- Sweden

- /

- Electrical

- /

- OM:META

Metacon (OM:META): Exploring Valuation Following Recent Share Price Volatility

Reviewed by Simply Wall St

Metacon (OM:META) has drawn attention from investors, especially as its shares have experienced sizable swings over the past month. With the company’s recent performance, market watchers are taking a closer look at what is driving sentiment around this hydrogen-focused business.

See our latest analysis for Metacon.

Metacon’s share price has soared 217.88% year-to-date, grabbing the spotlight after a powerful 37.34% gain over the last 90 days. Even as the recent 1-month share price return took a breather, the 1-year total shareholder return of 120.88% shows lasting optimism. The deeper track record reminds investors that momentum in this space can fade as quickly as it arrives.

If story stocks like Metacon interest you, it may be the perfect time to broaden your scope and discover fast growing stocks with high insider ownership

With Metacon’s impressive short-term rally and strong annual gains, investors are left wondering whether the recent pullback is a sign that value remains or if the market has already captured all the future growth prospects in the price.

Price-to-Sales of 3.6x: Is it justified?

Metacon trades at a price-to-sales ratio of 3.6x, compared to a peer average of 5.3x. This suggests that the market is valuing Metacon’s sales at a lower multiple than some industry peers, which may make the shares look reasonably priced to investors hunting for underappreciated growth stocks.

The price-to-sales ratio measures how much investors are willing to pay for each unit of revenue a company generates. In rapidly growing sectors like green hydrogen and renewables, this metric helps compare how the market rates a company’s current and future sales potential against competitors.

While Metacon’s price-to-sales is lower than its peer group, it is actually more expensive than the broader European Electrical industry average of just 1.2x. This means investors expect Metacon to grow significantly or maintain an edge, but the market is already pricing in more optimism here than in the industry at large. Compared to the estimated fair price-to-sales ratio of 2.7x, the current valuation points to some premium built in relative to projected fundamentals. This is a level the market could retrace toward if expectations shift.

Explore the SWS fair ratio for Metacon

Result: Preferred multiple of price-to-sales ratio of 3.6x (ABOUT RIGHT)

However, ongoing net losses and significant recent share declines could challenge the upbeat growth narrative. This may leave investors sensitive to shifts in sentiment.

Find out about the key risks to this Metacon narrative.

Another View: SWS DCF Model Paints a Different Picture

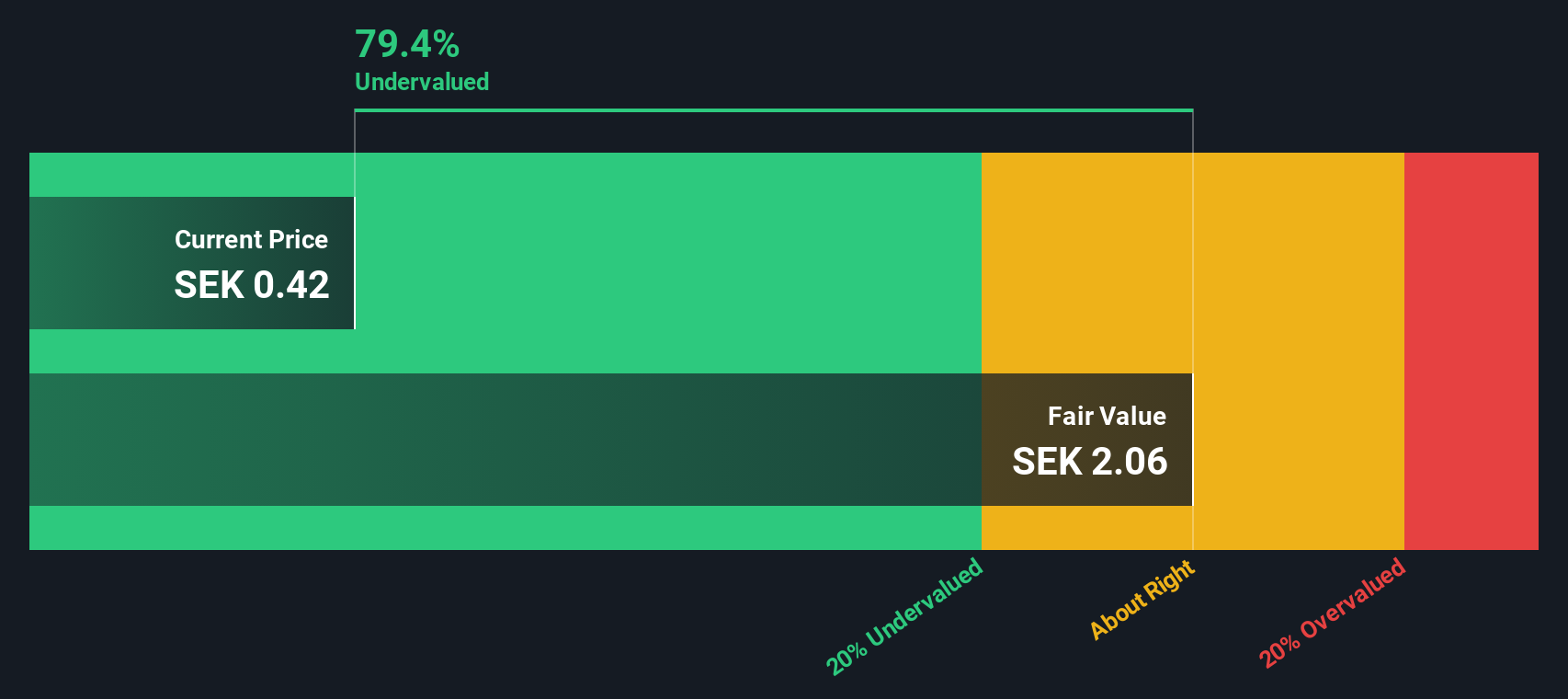

Our DCF model arrives at a much higher fair value of SEK 2.07 per share for Metacon, which is far above its current market price of SEK 0.43. This suggests the stock is trading at a significant discount. It raises the question of whether the market is overlooking the company’s growth potential or if the risks outweigh the opportunities.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Metacon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Metacon Narrative

If you want to approach things differently or see potential the market might be missing, you can explore the data and assemble your perspective in just minutes. Do it your way

A great starting point for your Metacon research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for just one opportunity. Get ahead of the market by finding stocks with untapped potential, unique innovation, or proven resilience using the free Simply Wall St screener.

- Catch rising trends early by tracking these 30 healthcare AI stocks companies making breakthroughs in medical technology and artificial intelligence-driven healthcare.

- Unlock overlooked value by sorting through these 928 undervalued stocks based on cash flows where strong cash flows meet compelling price opportunities.

- Boost your passive income with these 14 dividend stocks with yields > 3% offering stable yields above 3% and a history of reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:META

Metacon

Develops, manufactures, and sells energy systems to produce fossil-free green hydrogen in Sweden and Greece.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026