- Sweden

- /

- Trade Distributors

- /

- OM:MMGR B

Alantra Partners Leads These 3 Undiscovered Gems in Europe

Reviewed by Simply Wall St

In recent weeks, the European market has shown resilience, with the pan-European STOXX Europe 600 Index remaining stable as investors navigate interest rate policies and renewed trade tensions. Amid this backdrop of modest economic growth and cautious optimism, identifying promising small-cap stocks requires a keen understanding of their potential to thrive in fluctuating conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Freetrailer Group | 0.01% | 22.96% | 31.56% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Alantra Partners (BME:ALNT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Alantra Partners, S.A. is a company that provides investment banking and asset management services both in Spain and internationally, with a market capitalization of approximately €316.67 million.

Operations: Alantra Partners generates revenue primarily from asset management (€37.43 million) and investment banking services (€8.69 million).

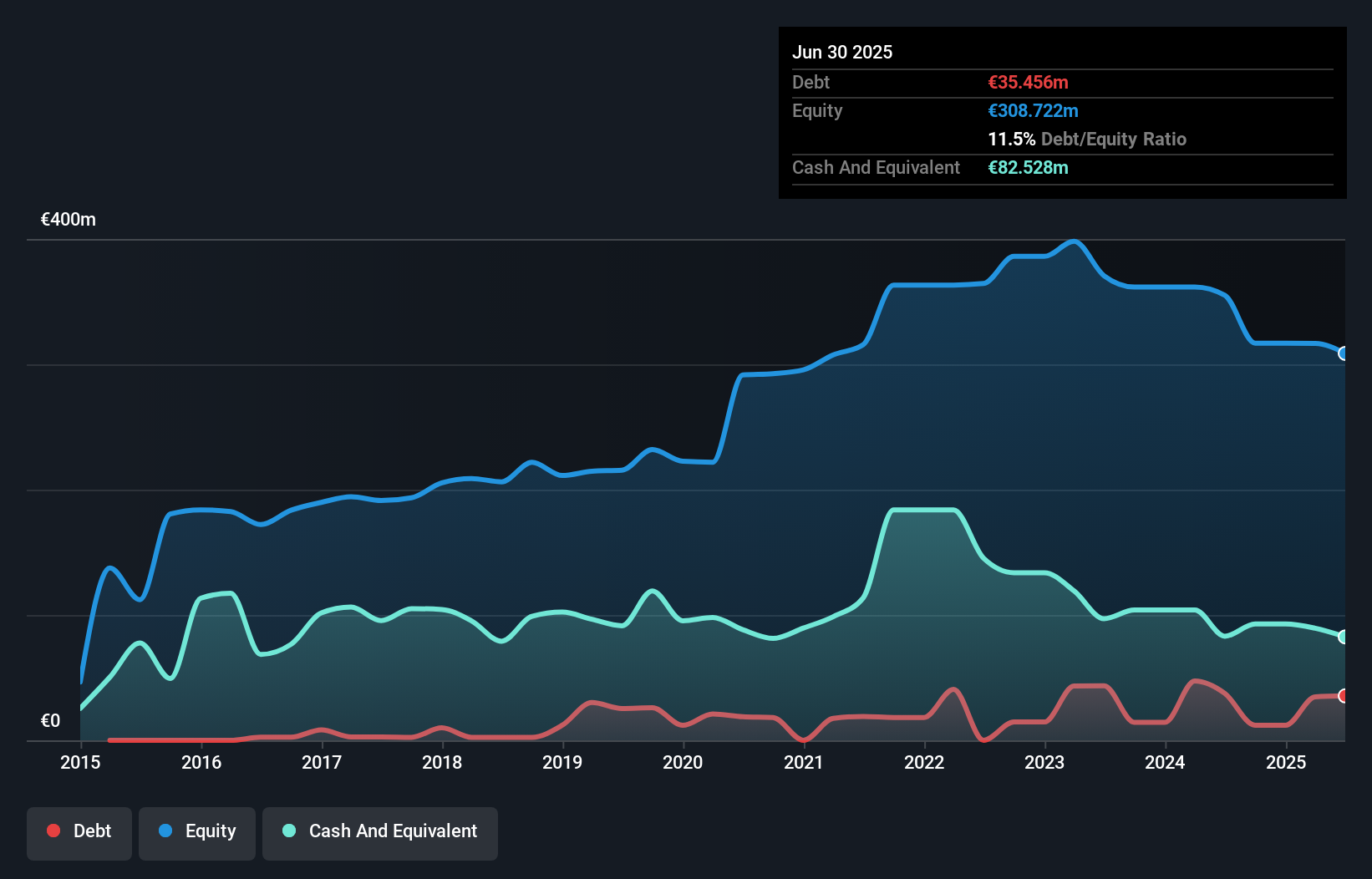

Alantra Partners, a smaller player in the financial sector, has shown remarkable earnings growth of 151.9% over the past year, outpacing the Capital Markets industry's 11.5%. Despite a challenging five-year period with earnings declining by 30.2% annually, recent performance indicates potential resilience. The company reported net income of €6 million for the first half of 2025, doubling from €3 million in the previous year, with basic and diluted EPS rising to €0.16 from €0.08. While its debt-to-equity ratio increased from 6.5% to 11.5%, Alantra holds more cash than total debt, suggesting financial stability amidst industry challenges.

- Navigate through the intricacies of Alantra Partners with our comprehensive health report here.

Review our historical performance report to gain insights into Alantra Partners''s past performance.

Momentum Group (OM:MMGR B)

Simply Wall St Value Rating: ★★★★★★

Overview: Momentum Group AB (publ) is a company that provides industrial components and services to the industrial sector across Sweden, Norway, Denmark, Finland, and internationally with a market capitalization of approximately SEK7.82 billion.

Operations: Momentum Group generates revenue primarily from its Industry segment, contributing SEK 1.74 billion, and its Infrastructure segment with SEK 1.29 billion. The company experiences a net profit margin trend worth noting at 5%.

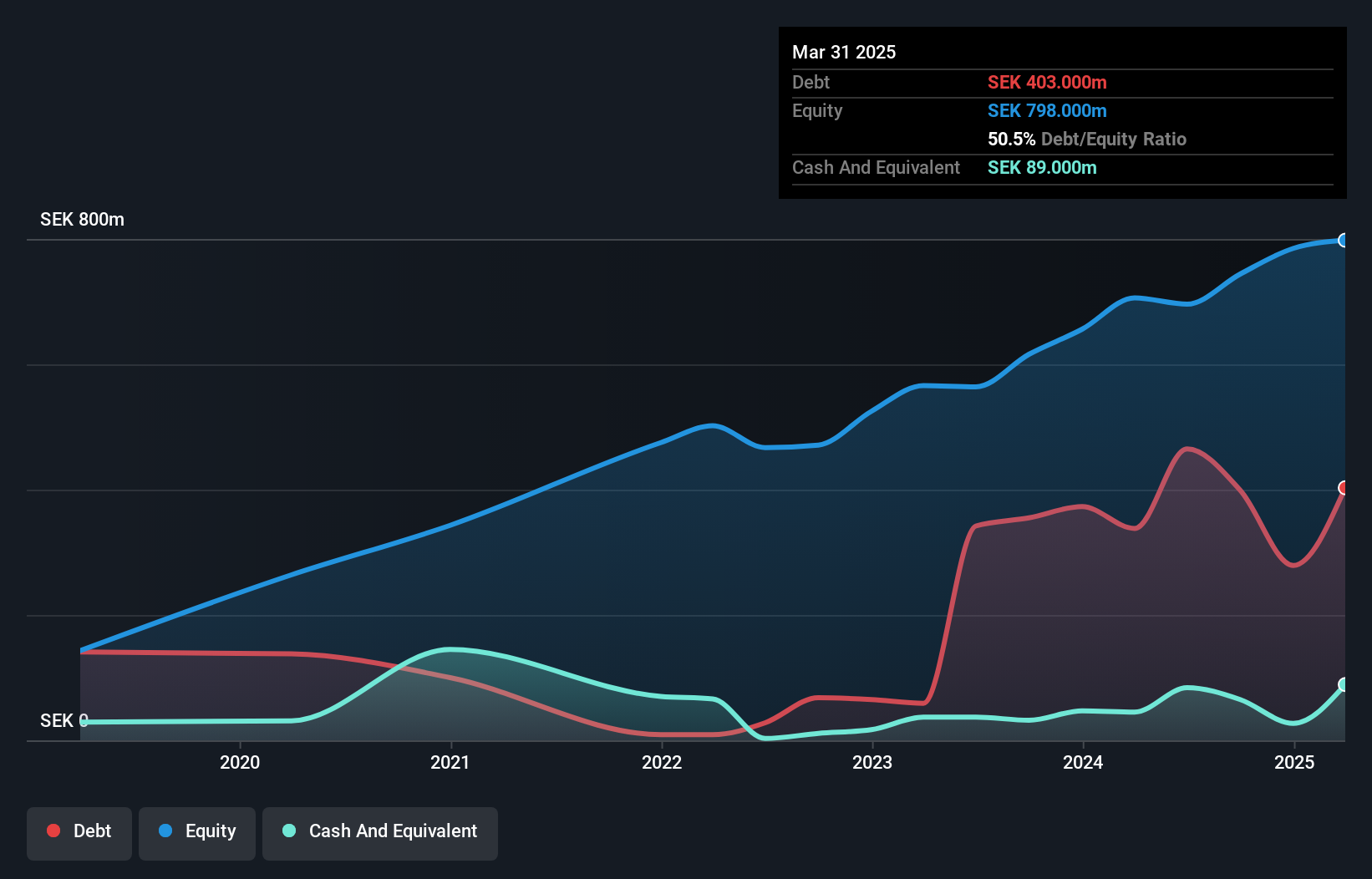

Momentum Group, a player in the industrial sector across Scandinavia and beyond, is making strides with its focus on sustainable products and operational efficiency. The company's debt to equity ratio has improved from 43.2% to 28.7% over five years, reflecting prudent financial management. Despite a slight dip in net income for Q2 2025 at SEK51 million compared to SEK53 million last year, sales rose from SEK773 million to SEK824 million year-on-year. Analysts forecast annual earnings growth of 15.85%, driven by energy-efficient investments and warehouse optimization efforts that aim to boost profit margins from 5.9% to 7.4%.

Nolato (OM:NOLA B)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nolato AB (publ) is a company that develops, manufactures, and sells plastic, silicone, and thermoplastic elastomer products across Europe, Asia, North America, and internationally with a market cap of approximately SEK15.80 billion.

Operations: The primary revenue streams for Nolato are Medical Solutions and Engineered Solutions, generating SEK5.47 billion and SEK4.18 billion, respectively.

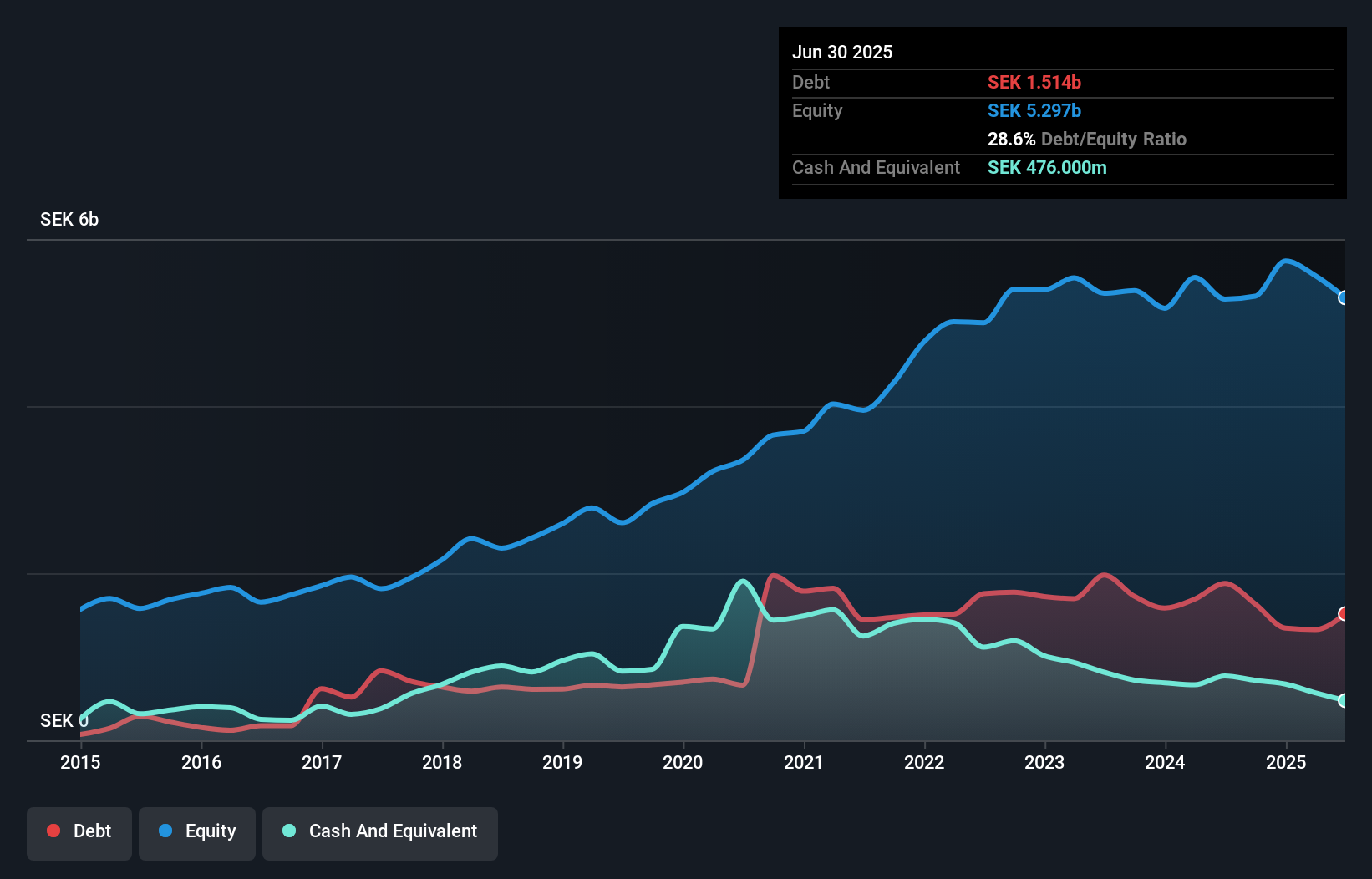

Nolato, a player in the industrial sector, showcases robust financial health with earnings growth of 55.4% over the past year, significantly outpacing its industry peers. The company's net debt to equity ratio is at a satisfactory 19.6%, reflecting prudent financial management. Recent earnings reports reveal an increase in net income to SEK 212 million for Q2, up from SEK 169 million last year, alongside EPS improvements from SEK 0.63 to SEK 0.79. Despite trading at nearly half its estimated fair value and strong interest coverage (44x), Nolato's aggressive expansion into medical and engineered solutions introduces potential cash flow challenges due to high capital expenditures without immediate revenue gains.

Seize The Opportunity

- Explore the 329 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MMGR B

Momentum Group

Supplies industrial components, industrial services, and related services to the industrial sector in Sweden, Norway, Denmark, Finland, and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives