February 2025's Highlighted Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings and geopolitical uncertainties, investors are keenly observing the effects of AI competition and monetary policy decisions on major indices. With the Federal Reserve maintaining steady interest rates amidst persistent inflation concerns, and the European Central Bank cutting rates to boost sentiment, identifying stocks that may be trading below their estimated value becomes crucial for those seeking potential opportunities. In this environment, a good stock is often characterized by strong fundamentals, resilience to market volatility, and potential for growth despite broader economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Old National Bancorp (NasdaqGS:ONB) | US$24.45 | US$48.78 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.96 | CA$11.91 | 50% |

| Tongqinglou Catering (SHSE:605108) | CN¥20.86 | CN¥41.63 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.14 | SEK165.53 | 49.8% |

| Solum (KOSE:A248070) | ₩18800.00 | ₩37257.19 | 49.5% |

| AbbVie (NYSE:ABBV) | US$192.97 | US$385.39 | 49.9% |

| Semiconductor Manufacturing International (SEHK:981) | HK$47.90 | HK$95.26 | 49.7% |

| Verra Mobility (NasdaqCM:VRRM) | US$25.88 | US$51.66 | 49.9% |

| Facephi Biometria (BME:FACE) | €2.24 | €4.46 | 49.7% |

| Sandfire Resources (ASX:SFR) | A$10.33 | A$20.47 | 49.5% |

Let's uncover some gems from our specialized screener.

Pluxee (ENXTPA:PLX)

Overview: Pluxee N.V. provides employee benefits and engagement solutions services across France, Latin America, Continental Europe, and internationally with a market cap of €3.34 billion.

Operations: The company's revenue segments include €460 million from Latin America, €216 million from the Rest of The World, and €534 million from Continental Europe.

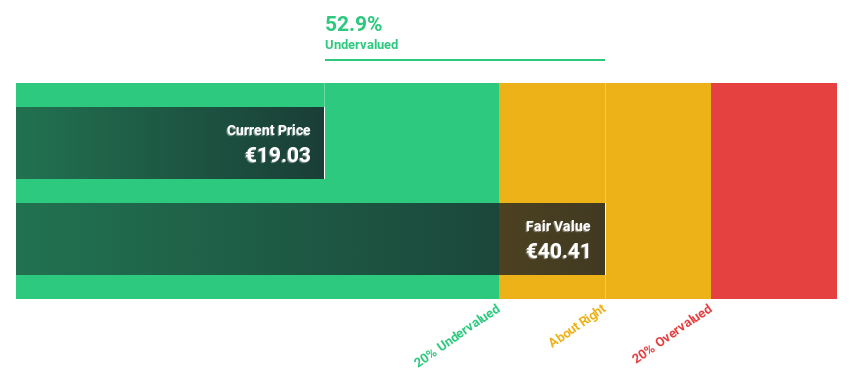

Estimated Discount To Fair Value: 42.3%

Pluxee is trading at €22.91, significantly below its estimated fair value of €39.7, making it highly undervalued based on cash flow analysis. The company has reiterated low double-digit organic revenue growth for fiscal years 2025 and 2026, with slight organic float revenue growth anticipated. Despite past earnings growth of 64.2%, future earnings are forecast to grow at a robust 19% annually, outpacing the French market's average growth rate of 12.4%.

- The analysis detailed in our Pluxee growth report hints at robust future financial performance.

- Click here and access our complete balance sheet health report to understand the dynamics of Pluxee.

Mips (OM:MIPS)

Overview: Mips AB (publ) develops, manufactures, and sells helmet-based safety systems across North America, Europe, Sweden, Asia, and Australia with a market cap of SEK14.81 billion.

Operations: The company generates revenue primarily from its Sporting Goods segment, which accounted for SEK430 million.

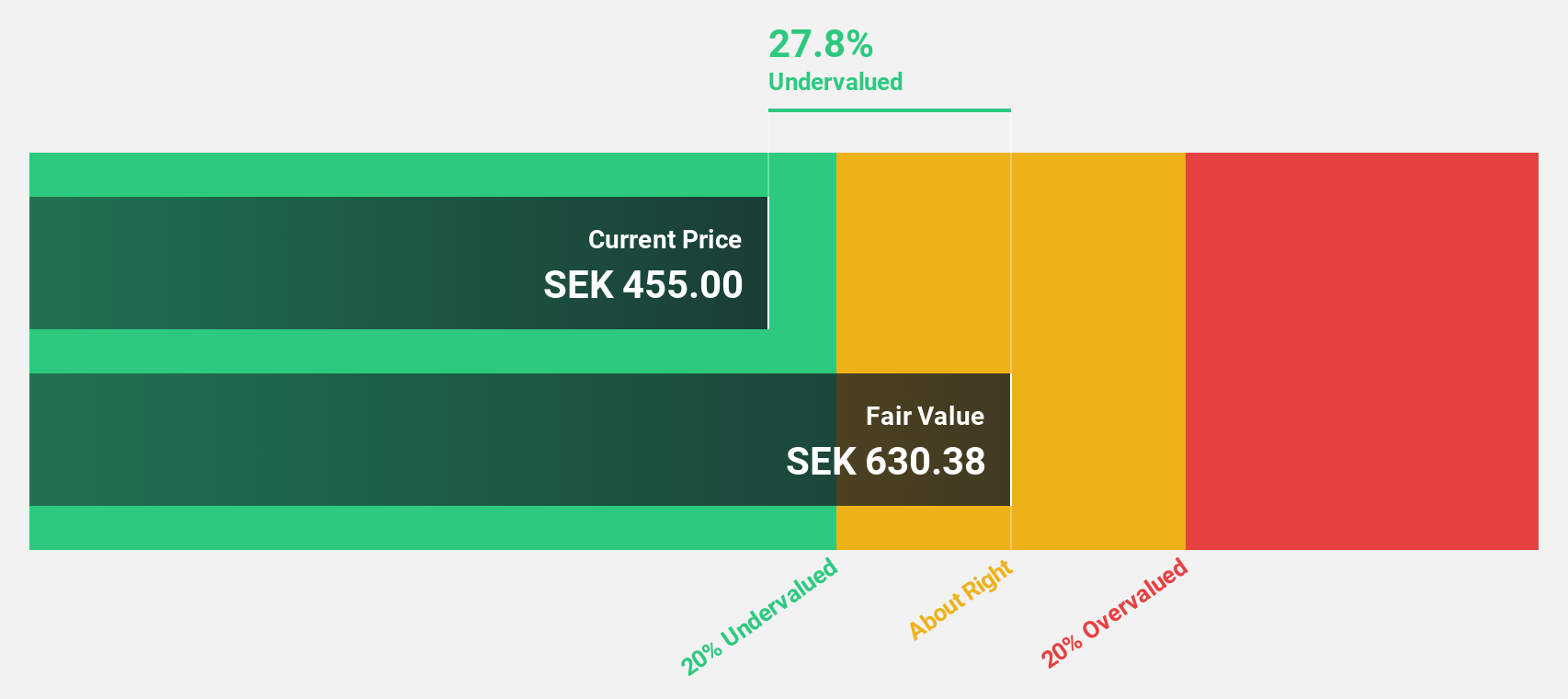

Estimated Discount To Fair Value: 22.5%

Mips is trading at SEK559, 22.5% below its estimated fair value of SEK721.46, indicating it is undervalued based on cash flow analysis. The company reported significant earnings growth with net income rising to SEK141 million from SEK64 million last year. Future earnings are forecast to grow 42.2% annually, outpacing the Swedish market's average growth rate of 13.3%, while revenue is expected to grow at a robust 30.2% per year.

- Our earnings growth report unveils the potential for significant increases in Mips' future results.

- Click to explore a detailed breakdown of our findings in Mips' balance sheet health report.

Appotronics (SHSE:688007)

Overview: Appotronics Corporation Limited focuses on the research, development, production, sale, and leasing of laser display devices and machines in China with a market cap of CN¥6.71 billion.

Operations: Appotronics Corporation Limited generates revenue primarily through its activities in the research, development, production, sale, and leasing of laser display devices and machines within China.

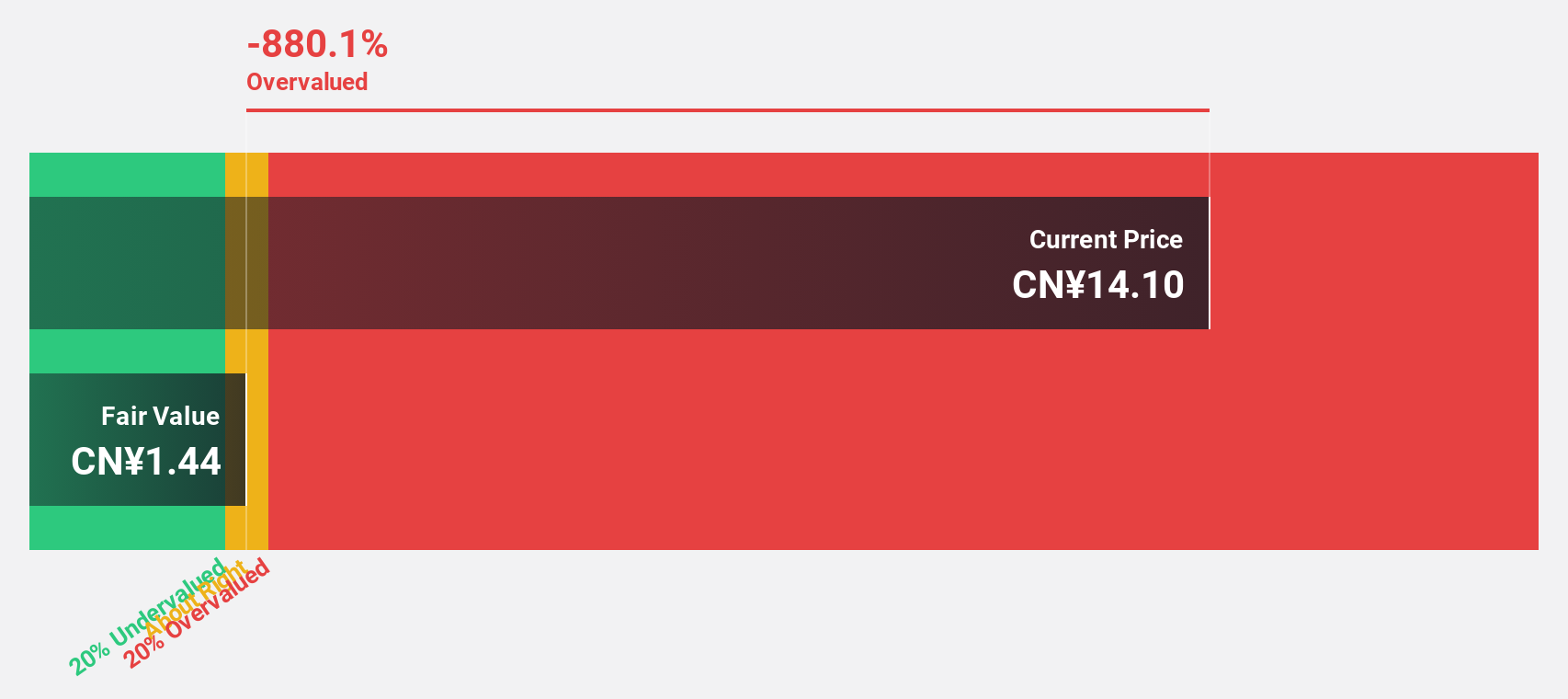

Estimated Discount To Fair Value: 15.9%

Appotronics, trading at CN¥14.88, is undervalued compared to its estimated fair value of CN¥17.69. Its earnings are projected to grow significantly at 90.1% annually, outpacing the Chinese market's 25.1%. Revenue growth is also strong at 21.5% per year, exceeding the market average of 13.5%. Despite lower profit margins this year due to large one-off items and a forecasted low return on equity (8.7%), recent partnerships may enhance future prospects.

- Our expertly prepared growth report on Appotronics implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Appotronics.

Key Takeaways

- Click through to start exploring the rest of the 918 Undervalued Stocks Based On Cash Flows now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MIPS

Mips

Develops, manufactures, and sells helmet-based safety systems in North America, Europe, Sweden, Asia, and Australia.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives