- Sweden

- /

- Trade Distributors

- /

- OM:MMGR B

The Momentum Group AB (publ) (STO:MMGR B) Second-Quarter Results Are Out And Analysts Have Published New Forecasts

Momentum Group AB (publ) (STO:MMGR B) missed earnings with its latest second-quarter results, disappointing overly-optimistic forecasters. Results look to have been somewhat negative - revenue fell 3.5% short of analyst estimates at kr824m, and statutory earnings of kr1.05 per share missed forecasts by 5.0%. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

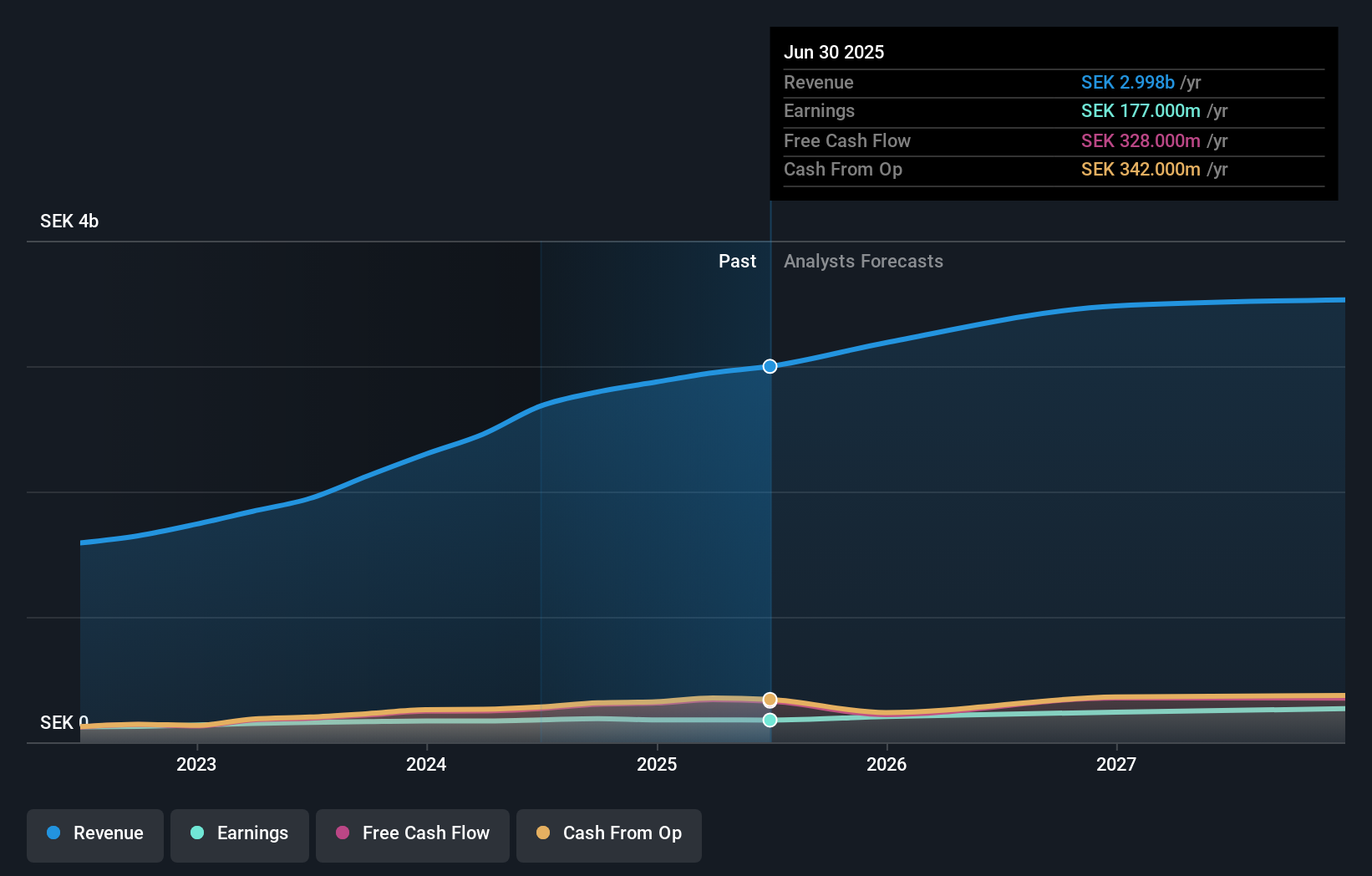

Taking into account the latest results, the current consensus from Momentum Group's three analysts is for revenues of kr3.19b in 2025. This would reflect an okay 6.3% increase on its revenue over the past 12 months. Per-share earnings are expected to climb 18% to kr4.21. In the lead-up to this report, the analysts had been modelling revenues of kr3.26b and earnings per share (EPS) of kr4.54 in 2025. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a minor downgrade to earnings per share estimates.

View our latest analysis for Momentum Group

The analysts made no major changes to their price target of kr180, suggesting the downgrades are not expected to have a long-term impact on Momentum Group's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Momentum Group analyst has a price target of kr195 per share, while the most pessimistic values it at kr170. This is a very narrow spread of estimates, implying either that Momentum Group is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that Momentum Group's revenue growth will slow down substantially, with revenues to the end of 2025 expected to display 13% growth on an annualised basis. This is compared to a historical growth rate of 23% over the past three years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 5.8% per year. So it's pretty clear that, while Momentum Group's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Regrettably, they also downgraded their revenue estimates, but the latest forecasts still imply the business will grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Momentum Group. Long-term earnings power is much more important than next year's profits. We have forecasts for Momentum Group going out to 2027, and you can see them free on our platform here.

You can also view our analysis of Momentum Group's balance sheet, and whether we think Momentum Group is carrying too much debt, for free on our platform here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:MMGR B

Momentum Group

Supplies industrial components, industrial services, and related services to the industrial sector in Sweden, Norway, Denmark, Finland, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.