- Netherlands

- /

- Chemicals

- /

- ENXTAM:CRBN

3 Top Undervalued European Small Caps With Recent Insider Activity

Reviewed by Simply Wall St

As European markets experience a resurgence, with the STOXX Europe 600 Index climbing 3.44% and economic growth in the eurozone doubling its pace, investor confidence is on the rise despite lingering concerns over tariffs and inflation. In this dynamic landscape, small-cap stocks often present intriguing opportunities due to their potential for growth and unique market positions. Identifying promising small caps involves looking at those with strong fundamentals and recent insider activity, which can signal confidence from within the company amidst current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Tristel | 28.4x | 4.0x | 24.32% | ★★★★★★ |

| Morgan Advanced Materials | 11.0x | 0.5x | 41.04% | ★★★★★☆ |

| Kitwave Group | 15.4x | 0.4x | 43.43% | ★★★★★☆ |

| Foxtons Group | 12.7x | 1.1x | 40.75% | ★★★★★☆ |

| Eastnine | 17.4x | 8.4x | 40.44% | ★★★★★☆ |

| Savills | 24.5x | 0.5x | 42.10% | ★★★★☆☆ |

| FRP Advisory Group | 12.8x | 2.3x | 13.47% | ★★★☆☆☆ |

| Italmobiliare | 10.8x | 1.4x | -265.39% | ★★★☆☆☆ |

| Speedy Hire | NA | 0.2x | -3.53% | ★★★☆☆☆ |

| Arendals Fossekompani | NA | 1.6x | 42.35% | ★★★☆☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

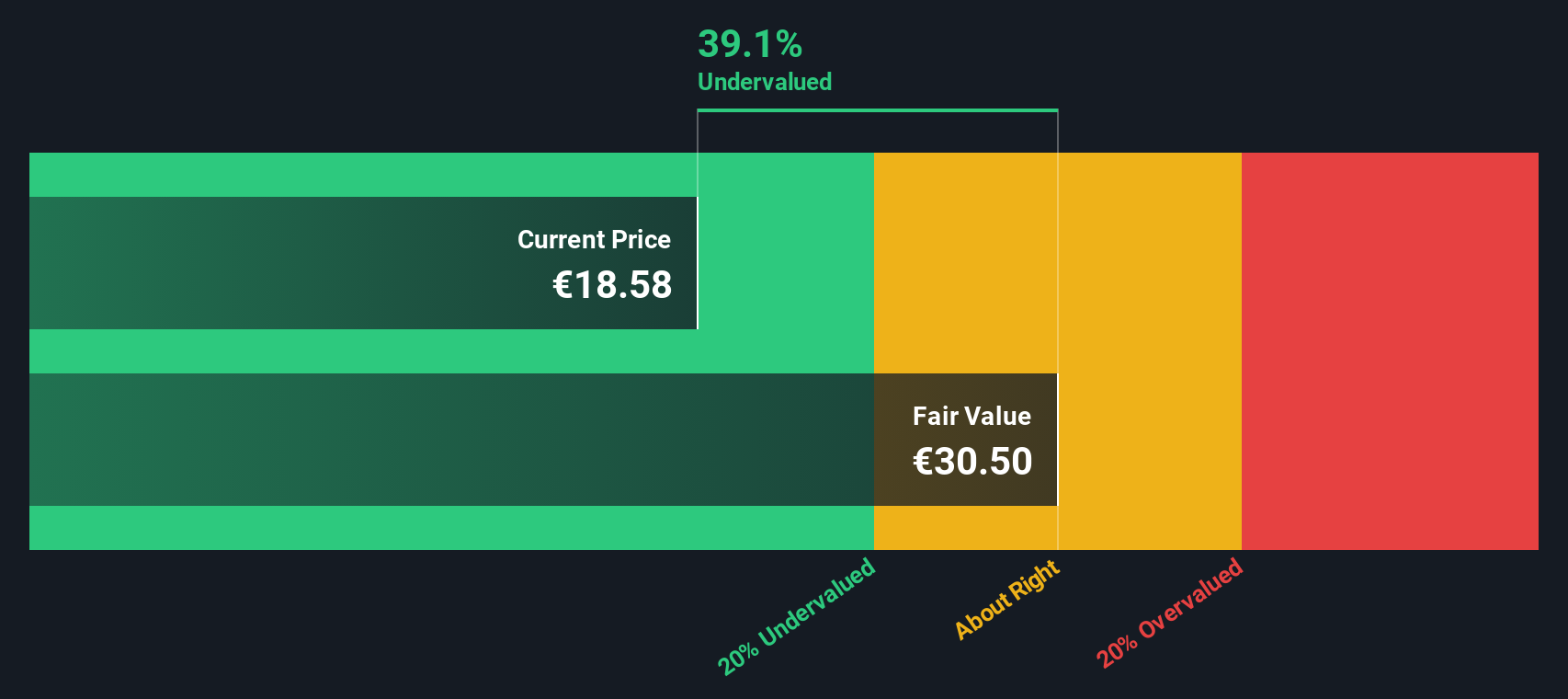

Corbion (ENXTAM:CRBN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Corbion is a company specializing in sustainable ingredient solutions, primarily focusing on health and nutrition as well as functional ingredients and solutions, with a market capitalization of approximately €1.98 billion.

Operations: Health & Nutrition and Functional Ingredients & Solutions segments contribute €290.2 million and €997.9 million, respectively, to the company's revenue streams. The gross profit margin has shown fluctuations, reaching 31.47% in late 2019 before declining to around 22.38% by late 2023, indicating variations in cost management or pricing strategies over time.

PE: 24.4x

Corbion, a European company with a market cap under €2 billion, is catching attention for its financial potential despite high debt levels. Their earnings are projected to grow nearly 20% annually. Recent insider confidence was evident in share purchases during March 2025. Although reliant on external borrowing, Corbion's net income surged to €192 million in 2024 from €73 million the previous year. The company announced an increased dividend of €0.64 per share for May 2025, signaling optimism about future performance amidst these challenges.

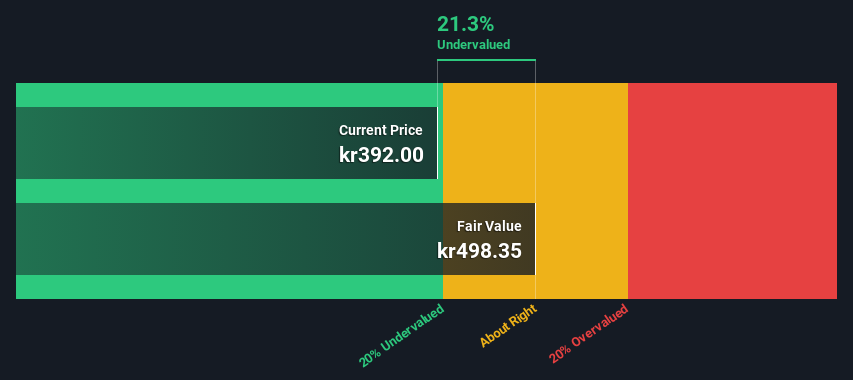

MedCap (OM:MCAP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MedCap is a company engaged in the support, specialty pharma, and medical technology sectors with a market capitalization of SEK 4.05 billion.

Operations: MedCap generates revenue through its three main segments: Support, Specialty Pharma, and Medical Technology. The company's gross profit margin has shown an upward trend from 28.62% to 58.48% over the analyzed period, indicating changes in cost efficiency or pricing strategies. Operating expenses are primarily driven by general and administrative costs, which reached SEK 720.4 million in the latest period reported.

PE: 32.4x

MedCap, a European small-cap company, is gaining attention for its potential value. Recent insider confidence is evident as Anders Dahlberg acquired 10,000 shares in April 2025 for SEK 3.9 million, increasing their stake by 33%. Despite relying on higher-risk external borrowing without customer deposits, MedCap's forecasted revenue growth of 13% annually suggests promising prospects. The first quarter of 2025 showed increased sales at SEK 493.8 million compared to the previous year, though net income slightly decreased to SEK 50.5 million.

- Get an in-depth perspective on MedCap's performance by reading our valuation report here.

Explore historical data to track MedCap's performance over time in our Past section.

