- Sweden

- /

- Consumer Durables

- /

- OM:CANDLE B

This Candles Scandinavia AB (publ) (STO:CANDLE B) Analyst Just Made A Noteworthy 13% Cut To Their Forecasts

Market forces rained on the parade of Candles Scandinavia AB (publ) (STO:CANDLE B) shareholders today, when the covering analyst downgraded their forecasts for this year. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic. Shares are up 9.4% to kr47.55 in the past week. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

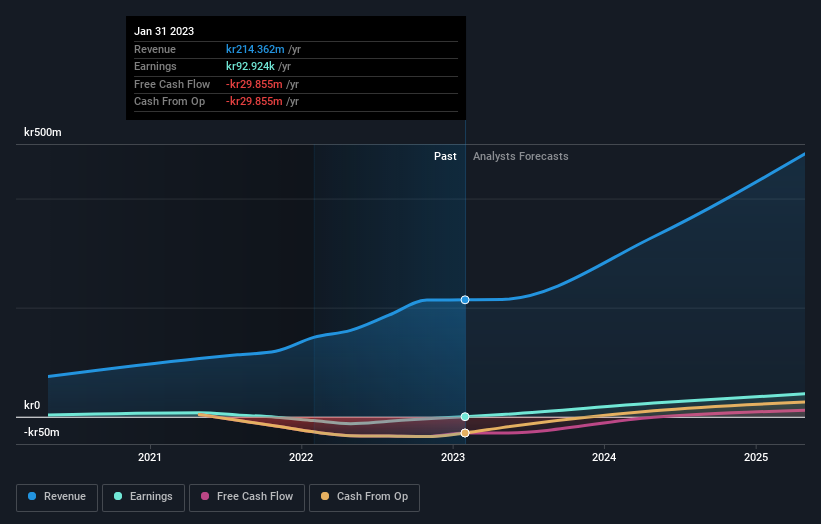

Following this downgrade, Candles Scandinavia's single analyst are forecasting 2023 revenues to be kr215m, approximately in line with the last 12 months. Before the latest update, the analyst was foreseeing kr246m of revenue in 2023. It looks like forecasts have become a fair bit less optimistic on Candles Scandinavia, given the substantial drop in revenue estimates.

See our latest analysis for Candles Scandinavia

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's pretty clear that there is an expectation that Candles Scandinavia's revenue growth will slow down substantially, with revenues to the end of 2023 expected to display 0.3% growth on an annualised basis. This is compared to a historical growth rate of 38% over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue shrink 2.5% per year. So it's clear that despite the slowdown in growth, Candles Scandinavia is still expected to grow meaningfully faster than the wider industry.

The Bottom Line

The clear low-light was that the analyst slashing their revenue forecasts for Candles Scandinavia this year. The analyst also expects revenues to perform better than the wider market. After a cut like that, investors could be forgiven for thinking the analyst is a lot more bearish on Candles Scandinavia, and a few readers might choose to steer clear of the stock.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with Candles Scandinavia, including dilutive stock issuance over the past year. Learn more, and discover the 2 other risks we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CANDLE B

Candles Scandinavia

Manufactures and sells scented candles based on plant-based wax made of rapeseed oil.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026