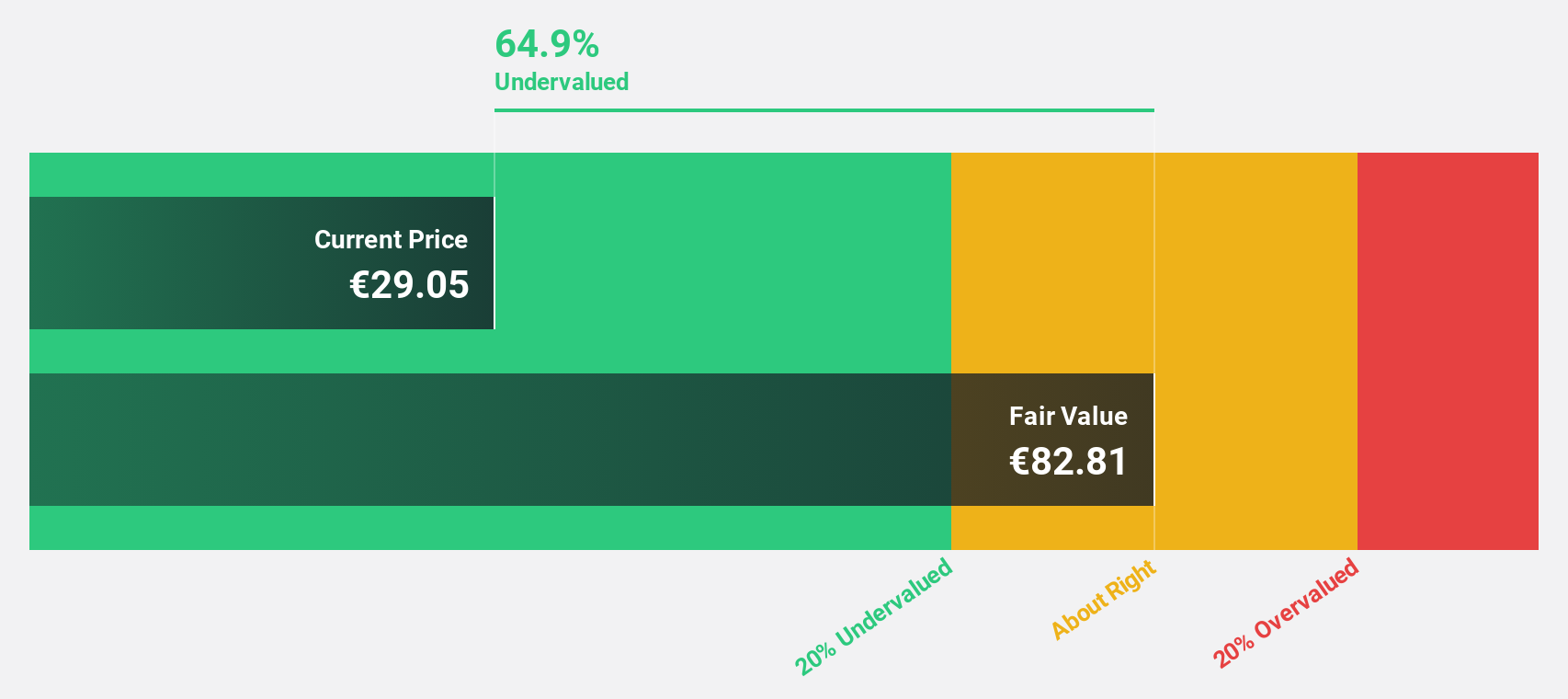

Estimated Discount To Fair Value: 46.2%

SBO AG, trading at €26.5, is significantly undervalued based on cash flows with a fair value estimate of €49.24. Despite recent declines in sales and net income for H1 2025, SBO's earnings are projected to grow substantially by 20.9% annually over the next three years, outpacing the Austrian market's growth rate. Analysts anticipate a substantial stock price increase of over 50%, supported by revenue growth forecasts exceeding market averages and an expected rise in profitability metrics.

- Insights from our recent growth report point to a promising forecast for SBO's business outlook.

- Click here to discover the nuances of SBO with our detailed financial health report.

Where To Now?

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 210 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:ROS

Rosenbauer International

Engages in the provision of systems for preventive firefighting and disaster protection technology worldwide.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives