- Sweden

- /

- Consumer Durables

- /

- OM:NBZ

Investors Still Aren't Entirely Convinced By Northbaze Group AB (publ)'s (STO:NBZ) Revenues Despite 29% Price Jump

The Northbaze Group AB (publ) (STO:NBZ) share price has done very well over the last month, posting an excellent gain of 29%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 48% in the last twelve months.

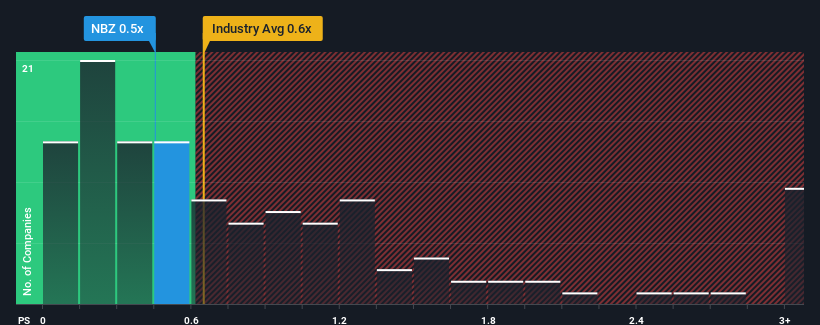

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Northbaze Group's P/S ratio of 0.5x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in Sweden is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Northbaze Group

What Does Northbaze Group's Recent Performance Look Like?

Northbaze Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Northbaze Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Northbaze Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Northbaze Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 20% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 8.3% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 11% per year during the coming three years according to the sole analyst following the company. With the rest of the industry predicted to shrink by 0.4% per year, that would be a fantastic result.

In light of this, it's peculiar that Northbaze Group's P/S sits in-line with the majority of other companies. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Key Takeaway

Its shares have lifted substantially and now Northbaze Group's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Northbaze Group's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. The market could be pricing in the event that tough industry conditions will impact future revenues. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 3 warning signs for Northbaze Group that you should be aware of.

If you're unsure about the strength of Northbaze Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Northbaze Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NBZ

Northbaze Group

Designs, develops, produces, and markets audio and sound equipment in Nordic, Europe, Asia, the Middle East, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives