Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that ITAB Shop Concept AB (publ) (STO:ITAB) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for ITAB Shop Concept

How Much Debt Does ITAB Shop Concept Carry?

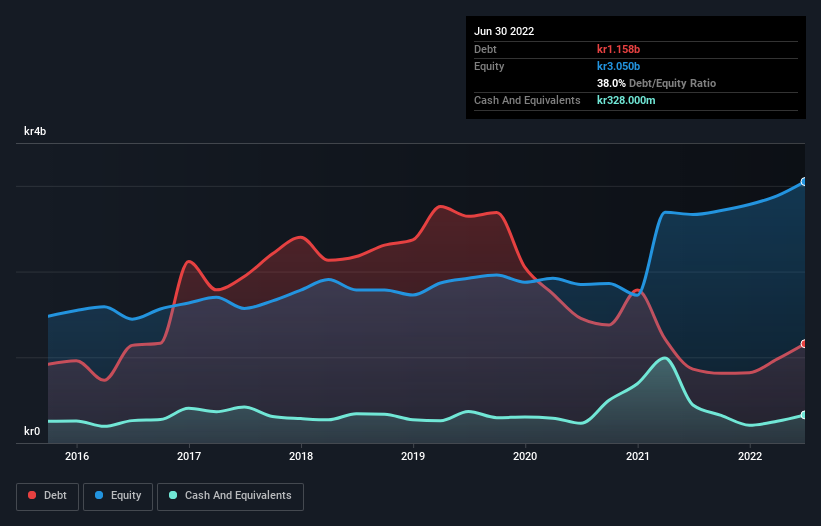

The image below, which you can click on for greater detail, shows that at June 2022 ITAB Shop Concept had debt of kr1.16b, up from kr862.0m in one year. On the flip side, it has kr328.0m in cash leading to net debt of about kr830.0m.

How Healthy Is ITAB Shop Concept's Balance Sheet?

We can see from the most recent balance sheet that ITAB Shop Concept had liabilities of kr2.33b falling due within a year, and liabilities of kr1.21b due beyond that. On the other hand, it had cash of kr328.0m and kr1.52b worth of receivables due within a year. So its liabilities total kr1.68b more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of kr1.82b, so it does suggest shareholders should keep an eye on ITAB Shop Concept's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

ITAB Shop Concept's net debt of 1.9 times EBITDA suggests graceful use of debt. And the alluring interest cover (EBIT of 9.8 times interest expense) certainly does not do anything to dispel this impression. One way ITAB Shop Concept could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 17%, as it did over the last year. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if ITAB Shop Concept can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, ITAB Shop Concept recorded free cash flow worth a fulsome 89% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

When it comes to the balance sheet, the standout positive for ITAB Shop Concept was the fact that it seems able to convert EBIT to free cash flow confidently. But the other factors we noted above weren't so encouraging. For instance it seems like it has to struggle a bit to handle its total liabilities. Considering this range of data points, we think ITAB Shop Concept is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for ITAB Shop Concept you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ITAB

ITAB Shop Concept

Develops, manufactures, sells, and installs store concepts for retail chain stores.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives