3 Undervalued Stocks Estimated To Trade At Discounts Up To 38.9%

Reviewed by Simply Wall St

As global markets navigate through a period marked by tariff uncertainties and mixed economic indicators, investors are increasingly focused on identifying opportunities amidst the volatility. With major indices like the S&P 500 experiencing slight declines and manufacturing activity showing signs of expansion, there is a growing interest in stocks that may be trading below their intrinsic value. In such an environment, understanding what makes a stock undervalued—such as strong earnings performance relative to market expectations—can be crucial for investors looking to capitalize on potential discounts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| National World (LSE:NWOR) | £0.225 | £0.45 | 49.9% |

| Geo Holdings (TSE:2681) | ¥1773.00 | ¥3508.29 | 49.5% |

| TCI (TPEX:8436) | NT$119.00 | NT$237.17 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$6.05 | CA$12.03 | 49.7% |

| APAC Realty (SGX:CLN) | SGD0.455 | SGD0.91 | 49.7% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €6.66 | €13.31 | 50% |

| Coastal Financial (NasdaqGS:CCB) | US$86.45 | US$172.68 | 49.9% |

| Prodways Group (ENXTPA:PWG) | €0.584 | €1.16 | 49.4% |

| Pantoro (ASX:PNR) | A$0.135 | A$0.27 | 49.5% |

| Believe (ENXTPA:BLV) | €14.48 | €28.83 | 49.8% |

Let's review some notable picks from our screened stocks.

Nordic Waterproofing Holding (OM:NWG)

Overview: Nordic Waterproofing Holding AB (publ) develops, manufactures, and distributes waterproofing products and services for buildings and infrastructure across Sweden, Norway, Denmark, Finland, the rest of Europe, and internationally with a market cap of approximately SEK4.38 billion.

Operations: The company's revenue is primarily derived from its Products & Solutions segment, which accounts for SEK3.06 billion, and Installation Services, contributing SEK1.18 billion.

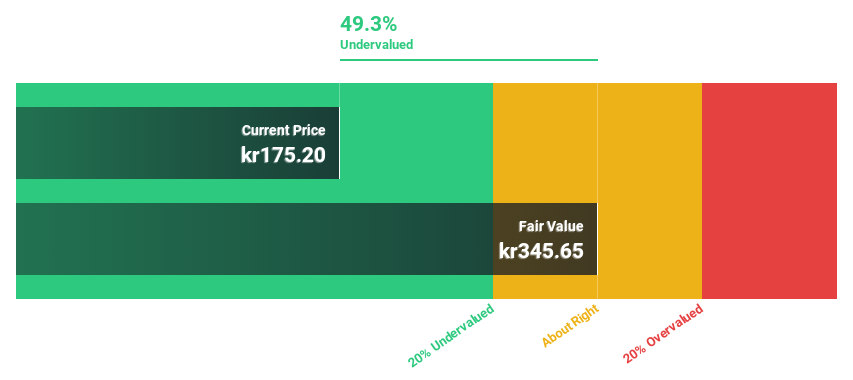

Estimated Discount To Fair Value: 38.9%

Nordic Waterproofing Holding is trading 38.9% below its estimated fair value of SEK 298.36, with earnings forecast to grow significantly at 29.1% annually, surpassing the Swedish market's growth rate. Despite recent earnings and revenue declines, the company remains undervalued based on discounted cash flow analysis. However, a proposed acquisition by Kingspan Holdings at SEK 182.5 per share could impact future valuations and investor decisions regarding its current undervaluation status.

- Our growth report here indicates Nordic Waterproofing Holding may be poised for an improving outlook.

- Click here to discover the nuances of Nordic Waterproofing Holding with our detailed financial health report.

Ratos (OM:RATO B)

Overview: Ratos AB (publ) is a private equity firm that focuses on buyouts, turnarounds, add-on acquisitions, and middle market transactions, with a market cap of SEK11.50 billion.

Operations: The company's revenue segments are Consumer at SEK5.46 billion, Industry at SEK10.41 billion, and Construction & Services at SEK16.49 billion.

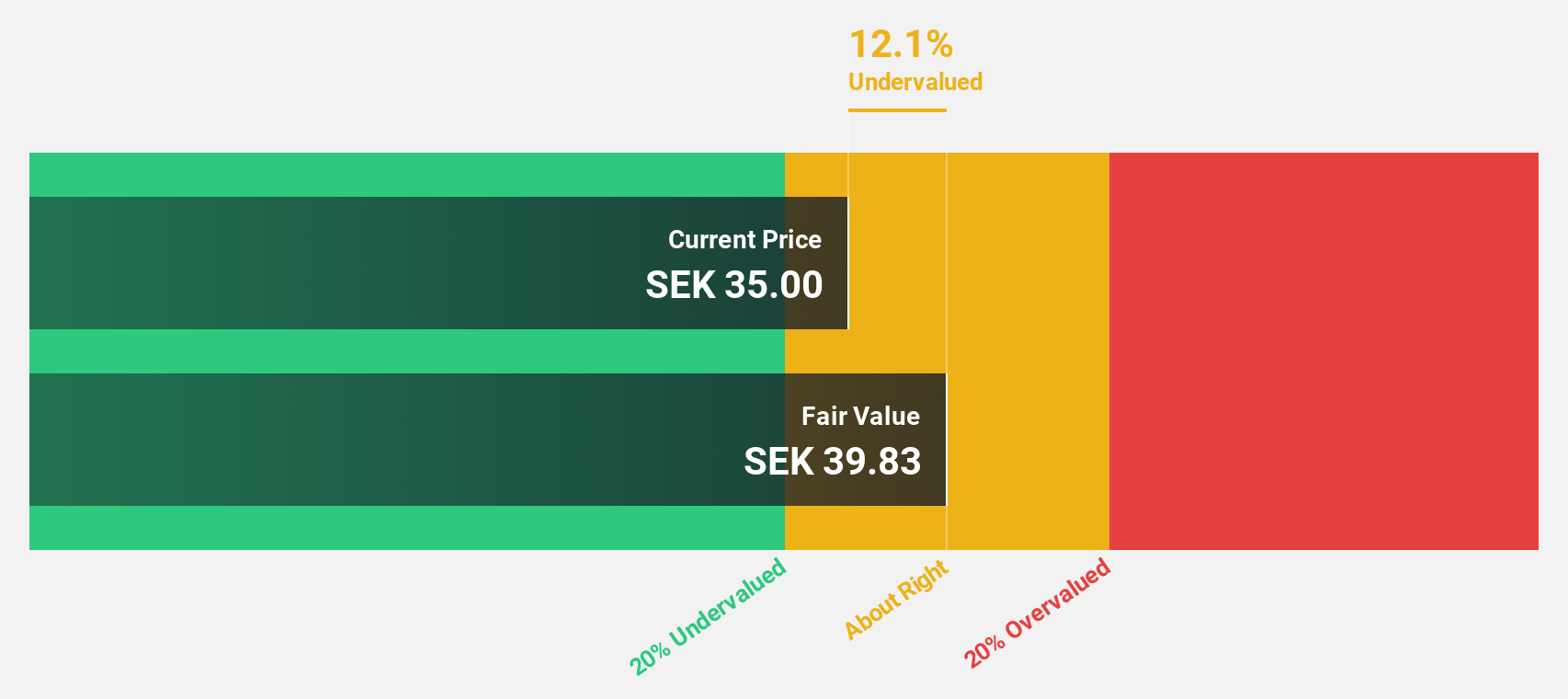

Estimated Discount To Fair Value: 24.9%

Ratos is trading 24.9% below its estimated fair value of SEK 46.37, with earnings expected to grow significantly at 25.7% annually, outpacing the Swedish market's growth rate. Despite a slower revenue growth forecast of 3% per year and significant insider selling recently, the stock remains undervalued based on discounted cash flow analysis. However, investors should consider its unstable dividend track record and large one-off items affecting financial results.

- In light of our recent growth report, it seems possible that Ratos' financial performance will exceed current levels.

- Dive into the specifics of Ratos here with our thorough financial health report.

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries with a market cap of SGD7.24 billion.

Operations: The company's revenue primarily stems from its Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding segment, which generated SGD8.39 billion, alongside a contribution of SGD24.71 million from Ship Chartering.

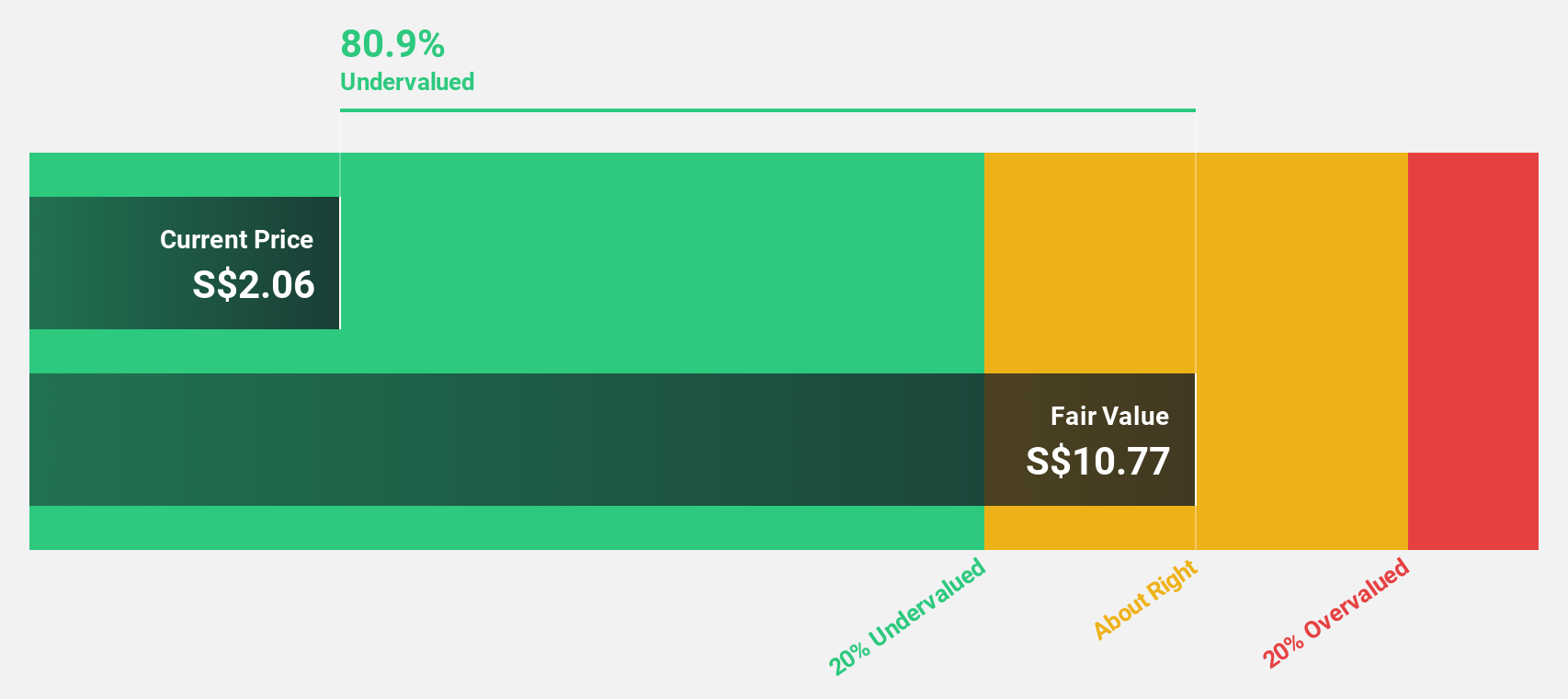

Estimated Discount To Fair Value: 37.7%

Seatrium is trading at S$2.16, 37.7% below its estimated fair value of S$3.47, and analysts expect a 26.1% price increase. Earnings are projected to grow significantly at 76.34% annually over the next three years, with revenue growth outpacing the Singapore market at 6.5%. Recent contracts with Penta-Ocean Construction and BP Exploration highlight Seatrium's strategic position in offshore wind and energy projects despite low forecasted return on equity of 8%.

- Our earnings growth report unveils the potential for significant increases in Seatrium's future results.

- Delve into the full analysis health report here for a deeper understanding of Seatrium.

Taking Advantage

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 900 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Waterproofing Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NWG

Nordic Waterproofing Holding

Develops, manufactures, and distributes waterproofing products and services for buildings and infrastructure in Sweden, Norway, Denmark, Finland, rest of Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives