- Sweden

- /

- Trade Distributors

- /

- OM:TEQ

If You Had Bought Teqnion (STO:TEQ) Stock A Year Ago, You Could Pocket A 154% Gain Today

Unless you borrow money to invest, the potential losses are limited. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example Teqnion AB (publ) (STO:TEQ). Its share price is already up an impressive 154% in the last twelve months. It's also good to see the share price up 94% over the last quarter. Teqnion hasn't been listed for long, so it's still not clear if it is a long term winner.

Check out our latest analysis for Teqnion

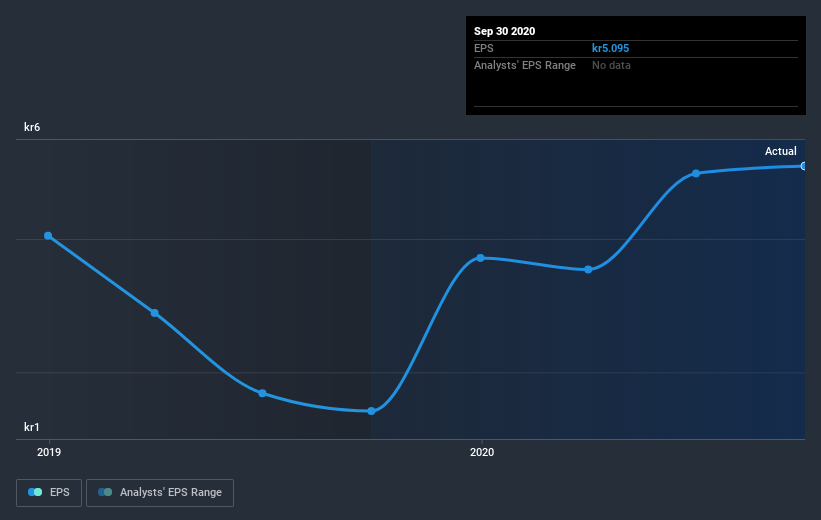

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Teqnion grew its earnings per share (EPS) by 253%. This EPS growth is significantly higher than the 154% increase in the share price. Therefore, it seems the market isn't as excited about Teqnion as it was before. This could be an opportunity.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Teqnion shareholders should be happy with the total gain of 154% over the last twelve months. A substantial portion of that gain has come in the last three months, with the stock up 94% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. It's always interesting to track share price performance over the longer term. But to understand Teqnion better, we need to consider many other factors. For instance, we've identified 2 warning signs for Teqnion that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SE exchanges.

If you’re looking to trade Teqnion, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Teqnion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OM:TEQ

Teqnion

A diversified industrial company, provides a range of products in selected niche markets.

Excellent balance sheet and overvalued.

Market Insights

Community Narratives