Munters Group (OM:MTRS): Valuation Check After $82m AI Data Center Cooling Order Boosts Growth Story

Reviewed by Simply Wall St

Munters Group (OM:MTRS) just landed a USD 82 million order for Geoclima Circlemiser chillers from a US data center operator focused on AI, underscoring how central its cooling technology is becoming.

See our latest analysis for Munters Group.

The deal lands after a steady stream of interest in Munters data center solutions, including its upcoming sustainability presentation at the SKF Friction Fighting Summit. This helps explain the strong 30 day share price return of 24.73 percent alongside a robust five year total shareholder return of 141.14 percent, suggesting momentum is rebuilding after a softer year to date patch.

If this AI driven cooling order has you thinking bigger about the theme, it is a good time to explore other potential winners using our high growth tech and AI stocks.

Yet with the shares now near analyst targets and trading after a powerful rebound, investors must decide: Is Munters still mispriced for an AI cooling boom, or is the market already discounting years of future growth?

Most Popular Narrative Narrative: 2.3% Undervalued

With the narrative fair value sitting just above Munters last close, the implied upside is modest, but the growth story behind it is anything but.

Enhanced focus on sustainability and energy efficiency, including innovation in green manufacturing, smart facilities (Amesbury flagship), and product leadership (e.g., chillers >20% more efficient than competitors), is expected to drive incremental customer demand and enable premium pricing, boosting both revenue and net margin over time.

Want to see what kind of revenue climb and margin lift could justify this price tag on an industrial name, and what future earnings multiple ties it all together? The most followed narrative lays out a full set of long range forecasts, including how fast profits must compound and where valuation settles years from now. Curious which assumptions have to hold for that slight discount to turn into something bigger, and which ones leave no room for disappointment? Read on to unpack the full story behind this fair value call.

Result: Fair Value of $188 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat narrative could be derailed by prolonged battery market weakness or by faster than expected adoption of alternative data center cooling technologies.

Find out about the key risks to this Munters Group narrative.

Another Angle on Valuation

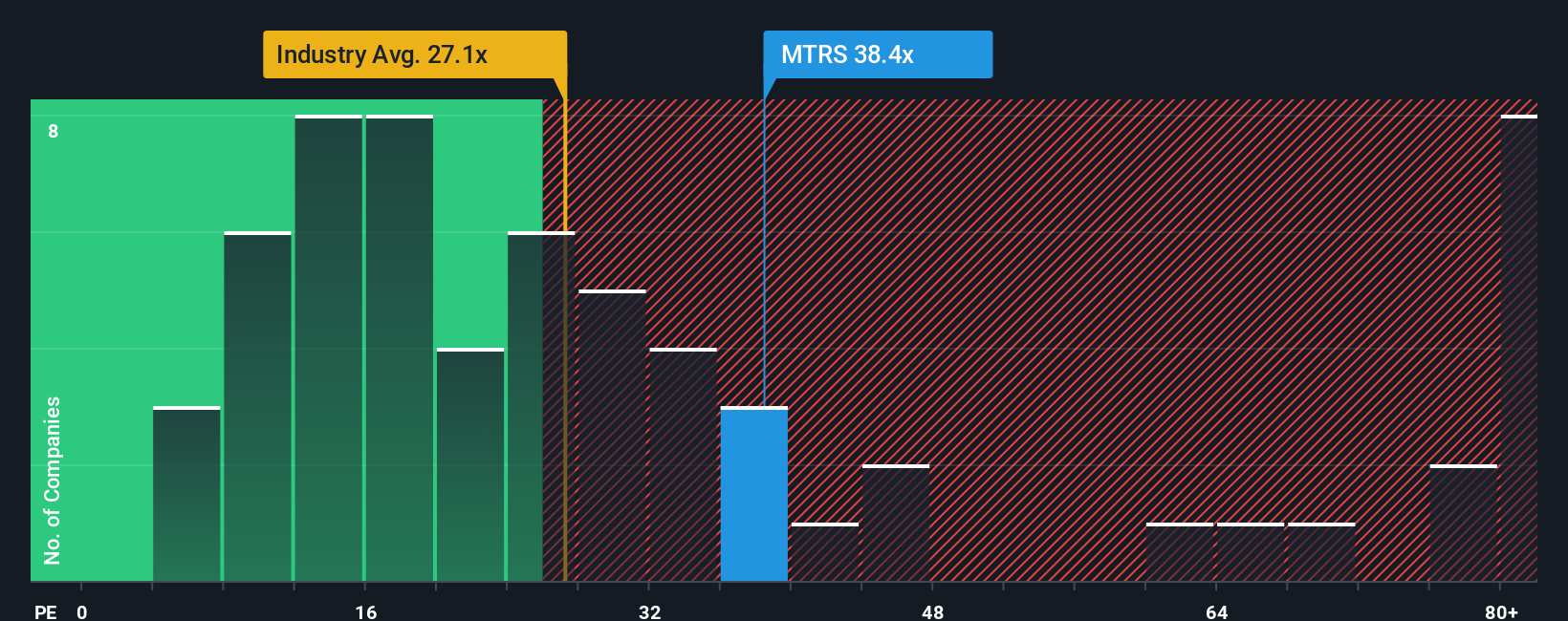

Looking at earnings multiples, Munters trades on a steep 42.7 times price to earnings, far above the European Building sector at 21.6 times and its own fair ratio of 42.6 times. That leaves little margin for error, so what happens if growth wobbles or sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Munters Group Narrative

If you are not fully convinced by this view, or simply want to dig into the numbers yourself, you can build a custom thesis from scratch in just a few minutes: Do it your way.

A great starting point for your Munters Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single opportunity when you can quickly scan fresh themes, compare trade offs, and line up your next moves with conviction.

- Capture potential mispricings by hunting through these 893 undervalued stocks based on cash flows, where strong cash flows may not yet be fully recognized in share prices.

- Position your portfolio for structural growth by targeting these 27 AI penny stocks, at the heart of accelerating artificial intelligence adoption.

- Strengthen your income stream by assessing these 15 dividend stocks with yields > 3%, offering attractive yields backed by sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MTRS

Munters Group

Provides climate solutions in the Americas, Europe, the Middle East, Africa, and Asia.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026