Is EIB’s €500m R&D Loan Recasting Sandvik’s Innovation-Led Investment Case (OM:SAND)?

Reviewed by Sasha Jovanovic

- In November 2025, Sandvik signed a €500 million seven-year loan agreement with the European Investment Bank to fund R&D projects across the Group through 2030, focusing on advanced, productive, safe and sustainable solutions.

- This EIB-backed funding underlines the EU’s support for Sandvik’s innovation agenda, highlighting the company’s role in strengthening regional competitiveness and sustainable industrial technology.

- We’ll now examine how this long-term EIB financing for R&D could reshape Sandvik’s investment narrative and future innovation trajectory.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Sandvik Investment Narrative Recap

To be a Sandvik shareholder you need to believe in its ability to turn strong mining exposure, electrification and automation-ready products, and disciplined cost control into resilient earnings, despite softness in general engineering and automotive. The new €500 million EIB loan strengthens Sandvik’s capacity to fund that innovation push without immediately changing the key near term catalyst, which remains mining-related demand, or the main risk, which is pressure on more cyclical Cutting Tools and Infrastructure volumes.

The EIB financing also sits alongside Sandvik’s recent pattern of growing ordinary dividends, with the 2025 AGM approving a SEK 5.75 per share payout. That combination of continued cash returns to shareholders and expanded funding for R&D is central to how many investors assess whether the current mining strength and new product pipeline can offset weaker regions such as Europe and potential demand headwinds elsewhere.

Yet for all the appeal of long term EU backed R&D funding, investors should also be aware of the risk that...

Read the full narrative on Sandvik (it's free!)

Sandvik's narrative projects SEK139.1 billion in revenue and SEK18.6 billion in earnings by 2028.

Uncover how Sandvik's forecasts yield a SEK282.56 fair value, a 3% downside to its current price.

Exploring Other Perspectives

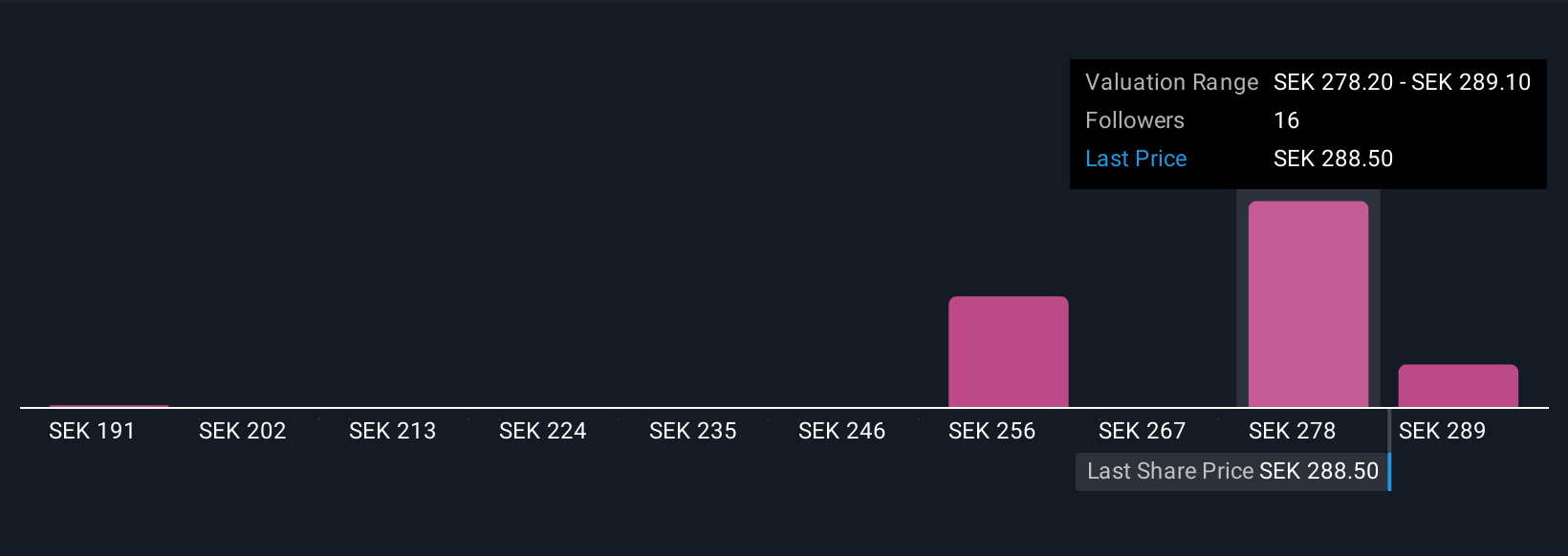

Five Simply Wall St Community fair value estimates for Sandvik span roughly SEK 191 to SEK 300, underlining how far individual views can differ. You can set those against the thesis that Sandvik’s mining strength and electrification focused R&D could help cushion macro pressure in Cutting Tools and Infrastructure, and then decide which set of assumptions feels more realistic for the company’s future performance.

Explore 5 other fair value estimates on Sandvik - why the stock might be worth as much as SEK300.00!

Build Your Own Sandvik Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sandvik research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sandvik research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sandvik's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SAND

Sandvik

An engineering company, provides products and solutions for mining and rock excavation, metal cutting, and materials technology worldwide.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026