- Sweden

- /

- Industrials

- /

- OM:STOR B

How Storskogen Group’s SEK 1 Billion Bond Refinancing May Shape Earnings Outlook (OM:STOR B)

Reviewed by Sasha Jovanovic

- Storskogen Group AB (publ) recently completed a SEK 1 billion floating rate senior unsecured bond offering due April 2030, following the arrangement of investor meetings and a conditional early redemption notice for its existing 2025 bonds.

- This successful refinancing strengthens Storskogen's liquidity profile and positions the company to better support its ongoing business operations and corporate initiatives.

- We'll now explore how the successful bond issue and improved liquidity may influence expectations for Storskogen's earnings stability and growth strategy.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Storskogen Group Investment Narrative Recap

For shareholders in Storskogen Group, the key premise is believing in the company's ability to deliver sustainable earnings growth, especially amid a challenging macroeconomic environment that includes organic sales pressure and integration hurdles. While the recent SEK 1 billion floating rate bond issue supports near-term liquidity and reduces refinancing risk, it does not itself resolve concerns about sales recovery in weak segments or the need for stronger organic growth, which remain the central catalyst and risk in the short term. The most relevant recent announcement is Storskogen's early redemption of its 2025 bonds financed by the new debt issuance. This refinancing removes a short-term maturity overhang, potentially lowering interest expenses and giving the company greater flexibility to focus on improving core business performance and executing on acquisition targets, both vital for restoring confidence in its growth trajectory. However, investors should also consider that despite improved liquidity, persistent challenges in reviving organic sales momentum remain an issue to monitor...

Read the full narrative on Storskogen Group (it's free!)

Storskogen Group's narrative projects SEK35.1 billion revenue and SEK2.0 billion earnings by 2028. This requires 2.1% yearly revenue growth and a SEK1.0 billion earnings increase from SEK973.0 million.

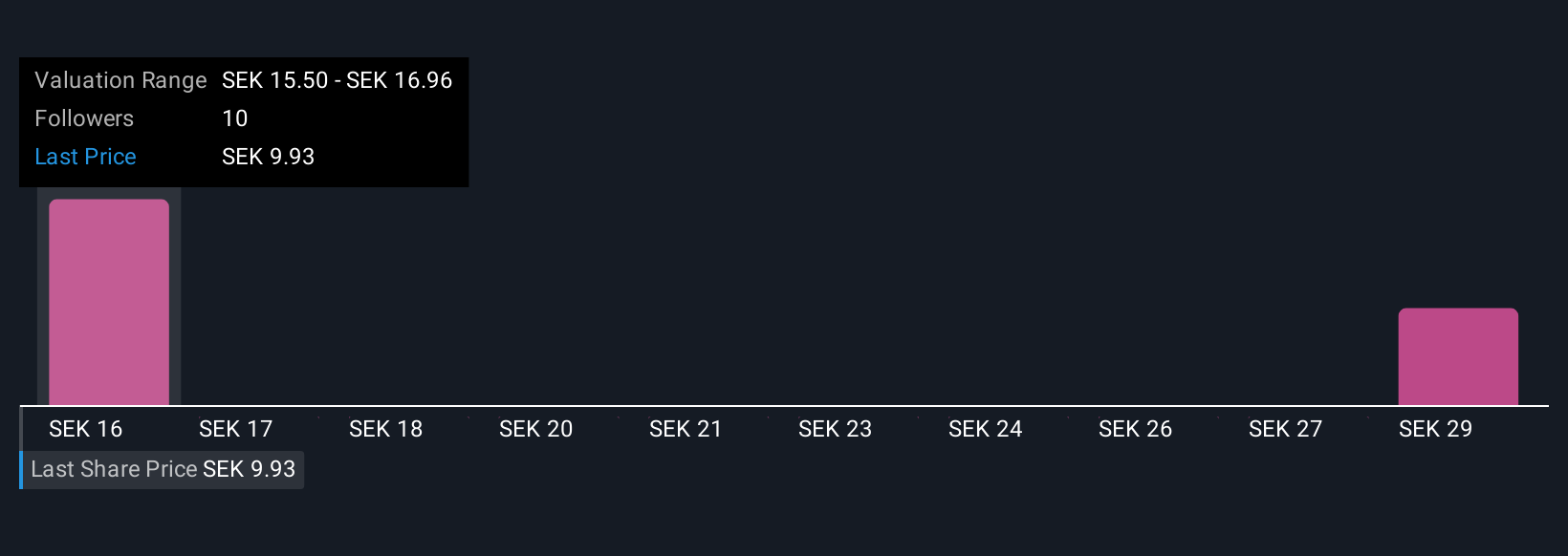

Uncover how Storskogen Group's forecasts yield a SEK15.50 fair value, a 60% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates for Storskogen Group range widely from SEK15.50 to SEK29.96, with two perspectives shown. While many see significant upside, ongoing organic growth concerns continue to shape sentiment and suggest that differences in outlook are substantial.

Explore 2 other fair value estimates on Storskogen Group - why the stock might be worth over 3x more than the current price!

Build Your Own Storskogen Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Storskogen Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Storskogen Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Storskogen Group's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STOR B

Storskogen Group

Owns and develops small and medium-sized businesses operating in trade, industry, and services business areas.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives