- Sweden

- /

- Consumer Durables

- /

- OM:NBZ

A Piece Of The Puzzle Missing From Northbaze Group AB (publ)'s (STO:NBZ) 25% Share Price Climb

Northbaze Group AB (publ) (STO:NBZ) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 40% over that time.

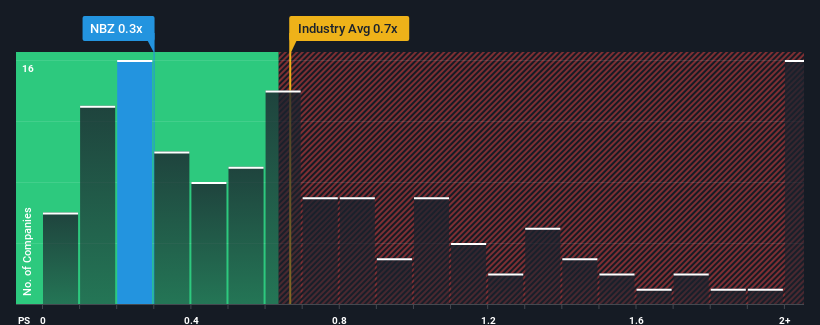

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Northbaze Group's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in Sweden is also close to 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Northbaze Group

What Does Northbaze Group's P/S Mean For Shareholders?

Recent times have been advantageous for Northbaze Group as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Northbaze Group.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Northbaze Group's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. As a result, it also grew revenue by 18% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 168% as estimated by the sole analyst watching the company. With the rest of the industry predicted to shrink by 3.4%, that would be a fantastic result.

In light of this, it's peculiar that Northbaze Group's P/S sits in-line with the majority of other companies. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Final Word

Northbaze Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We note that even though Northbaze Group trades at a similar P/S as the rest of the industry, it far eclipses them in terms of forecasted revenue growth. There could be some unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. The market could be pricing in the event that tough industry conditions will impact future revenues. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Northbaze Group that you should be aware of.

If you're unsure about the strength of Northbaze Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Northbaze Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:NBZ

Northbaze Group

Designs, develops, produces, and markets audio and sound equipment in Nordic, Europe, Asia, the Middle East, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives