Bulten And 2 Top Swedish Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As the European markets show resilience with hopes for interest rate cuts, Swedish dividend stocks present a compelling opportunity for investors seeking stable income and potential growth. In this article, we will explore Bulten and two other top Swedish dividend stocks that can enhance your portfolio by providing consistent returns amidst evolving market conditions.

Top 10 Dividend Stocks In Sweden

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.40% | ★★★★★★ |

| Betsson (OM:BETS B) | 5.62% | ★★★★★☆ |

| Nordea Bank Abp (OM:NDA SE) | 8.77% | ★★★★★☆ |

| Zinzino (OM:ZZ B) | 4.01% | ★★★★★☆ |

| HEXPOL (OM:HPOL B) | 3.57% | ★★★★★☆ |

| Axfood (OM:AXFO) | 3.16% | ★★★★★☆ |

| Duni (OM:DUNI) | 4.99% | ★★★★★☆ |

| Skandinaviska Enskilda Banken (OM:SEB A) | 5.57% | ★★★★★☆ |

| Avanza Bank Holding (OM:AZA) | 4.82% | ★★★★★☆ |

| Loomis (OM:LOOMIS) | 3.79% | ★★★★☆☆ |

Click here to see the full list of 22 stocks from our Top Swedish Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

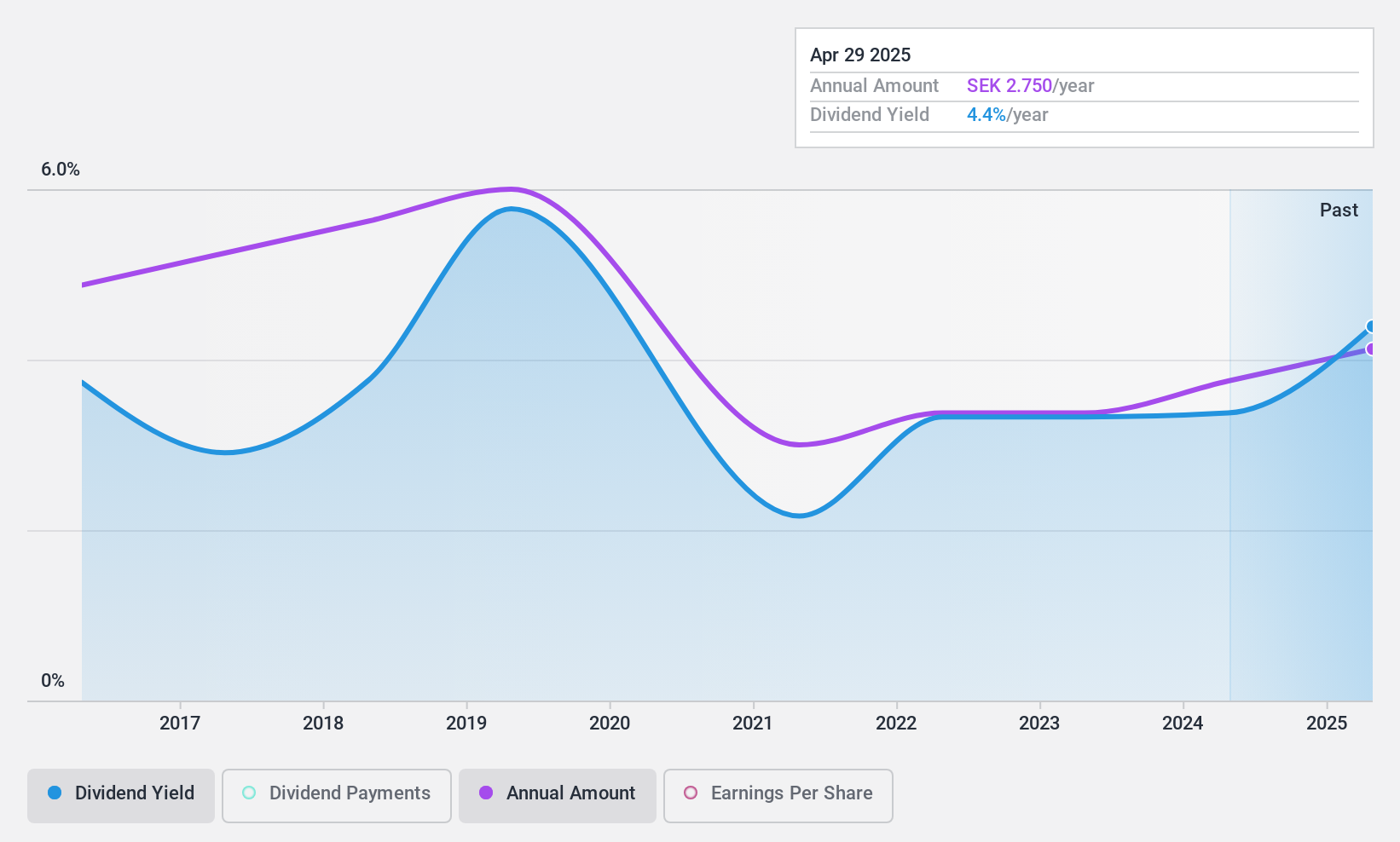

Bulten (OM:BULTEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bulten AB (publ) manufactures and distributes fasteners and related services for various industries, including automotive and consumer electronics, across multiple regions globally, with a market cap of approximately SEK1.61 billion.

Operations: Bulten AB (publ) generated SEK5.95 billion in revenue from its fasteners and related services across various industries and regions globally.

Dividend Yield: 3.3%

Bulten's dividend payments have been volatile over the past decade, with a notable annual drop of over 20% at times. Despite this, the company's current payout ratio of 57% and cash payout ratio of 30.9% indicate dividends are covered by earnings and cash flows. However, profit margins have decreased from 3.6% to 1.5%, and its dividend yield (3.26%) is below the top quartile in Sweden (4.26%). Recent leadership changes could impact future performance as Axel Berntsson takes over as CEO by January 2025.

- Navigate through the intricacies of Bulten with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Bulten shares in the market.

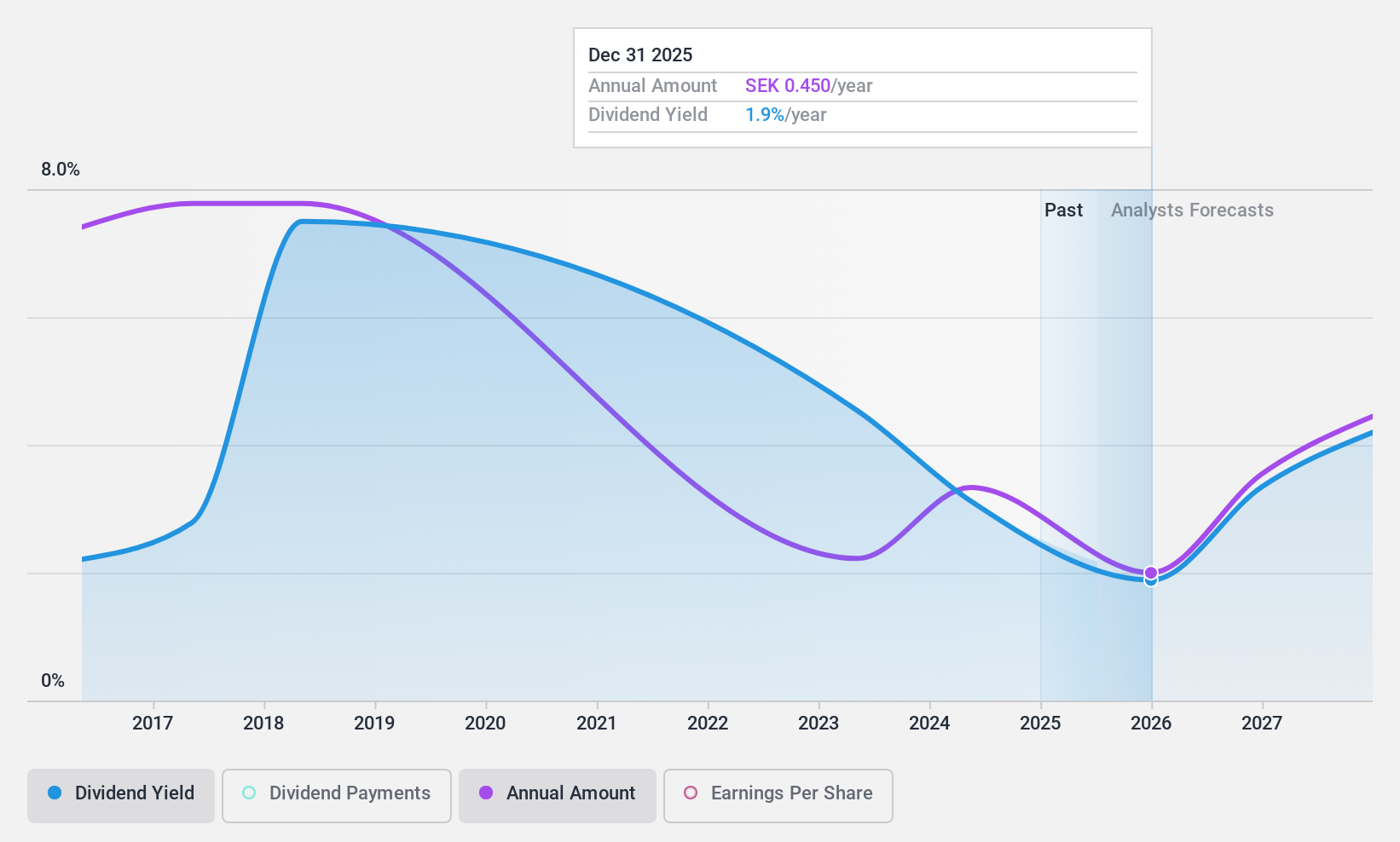

ITAB Shop Concept (OM:ITAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ) offers solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores with a market cap of SEK5.22 billion.

Operations: ITAB Shop Concept AB (publ) generates revenue through solution design, customized shop fittings, checkouts, consumer flow solutions, professional lighting systems, and digitally interactive solutions for physical stores.

Dividend Yield: 3.1%

ITAB Shop Concept's dividend yield (3.09%) is below Sweden's top quartile (4.26%), but its dividends are well-covered by earnings (42.3% payout ratio) and cash flows (28.2% cash payout ratio). Despite a volatile dividend history, recent financials show growth: Q2 2024 sales increased to SEK 1.69 billion from SEK 1.50 billion, and net income rose to SEK 95 million from SEK 56 million year-over-year, indicating potential for future stability in payouts.

- Click to explore a detailed breakdown of our findings in ITAB Shop Concept's dividend report.

- Upon reviewing our latest valuation report, ITAB Shop Concept's share price might be too pessimistic.

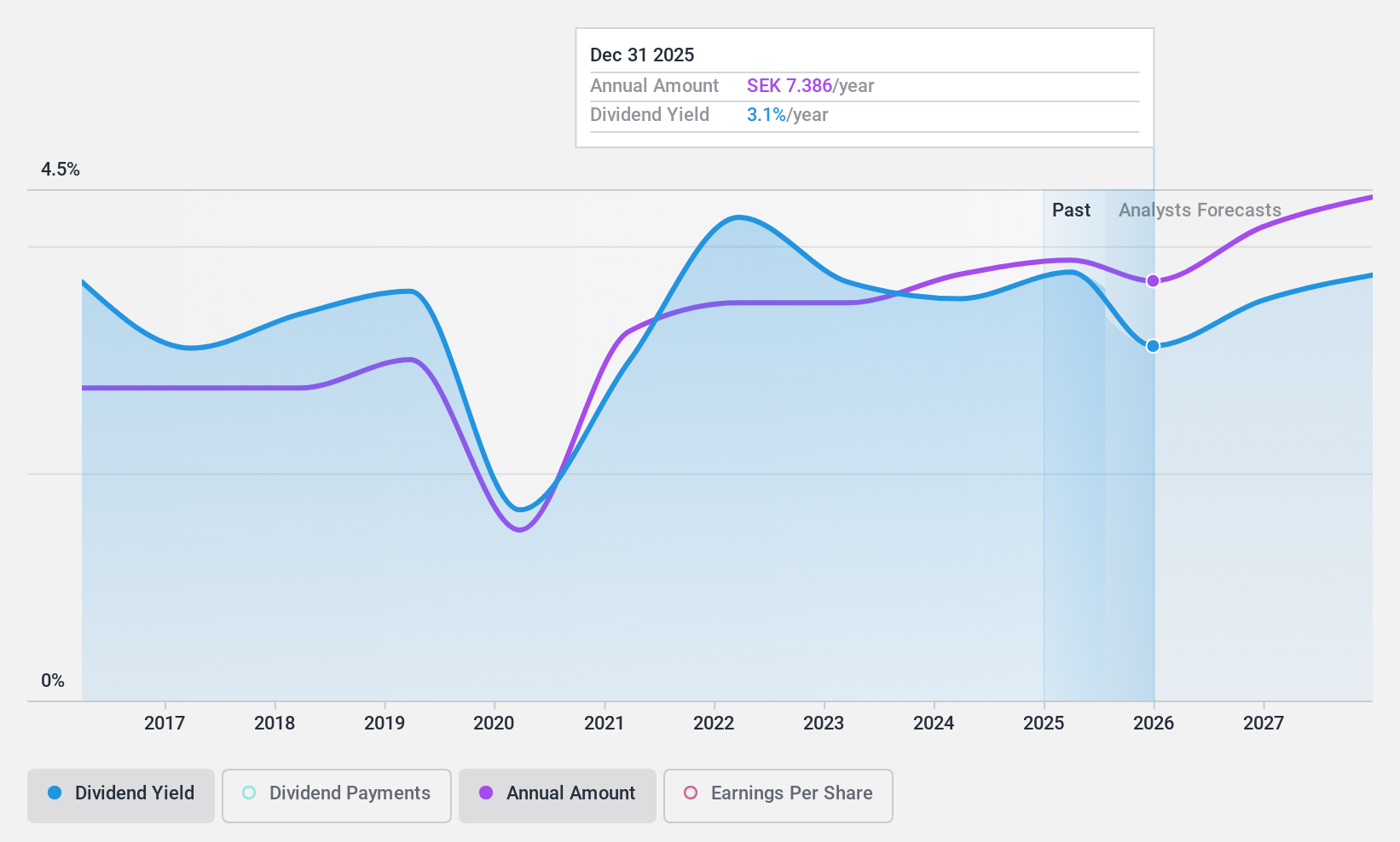

AB SKF (OM:SKF B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB SKF (publ) designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services worldwide with a market cap of SEK87.03 billion.

Operations: AB SKF (publ) generates revenue from two main segments: Automotive, which contributes SEK29.44 billion, and Industrial, which brings in SEK71.08 billion.

Dividend Yield: 3.9%

AB SKF's dividend payments are covered by earnings (59.9% payout ratio) and cash flows (53.6% cash payout ratio), though the dividend history has been volatile over the past decade. Recent financials show a decline, with Q2 2024 sales at SEK 25.61 billion and net income at SEK 1.53 billion, down from last year. The company is trading below its fair value estimate but offers a lower yield (3.92%) compared to top-tier Swedish dividend payers (4.26%).

- Unlock comprehensive insights into our analysis of AB SKF stock in this dividend report.

- The valuation report we've compiled suggests that AB SKF's current price could be quite moderate.

Seize The Opportunity

- Unlock our comprehensive list of 22 Top Swedish Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SKF B

AB SKF

Designs, manufactures, and sells bearings and units, seals, lubrication systems, condition monitoring, and services worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.