- Sweden

- /

- Commercial Services

- /

- OM:GIAB

Revenues Not Telling The Story For Godsinlösen Nordic AB (publ) (STO:GIAB) After Shares Rise 29%

Those holding Godsinlösen Nordic AB (publ) (STO:GIAB) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

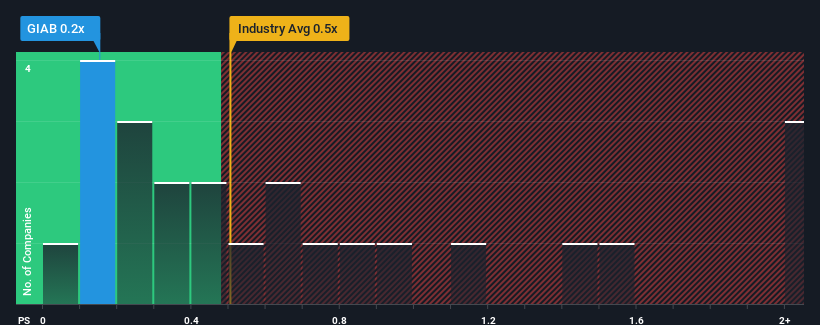

Although its price has surged higher, there still wouldn't be many who think Godsinlösen Nordic's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Sweden's Commercial Services industry is similar at about 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Godsinlösen Nordic

What Does Godsinlösen Nordic's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Godsinlösen Nordic's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Godsinlösen Nordic will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Godsinlösen Nordic would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.6%. This means it has also seen a slide in revenue over the longer-term as revenue is down 31% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 0.5% per year during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 4.2% per year, which is noticeably more attractive.

With this information, we find it interesting that Godsinlösen Nordic is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Godsinlösen Nordic's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Godsinlösen Nordic's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Godsinlösen Nordic (3 make us uncomfortable!) that you need to be mindful of.

If you're unsure about the strength of Godsinlösen Nordic's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:GIAB

Godsinlösen Nordic

Provides various solutions for handling returns and complaints to e-retailers, producers, and distributors in Sweden and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives