Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, ITAB Shop Concept AB (publ) (STO:ITAB) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for ITAB Shop Concept

What Is ITAB Shop Concept's Net Debt?

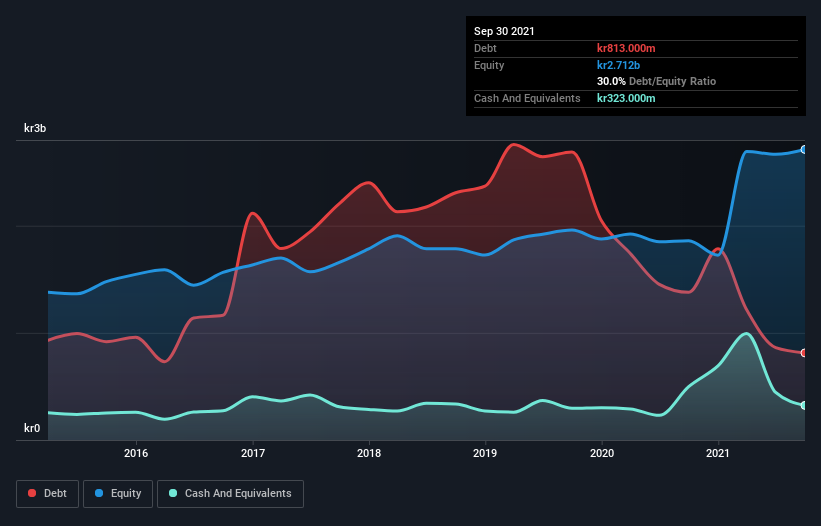

As you can see below, ITAB Shop Concept had kr813.0m of debt at September 2021, down from kr1.38b a year prior. However, because it has a cash reserve of kr323.0m, its net debt is less, at about kr490.0m.

How Strong Is ITAB Shop Concept's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that ITAB Shop Concept had liabilities of kr1.98b due within 12 months and liabilities of kr1.30b due beyond that. Offsetting these obligations, it had cash of kr323.0m as well as receivables valued at kr1.28b due within 12 months. So it has liabilities totalling kr1.68b more than its cash and near-term receivables, combined.

This deficit isn't so bad because ITAB Shop Concept is worth kr3.09b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While ITAB Shop Concept's low debt to EBITDA ratio of 1.2 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 4.5 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Notably, ITAB Shop Concept's EBIT launched higher than Elon Musk, gaining a whopping 160% on last year. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine ITAB Shop Concept's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Happily for any shareholders, ITAB Shop Concept actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Happily, ITAB Shop Concept's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. But truth be told we feel its level of total liabilities does undermine this impression a bit. Taking all this data into account, it seems to us that ITAB Shop Concept takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for ITAB Shop Concept (1 doesn't sit too well with us) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:ITAB

ITAB Shop Concept

Provides solution and store design, customized concept fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for the physical stores.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives