- Sweden

- /

- Commercial Services

- /

- OM:INTRUM

Intrum (OM:INTRUM): Losses Worsen at 43% Annual Rate, Challenging Bullish Profitability Forecasts

Reviewed by Simply Wall St

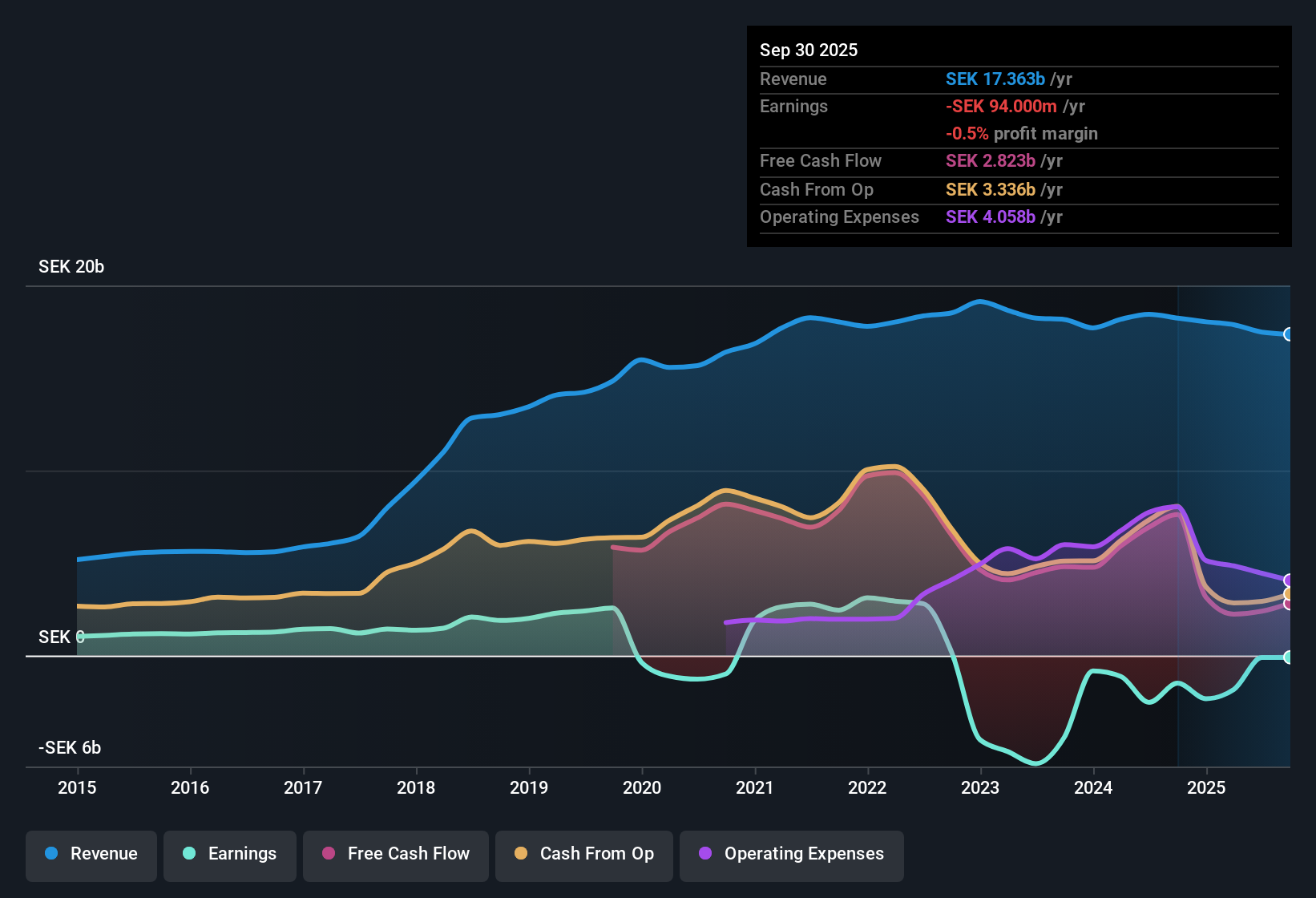

Intrum (OM:INTRUM) has seen its losses deepen over the past five years, with net losses increasing at a rate of 43.3% per year. Meanwhile, revenue is projected to grow at just 0.1% per year, falling behind the broader Swedish market’s expected 3.7% annual growth. Looking ahead, the company is expected to return to profitability within the next three years, with earnings forecast to grow 3.27% per year, which is considered an above-average outlook compared to market peers.

See our full analysis for Intrum.Next, we will see how Intrum’s latest numbers compare to the market’s prevailing narratives. Some assumptions may hold up while others could be in for a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Major Risk Flagged on Financial Position

- Intrum’s filings highlight a significant risk around its financial health, which is unusual among peers in the Commercial Services sector and directly impacts its ability to maintain or return to profitability.

- Prevailing market view emphasizes how persistent challenges with losses, now increasing at a 43.3% annual rate, are compounded by this flagged financial risk.

- Some speculators hope cost-cutting or asset sales could help; however, the core concern is whether the company's balance sheet can withstand further macro or sector shocks.

- The risk appears to support ongoing caution as Intrum pursues turnaround efforts, with earnings growth forecasts still lagging behind market averages.

Valuation Stands Out Versus Peers

- At a Price-to-Sales ratio of 0.3x, Intrum trades below the Commercial Services industry (0.4x) and Swedish peer average (0.7x), and the current share price of SEK43.18 is significantly discounted compared to its DCF fair value estimate of SEK633.65.

- Prevailing market view notes this steep discount may attract deep value investors, but it depends on the company's ability to deliver a financial turnaround.

- The low multiple suggests the market is pricing in continued financial distress or doubts about execution.

- If Intrum can stabilize its core business as projected, there is potential for a sharp re-rating closer to sector norms or DCF fair value.

Profitability Forecast: Back in the Black?

- Management guides toward a return to profitability within three years, with earnings growth forecast at 3.27% per year, notably stronger than broader market expectations for the company’s sector.

- Prevailing market view underscores how fiscal discipline and strategic restructuring remain central to turning this guidance into reality.

- Investors will look for concrete evidence that ongoing losses, previously increasing at double-digit rates, are moderating in line with improved outlook.

- However, the absence of material revenue growth and continued macro pressures mean this earnings inflection is not assured.

Market watchers weighing these signals can track how Intrum’s fundamentals stack up against sector volatility, balance sheet strain, and the sizable valuation gap through recovery or further risk.

See our latest analysis for Intrum.Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Intrum's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Intrum’s deepening losses and flagged financial health issues raise concerns about the company’s ability to withstand future market shocks and return to sustainable profitability.

If you want more confidence in a company’s resilience, check out our solid balance sheet and fundamentals stocks screener (1984 results) to find businesses backed by robust finances and reliable balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:INTRUM

Intrum

Provides payment solutions, and credit and collection services in Europe and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives