- Norway

- /

- Electrical

- /

- OB:OTOVO

Spotlighting 3 European Penny Stocks With Over €40M Market Cap

Reviewed by Simply Wall St

As European markets show mixed returns with hopes for interest rate cuts in the U.S. and UK, investors are keeping a close eye on economic indicators such as inflation and GDP revisions. In this context, penny stocks—often smaller or newer companies—remain an intriguing area for those looking to uncover hidden opportunities. Despite being an outdated term, penny stocks still hold relevance today, especially when backed by strong financials that can offer a blend of value and growth potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.402 | €1.52B | ✅ 4 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.68 | €83.11M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €0.985 | €14.63M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.98 | €27.36M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €231.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.10 | €65.75M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.37 | €386.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.28 | €315.14M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.838 | €28.06M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 276 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

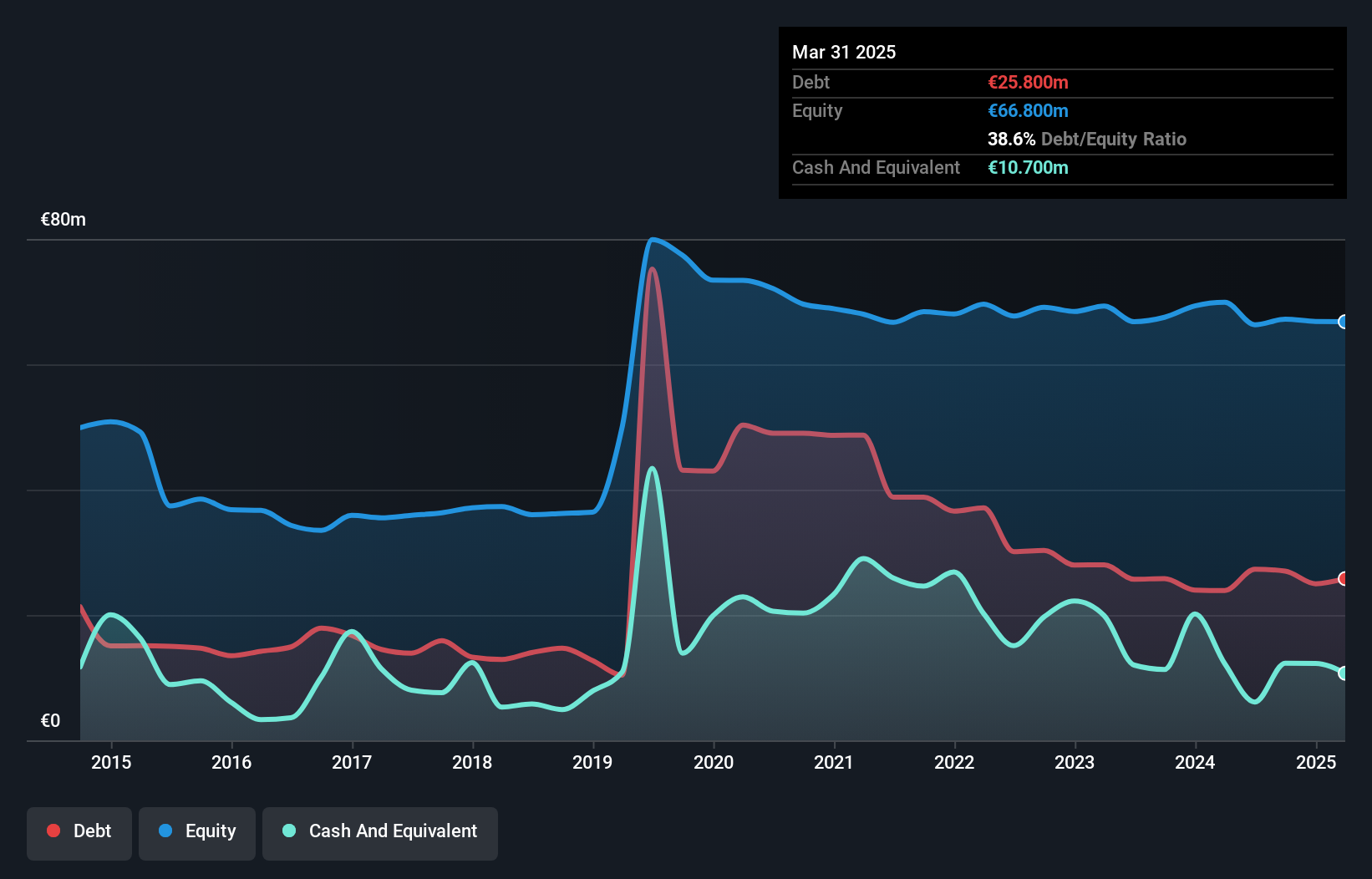

Glaston Oyj Abp (HLSE:GLA1V)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Glaston Oyj Abp manufactures and sells glass processing machines across various regions including Finland, Europe, the Middle East, Africa, the Americas, China and the rest of Asia Pacific with a market cap of €47.51 million.

Operations: The company generates revenue from two primary segments: Architecture, contributing €168.36 million, and Mobility, Display & Solar, accounting for €48.22 million.

Market Cap: €47.51M

Glaston Oyj Abp, with a market cap of €47.51 million, presents a mixed picture for penny stock investors. Despite its reliable 9.73% dividend and satisfactory net debt to equity ratio of 35.7%, the company faces challenges such as declining profit margins and negative earnings growth over the past year. While short-term assets cover both short- and long-term liabilities, Glaston's management team lacks experience with an average tenure of only 0.6 years, potentially impacting strategic decisions. The company's unchanged earnings guidance for 2025 suggests cautious expectations amidst stable yet low return on equity at 1.2%.

- Take a closer look at Glaston Oyj Abp's potential here in our financial health report.

- Understand Glaston Oyj Abp's earnings outlook by examining our growth report.

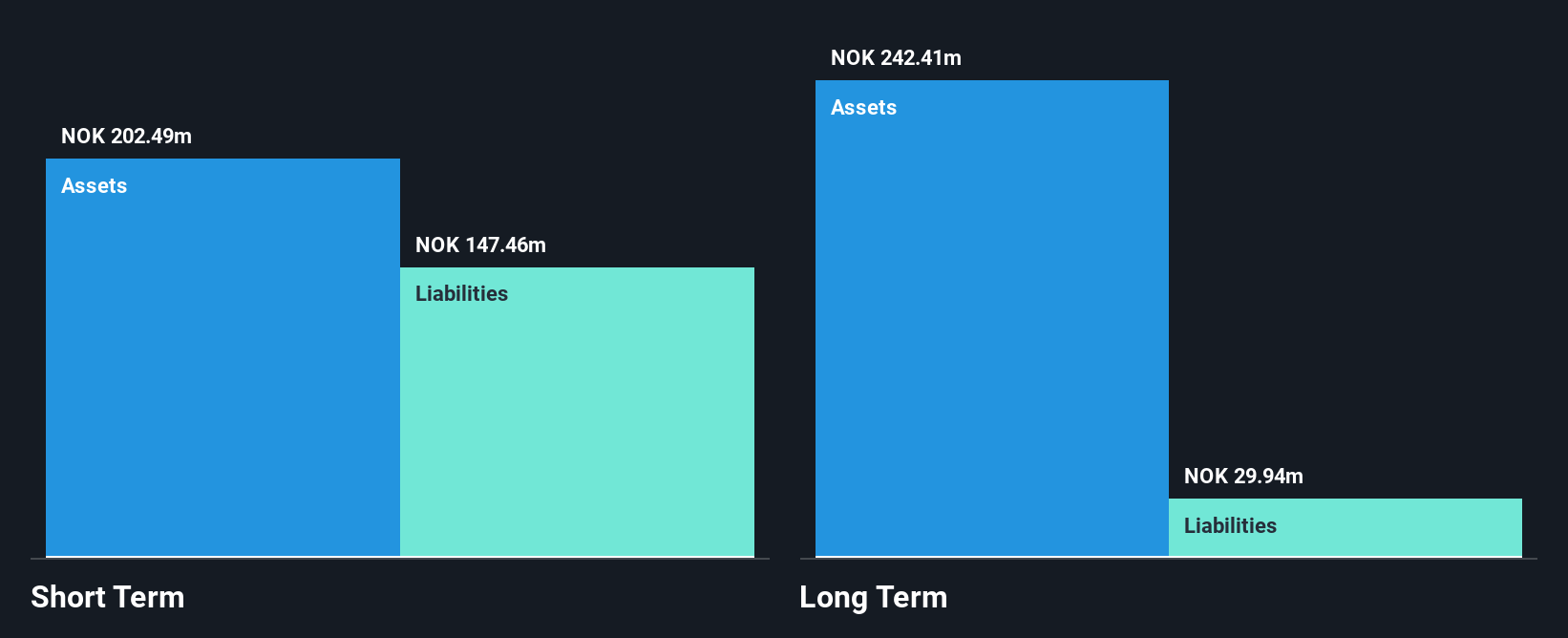

Otovo (OB:OTOVO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Otovo ASA operates an online marketplace for solar installations in Norway and has a market cap of NOK195.87 million.

Operations: The company's revenue is primarily derived from its B2C segment, which generated NOK629.96 million.

Market Cap: NOK195.87M

Otovo ASA, with a market cap of NOK195.87 million, is navigating the challenges typical of penny stocks. Despite being unprofitable and facing increased losses over the past five years, Otovo has managed to reduce its debt-to-equity ratio from 11.3% to 6%. The company recently raised NOK16.95 million through a follow-on equity offering and amended its articles of association to reflect this increase in share capital. Revenue primarily stems from its B2C segment, generating NOK629.96 million annually, while short-term assets comfortably cover both short- and long-term liabilities. Management changes include John Berger's upcoming role as CEO following a merger with Onvis.

- Dive into the specifics of Otovo here with our thorough balance sheet health report.

- Assess Otovo's future earnings estimates with our detailed growth reports.

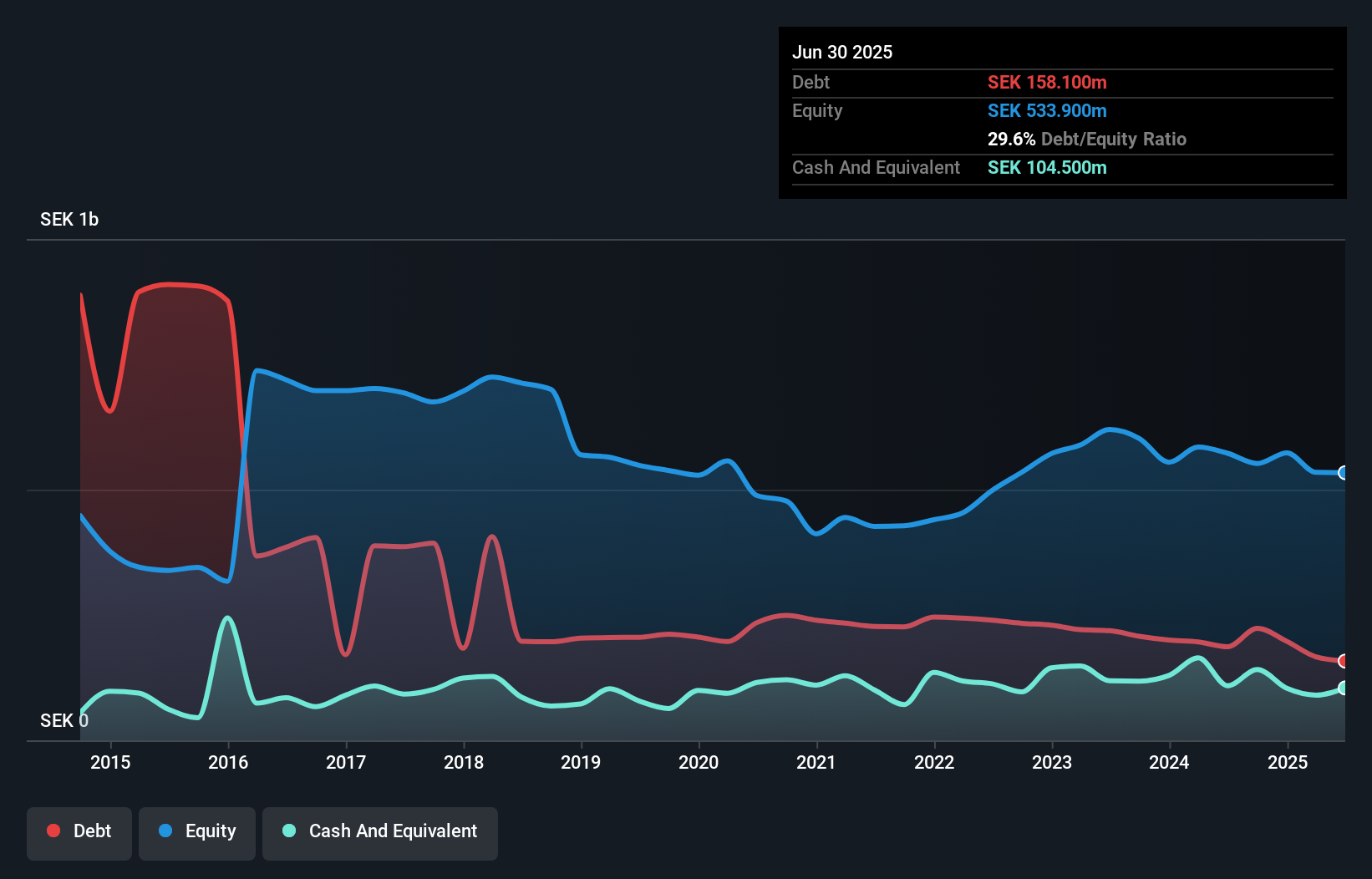

Bong (OM:BONG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bong AB (publ) specializes in light packaging and envelope products across Central Europe, South Europe, North Africa, the Nordics, and the United Kingdom with a market cap of SEK141.51 million.

Operations: The company's revenue is primarily generated from Central Europe (SEK835.70 million), South Europe (SEK610.56 million), the United Kingdom (SEK282.59 million), and the Nordics (SEK232.04 million).

Market Cap: SEK141.51M

Bong AB (publ), with a market cap of SEK141.51 million, is navigating the complexities of penny stocks. The company remains unprofitable, reporting a net loss increase to SEK18 million for Q3 2025, compared to SEK13.1 million the previous year. Despite this, Bong has reduced its debt-to-equity ratio from 52.2% to 29% over five years and maintains a satisfactory net debt-to-equity ratio of 11.1%. Its short-term assets exceed liabilities, providing financial stability alongside a cash runway exceeding three years due to positive free cash flow growth. The board's average tenure is an experienced 11.6 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Bong.

- Assess Bong's previous results with our detailed historical performance reports.

Taking Advantage

- Click this link to deep-dive into the 276 companies within our European Penny Stocks screener.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:OTOVO

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026