- Sweden

- /

- Professional Services

- /

- OM:WISE

It's Down 25% But Wise Group AB (publ) (STO:WISE) Could Be Riskier Than It Looks

Wise Group AB (publ) (STO:WISE) shares have had a horrible month, losing 25% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

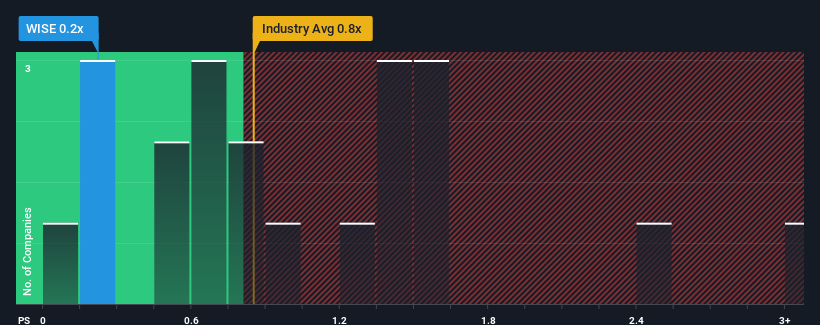

After such a large drop in price, given about half the companies operating in Sweden's Professional Services industry have price-to-sales ratios (or "P/S") above 0.7x, you may consider Wise Group as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Wise Group

How Wise Group Has Been Performing

For example, consider that Wise Group's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Wise Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Wise Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Wise Group's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. Regardless, revenue has managed to lift by a handy 17% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

It's interesting to note that the rest of the industry is similarly expected to grow by 3.8% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Wise Group is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

What Does Wise Group's P/S Mean For Investors?

Wise Group's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

The fact that Wise Group currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. While recent

We don't want to rain on the parade too much, but we did also find 1 warning sign for Wise Group that you need to be mindful of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Wise Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:WISE

Wise Group

Engages in the provision of recruitment and consultancy services in Sweden, Finland, and Denmark.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives