- Sweden

- /

- Electrical

- /

- OM:PCELL

Shareholders Should Be Pleased With PowerCell Sweden AB (publ)'s (STO:PCELL) Price

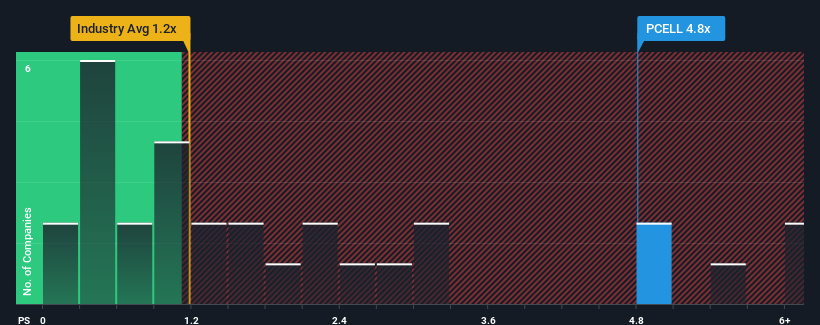

When close to half the companies in the Electrical industry in Sweden have price-to-sales ratios (or "P/S") below 1.2x, you may consider PowerCell Sweden AB (publ) (STO:PCELL) as a stock to avoid entirely with its 4.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for PowerCell Sweden

How PowerCell Sweden Has Been Performing

With revenue growth that's superior to most other companies of late, PowerCell Sweden has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PowerCell Sweden.Do Revenue Forecasts Match The High P/S Ratio?

PowerCell Sweden's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. The latest three year period has also seen an excellent 200% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 30% per year as estimated by the three analysts watching the company. With the industry only predicted to deliver 13% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why PowerCell Sweden's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From PowerCell Sweden's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that PowerCell Sweden maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electrical industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with PowerCell Sweden, and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade PowerCell Sweden, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:PCELL

PowerCell Sweden

Develops and produces fuel cells and fuel cell systems for automotive, marine, and stationary applications in Sweden and internationally.

High growth potential with excellent balance sheet.