- Sweden

- /

- Capital Markets

- /

- OM:EQT

Top Swedish Growth Stocks With High Insider Ownership In September 2024

Reviewed by Simply Wall St

As of September 2024, the Swedish market has shown resilience amidst global economic shifts, with growth stocks particularly standing out against a backdrop of interest rate cuts by the European Central Bank and cautious optimism in broader European markets. In this context, identifying growth companies with high insider ownership can be a prudent strategy for investors seeking to align their interests with those who have intimate knowledge and confidence in their business prospects.

Top 10 Growth Companies With High Insider Ownership In Sweden

| Name | Insider Ownership | Earnings Growth |

| CTT Systems (OM:CTT) | 16.9% | 24.8% |

| Truecaller (OM:TRUE B) | 29.6% | 21.6% |

| Fortnox (OM:FNOX) | 21.1% | 22.6% |

| Biovica International (OM:BIOVIC B) | 17.6% | 78.5% |

| Magle Chemoswed Holding (OM:MAGLE) | 14.9% | 72.2% |

| Yubico (OM:YUBICO) | 37.5% | 42.3% |

| BioArctic (OM:BIOA B) | 34% | 98.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| InCoax Networks (OM:INCOAX) | 19.5% | 115.5% |

| C-Rad (OM:CRAD B) | 16.1% | 33.9% |

Let's take a closer look at a couple of our picks from the screened companies.

EQT (OM:EQT)

Simply Wall St Growth Rating: ★★★★★☆

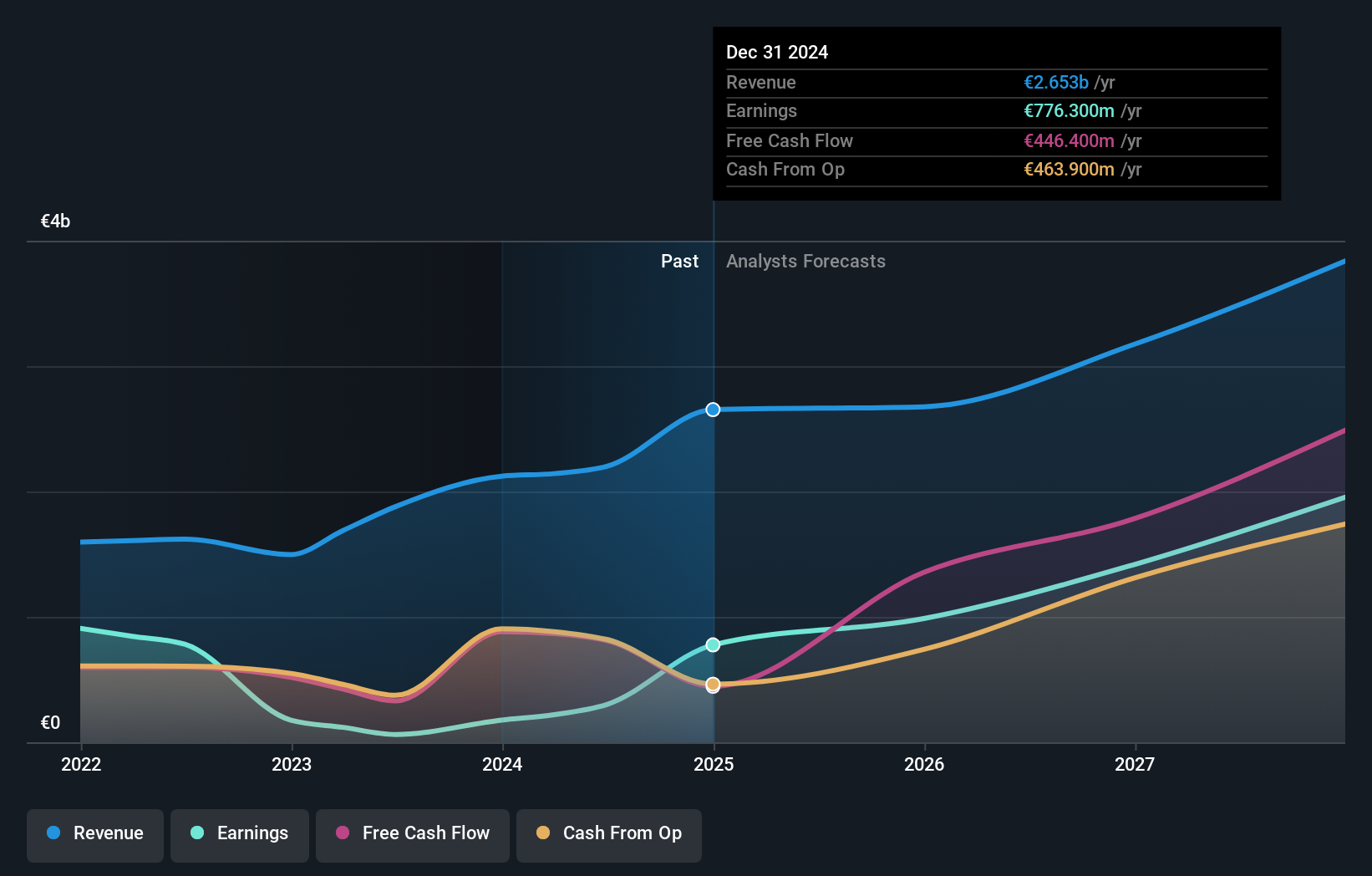

Overview: EQT AB (publ) is a global private equity firm specializing in private capital and real asset segments, with a market cap of SEK427.41 billion.

Operations: The company's revenue segments include Central (€37.20 million), Real Assets (€878.70 million), and Private Capital (€1.28 billion).

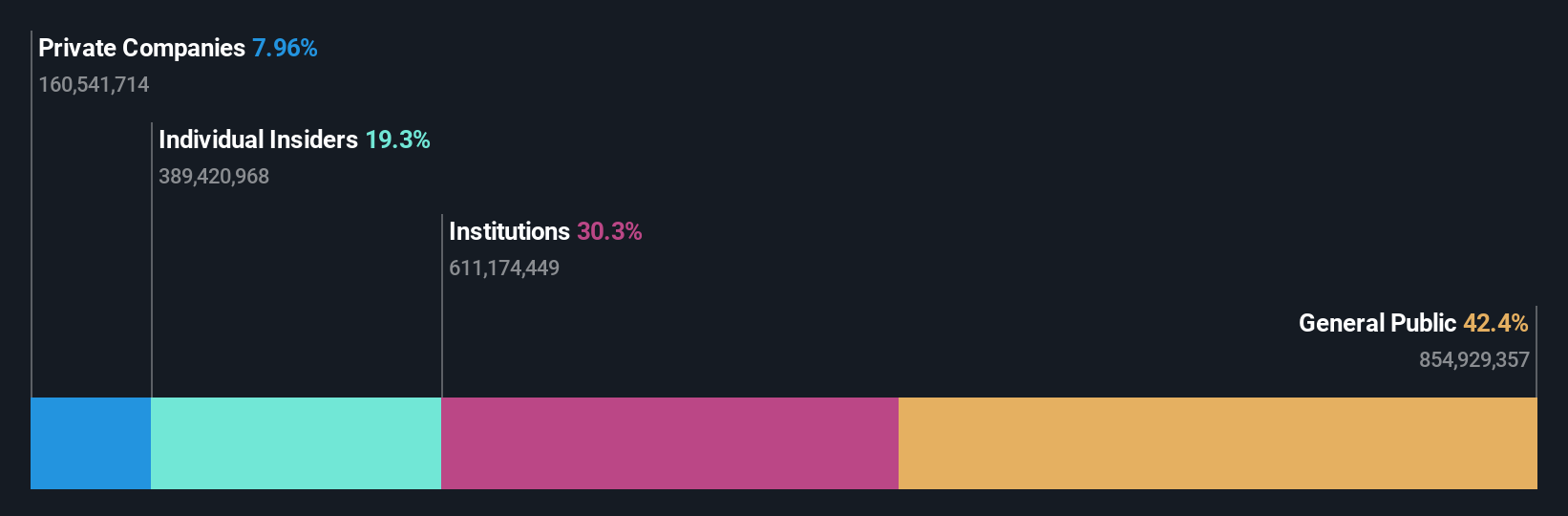

Insider Ownership: 30.9%

Earnings Growth Forecast: 35.4% p.a.

EQT, a Swedish private equity firm, is poised for significant earnings growth at 35.4% annually, outpacing the Swedish market's 15.1%. Despite slower revenue growth at 15.5%, it remains above the market average of 0.9%. However, recent substantial insider selling and large one-off items impacting financial results are concerns. EQT's high Return on Equity forecast of 23.1% in three years underscores its potential profitability amidst active M&A activities and strategic divestitures.

- Dive into the specifics of EQT here with our thorough growth forecast report.

- The valuation report we've compiled suggests that EQT's current price could be inflated.

NIBE Industrier (OM:NIBE B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NIBE Industrier AB (publ) develops, manufactures, markets, and sells energy-efficient solutions for indoor climate comfort and intelligent heating and control components internationally, with a market cap of SEK98.61 billion.

Operations: The company's revenue segments consist of SEK5.33 billion from Stoves, SEK13.48 billion from Element, and SEK35.22 billion from Climate Solutions.

Insider Ownership: 20.2%

Earnings Growth Forecast: 42.5% p.a.

NIBE Industrier, a growth company with high insider ownership, is forecasted to achieve significant annual earnings growth of 42.55%, surpassing the Swedish market's 15.1%. Despite this, recent financial results show a decline in revenue and net income for Q2 2024 compared to the previous year. Insider transactions include Sofia Schörling Högberg and Märta Schörling Andreen acquiring an unknown minority stake in June 2024, highlighting continued insider confidence amidst mixed financial performance.

- Unlock comprehensive insights into our analysis of NIBE Industrier stock in this growth report.

- Upon reviewing our latest valuation report, NIBE Industrier's share price might be too optimistic.

Surgical Science Sweden (OM:SUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Surgical Science Sweden AB (publ) develops and markets virtual reality simulators for evidence-based medical training globally, with a market cap of SEK6.25 billion.

Operations: The company generates revenue from two main segments: Industry/OEM at SEK400.72 million and Educational Products at SEK437.53 million.

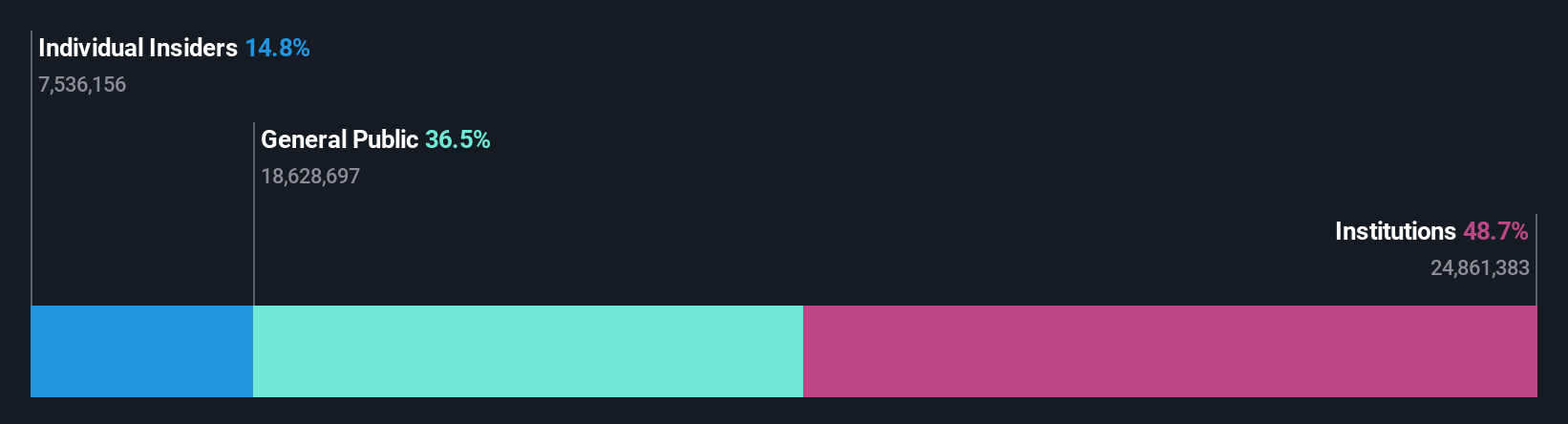

Insider Ownership: 26.6%

Earnings Growth Forecast: 32.6% p.a.

Surgical Science Sweden is expected to achieve significant annual earnings growth of 32.6%, outpacing the Swedish market's 15.1%. However, recent financial results show a decline in sales and net income for Q2 2024 compared to the previous year. Trading at 63.2% below its estimated fair value, it presents a potential investment opportunity despite mixed short-term performance. The upcoming CEO transition may further influence its strategic direction and growth trajectory.

- Take a closer look at Surgical Science Sweden's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Surgical Science Sweden is trading behind its estimated value.

Seize The Opportunity

- Take a closer look at our Fast Growing Swedish Companies With High Insider Ownership list of 91 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if EQT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:EQT

EQT

A global private equity firm specializing in private capital and real asset segments.

Excellent balance sheet with reasonable growth potential.