- India

- /

- Commercial Services

- /

- NSEI:FLAIR

Three Stocks Priced Below Estimated Value In November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of a changing political landscape and fluctuating economic indicators, investors are closely watching sectors affected by policy shifts under the Trump 2.0 administration. With U.S. stocks experiencing volatility due to regulatory expectations and interest rate speculations, identifying stocks that are priced below their estimated value can offer potential opportunities amid uncertainty. In such an environment, a good stock is often characterized by strong fundamentals and resilience to external pressures, making it potentially undervalued in the current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.63 | CN¥33.16 | 49.9% |

| KMC (Kuei Meng) International (TWSE:5306) | NT$126.50 | NT$251.32 | 49.7% |

| Lindab International (OM:LIAB) | SEK226.60 | SEK450.18 | 49.7% |

| SeSa (BIT:SES) | €76.00 | €150.71 | 49.6% |

| Accent Group (ASX:AX1) | A$2.51 | A$4.99 | 49.7% |

| S-Pool (TSE:2471) | ¥344.00 | ¥681.84 | 49.5% |

| GemPharmatech (SHSE:688046) | CN¥12.90 | CN¥25.74 | 49.9% |

| AirBoss of America (TSX:BOS) | CA$4.25 | CA$8.45 | 49.7% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2901.00 | ¥5793.23 | 49.9% |

| Audinate Group (ASX:AD8) | A$8.82 | A$17.59 | 49.9% |

We'll examine a selection from our screener results.

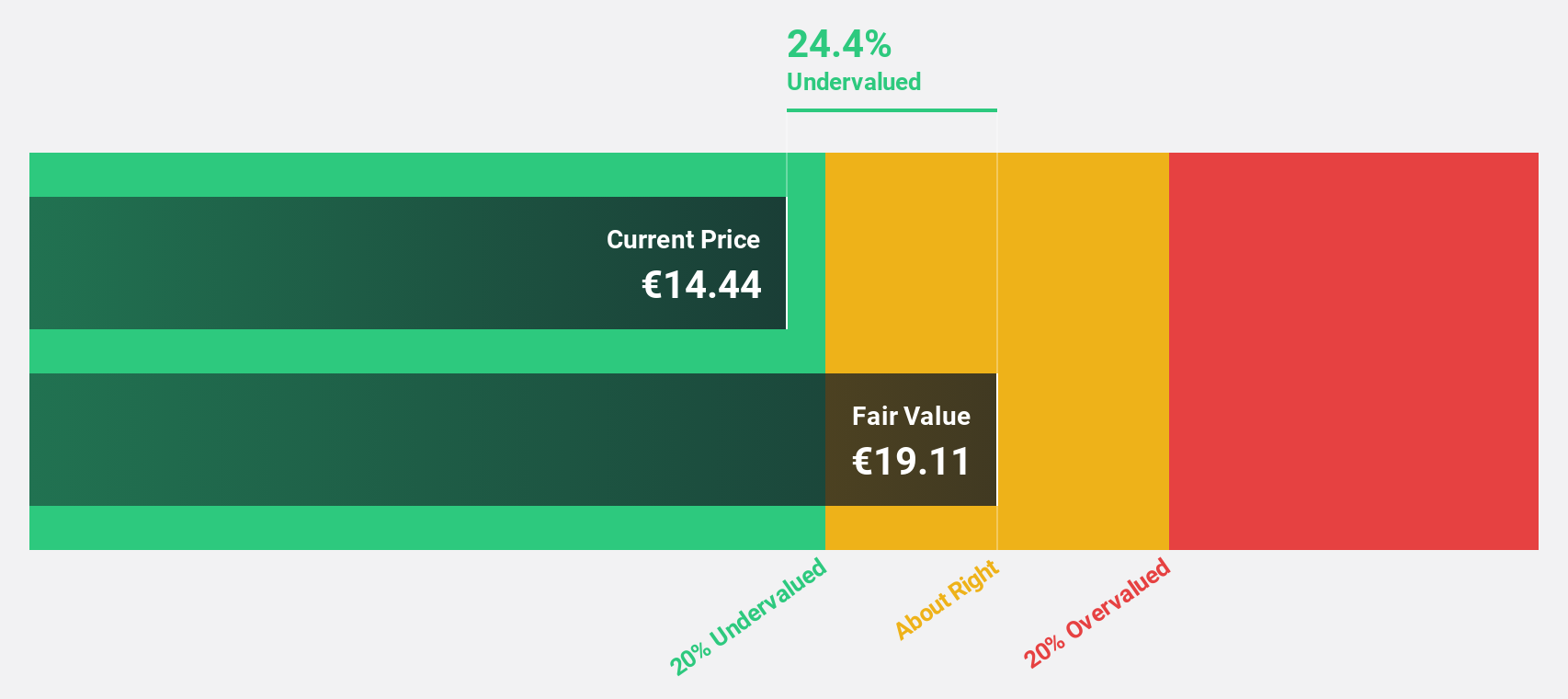

Fiskars Oyj Abp (HLSE:FSKRS)

Overview: Fiskars Oyj Abp manufactures and markets consumer products for indoor and outdoor living across Europe, the Americas, and the Asia Pacific, with a market cap of €1.22 billion.

Operations: The company's revenue segments include Vita at €609.50 million and Fiskars at €551.50 million.

Estimated Discount To Fair Value: 18%

Fiskars Oyj Abp is trading at €15.1, approximately 18% below its estimated fair value of €18.41, suggesting it may be undervalued based on discounted cash flow analysis. Despite recent financial challenges, including a net loss in the third quarter and declining profit margins to 1.6%, earnings are forecasted to grow significantly at 75.3% annually over the next three years, potentially outpacing the Finnish market's growth rate of 14.4%.

- Our earnings growth report unveils the potential for significant increases in Fiskars Oyj Abp's future results.

- Click here to discover the nuances of Fiskars Oyj Abp with our detailed financial health report.

Flair Writing Industries (NSEI:FLAIR)

Overview: Flair Writing Industries Limited manufactures and sells writing instruments, stationeries, and other allied products both in India and internationally, with a market cap of ₹27.52 billion.

Operations: The company's revenue from manufacturing and dealing in writing instruments and its allied products amounts to ₹9.92 billion.

Estimated Discount To Fair Value: 13.6%

Flair Writing Industries, trading at ₹265.5, is undervalued relative to its estimated fair value of ₹307.39 according to discounted cash flow analysis. Despite recent regulatory challenges and a slight decline in net income for the second quarter, the company shows potential with forecasted earnings growth of 21.2% annually over three years, outpacing the Indian market's expected growth rate of 17.9%. Revenue growth is projected at 16% per year, above market averages.

- The growth report we've compiled suggests that Flair Writing Industries' future prospects could be on the up.

- Navigate through the intricacies of Flair Writing Industries with our comprehensive financial health report here.

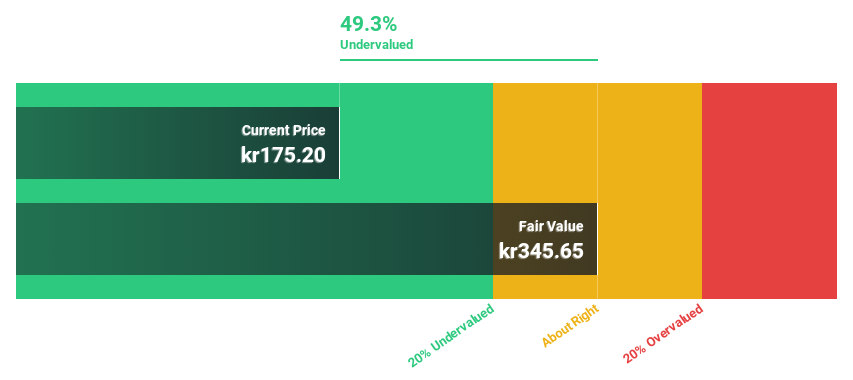

Nordic Waterproofing Holding (OM:NWG)

Overview: Nordic Waterproofing Holding AB (publ) develops, manufactures, and distributes waterproofing products and services for buildings and infrastructure across Sweden, Norway, Denmark, Finland, the rest of Europe, and internationally with a market cap of SEK4.21 billion.

Operations: The company's revenue is primarily generated from Products & Solutions, contributing SEK3.11 billion, and Installation Services, accounting for SEK1.25 billion.

Estimated Discount To Fair Value: 49.3%

Nordic Waterproofing Holding, trading at SEK 175.2, is significantly undervalued with a fair value estimate of SEK 345.65 based on discounted cash flow analysis. Despite a high debt level and unstable dividend history, earnings are projected to grow at 23.55% annually over the next three years, outpacing the Swedish market's growth rate of 15.2%. Recent earnings showed improved net income for Q3 despite lower sales compared to last year, while Kingspan Group increased its stake to 62.6%.

- The analysis detailed in our Nordic Waterproofing Holding growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Nordic Waterproofing Holding stock in this financial health report.

Summing It All Up

- Embark on your investment journey to our 933 Undervalued Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:FLAIR

Flair Writing Industries

Manufactures and sells writing instruments, stationeries, and other allied products in India and internationally.

Flawless balance sheet and good value.