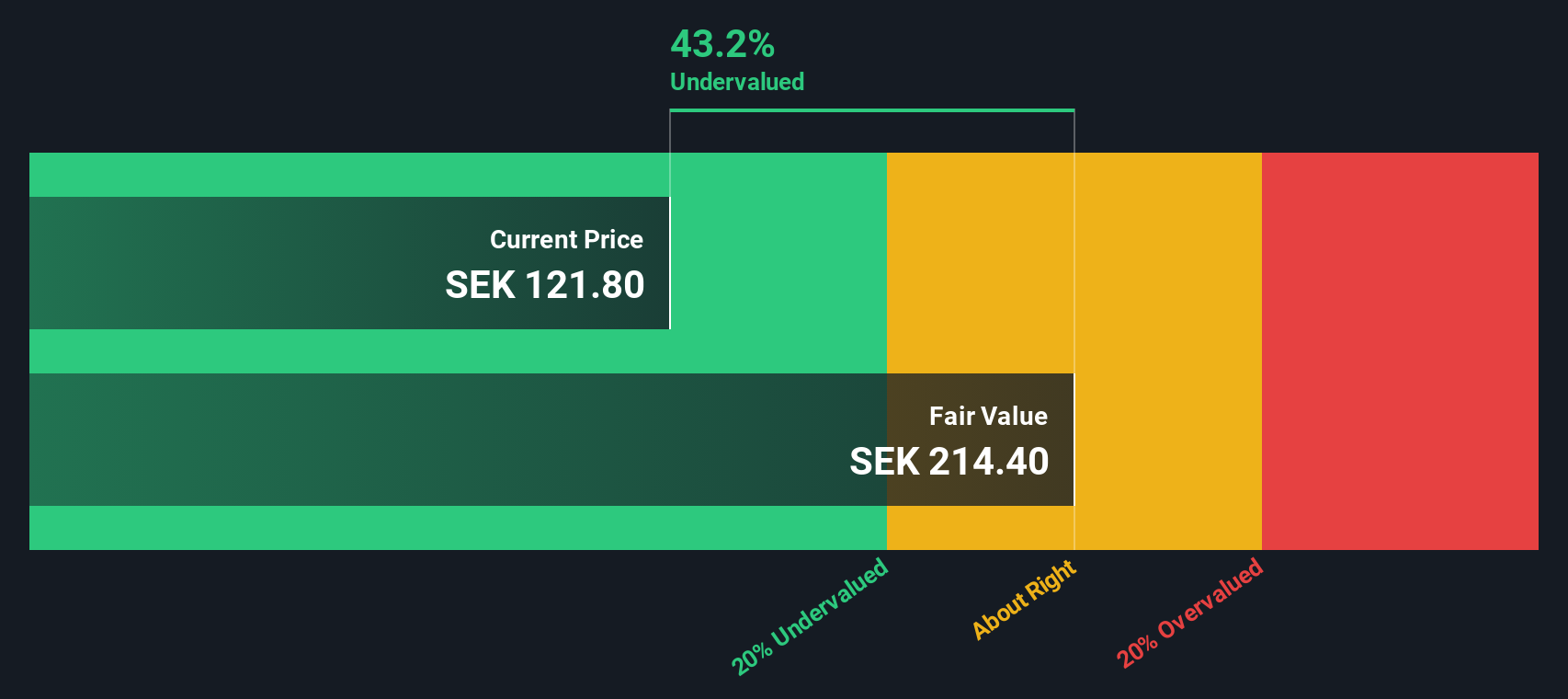

New Wave Group (OM:NEWA B)

Simply Wall St Value Rating: ★★★★★☆

Overview: New Wave Group is a diversified company engaged in the design, acquisition, and development of branded consumer products within the Corporate, Sports & Leisure, and Gifts & Home Furnishings segments with a market cap of SEK 8.52 billion.

Operations: The company generates revenue primarily from its Corporate, Sports & Leisure, and Gifts & Home Furnishings segments. Over recent periods, the gross profit margin has shown a notable trend reaching 50.14% as of March 2023. Operating expenses have been consistently significant, with general and administrative expenses forming a substantial portion of these costs.

PE: 17.3x

New Wave Group, a company with a focus on external borrowing for funding, recently demonstrated insider confidence through significant share purchases by Jens Petersson. They acquired 248,250 shares valued at SEK 24.9 million in April 2025, signaling strong belief in the company's potential. The first quarter of 2025 showed promising growth with sales increasing to SEK 2.18 billion from SEK 1.99 billion year-over-year and net income rising to SEK 144 million from SEK 121 million. Earnings per share improved as well, reflecting positive momentum despite reliance on higher-risk funding sources.

- Delve into the full analysis valuation report here for a deeper understanding of New Wave Group.

Gain insights into New Wave Group's historical performance by reviewing our past performance report.

Seize The Opportunity

- Unlock more gems! Our Undervalued European Small Caps With Insider Buying screener has unearthed 62 more companies for you to explore.Click here to unveil our expertly curated list of 65 Undervalued European Small Caps With Insider Buying.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CRBN

Corbion

Provides lactic acid and lactic acid derivatives, food preservation solutions, functional blends, and algae ingredients in the Netherlands, the United States, Asia, rest of North Americas, the rest of Europe, the Middle East, and Africa.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives