Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that ITAB Shop Concept AB (publ) (STO:ITAB) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for ITAB Shop Concept

What Is ITAB Shop Concept's Debt?

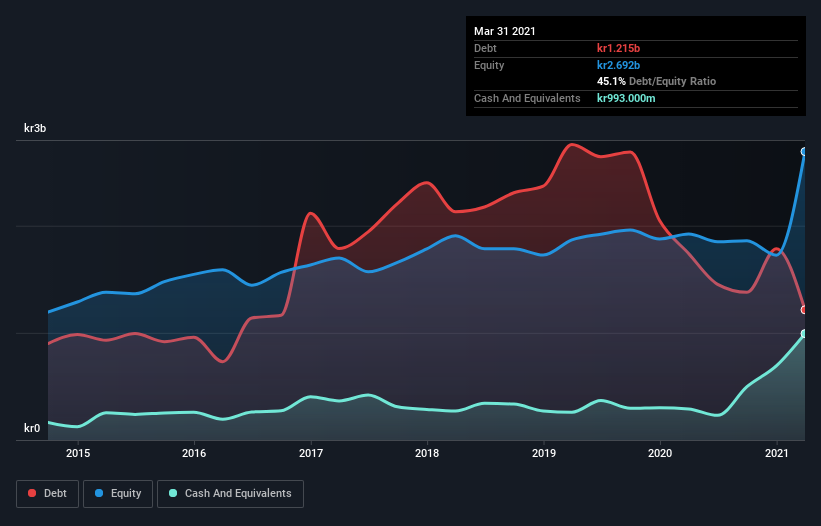

As you can see below, ITAB Shop Concept had kr1.10b of debt at March 2021, down from kr1.74b a year prior. However, it does have kr993.0m in cash offsetting this, leading to net debt of about kr108.0m.

A Look At ITAB Shop Concept's Liabilities

Zooming in on the latest balance sheet data, we can see that ITAB Shop Concept had liabilities of kr1.92b due within 12 months and liabilities of kr1.66b due beyond that. On the other hand, it had cash of kr993.0m and kr1.10b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr1.49b.

ITAB Shop Concept has a market capitalization of kr3.81b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While ITAB Shop Concept's low debt to EBITDA ratio of 0.26 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 3.2 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Notably, ITAB Shop Concept's EBIT launched higher than Elon Musk, gaining a whopping 220% on last year. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if ITAB Shop Concept can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Happily for any shareholders, ITAB Shop Concept actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Happily, ITAB Shop Concept's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its interest cover. Zooming out, ITAB Shop Concept seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 5 warning signs for ITAB Shop Concept (of which 1 doesn't sit too well with us!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade ITAB Shop Concept, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:ITAB

ITAB Shop Concept

Provides solution and store design, customized concept fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for the physical stores.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives