- Sweden

- /

- Consumer Durables

- /

- OM:CANDLE B

A Piece Of The Puzzle Missing From Candles Scandinavia AB (publ)'s (STO:CANDLE B) 39% Share Price Climb

Candles Scandinavia AB (publ) (STO:CANDLE B) shareholders would be excited to see that the share price has had a great month, posting a 39% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 10% in the last twelve months.

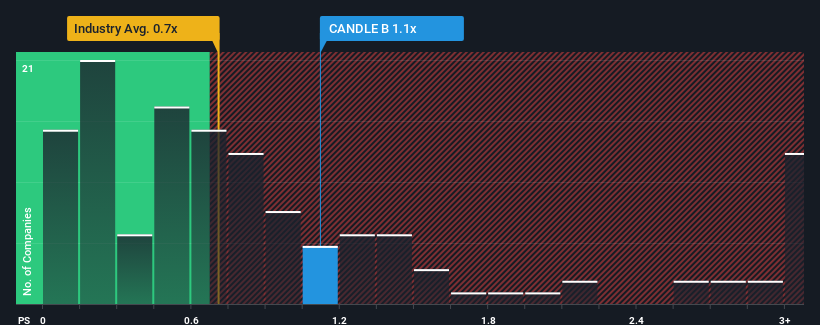

Although its price has surged higher, you could still be forgiven for feeling indifferent about Candles Scandinavia's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Consumer Durables industry in Sweden is also close to 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Our free stock report includes 4 warning signs investors should be aware of before investing in Candles Scandinavia. Read for free now.View our latest analysis for Candles Scandinavia

What Does Candles Scandinavia's Recent Performance Look Like?

It looks like revenue growth has deserted Candles Scandinavia recently, which is not something to boast about. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. Those who are bullish on Candles Scandinavia will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Candles Scandinavia will help you shine a light on its historical performance.How Is Candles Scandinavia's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Candles Scandinavia's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 19% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 5.1% shows it's a great look while it lasts.

With this in mind, we find it intriguing that Candles Scandinavia's P/S matches its industry peers. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What Does Candles Scandinavia's P/S Mean For Investors?

Candles Scandinavia's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As mentioned previously, Candles Scandinavia currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears some are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Candles Scandinavia (2 make us uncomfortable) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:CANDLE B

Candles Scandinavia

Manufactures and sells scented candles based on plant-based wax made of rapeseed oil.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives