European Stocks That Might Be Trading Below Value Estimates In October 2025

Reviewed by Simply Wall St

As the European markets navigate a landscape marked by mixed performances across major indices and economic uncertainties, investors are keenly observing opportunities that might arise from undervalued stocks. In this environment, identifying stocks trading below their intrinsic value can be a strategic move for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sandoz Group (SWX:SDZ) | CHF48.42 | CHF95.00 | 49% |

| Mo-BRUK (WSE:MBR) | PLN291.50 | PLN582.24 | 49.9% |

| Micro Systemation (OM:MSAB B) | SEK62.00 | SEK122.78 | 49.5% |

| Lingotes Especiales (BME:LGT) | €5.60 | €11.14 | 49.7% |

| DSV (CPSE:DSV) | DKK1333.00 | DKK2654.85 | 49.8% |

| doValue (BIT:DOV) | €2.798 | €5.53 | 49.4% |

| DigiTouch (BIT:DGT) | €1.90 | €3.79 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.38 | €6.62 | 48.9% |

| Allegro.eu (WSE:ALE) | PLN33.545 | PLN66.46 | 49.5% |

| Aker BioMarine (OB:AKBM) | NOK85.50 | NOK169.44 | 49.5% |

Here's a peek at a few of the choices from the screener.

Sanoma Oyj (HLSE:SANOMA)

Overview: Sanoma Oyj is a media and learning company with operations in Finland, the Netherlands, Poland, Spain, Belgium, and internationally; it has a market cap of €1.78 billion.

Operations: Sanoma Oyj generates revenue through its Learning segment, which accounts for €773.10 million, and its Media Finland segment, contributing €569.50 million.

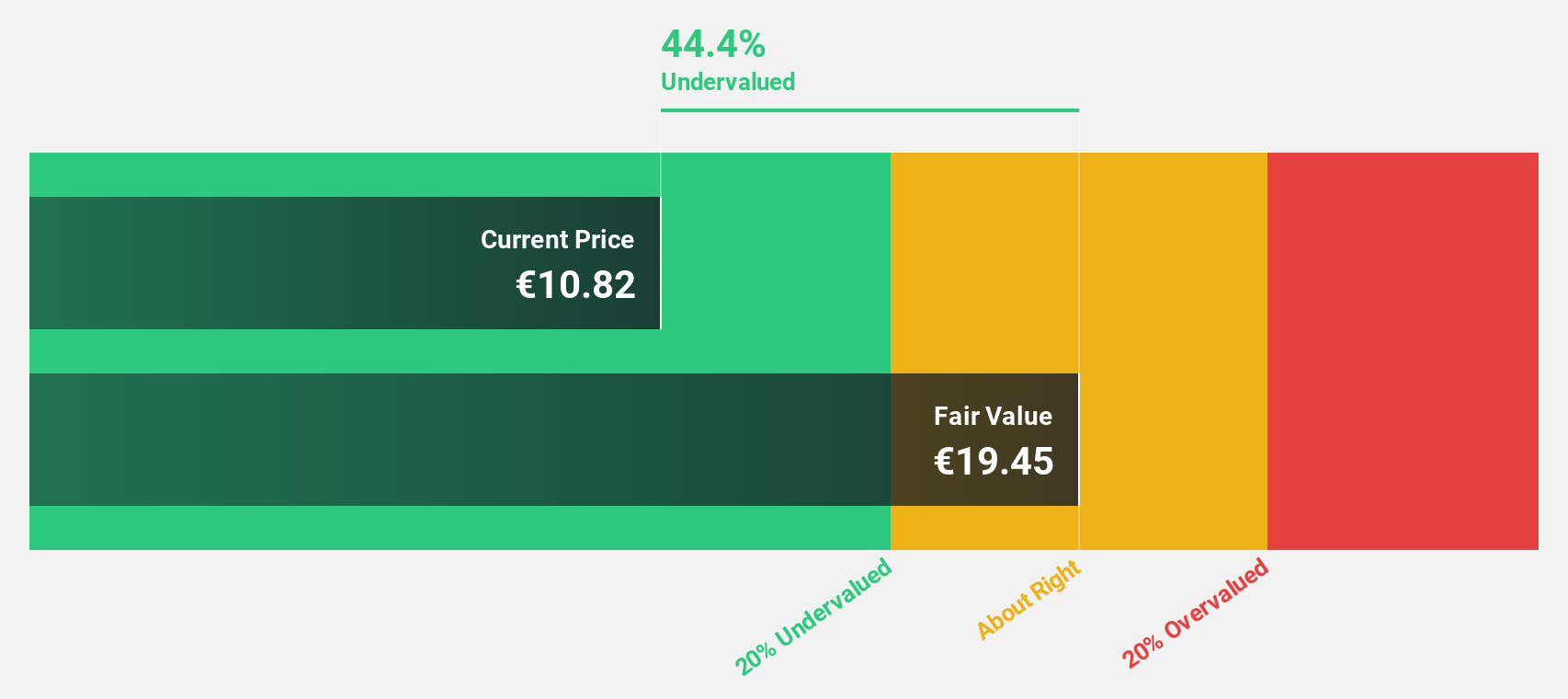

Estimated Discount To Fair Value: 44.3%

Sanoma Oyj is trading at €10.92, significantly below its estimated fair value of €19.6, indicating it may be undervalued based on discounted cash flows. Despite slower revenue growth projections compared to the Finnish market, Sanoma's earnings are expected to grow substantially at 46.7% annually over the next three years. However, its dividend yield of 3.57% is not well covered by earnings and the company maintains a high level of debt with large one-off items affecting financial results.

- Our expertly prepared growth report on Sanoma Oyj implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Sanoma Oyj's balance sheet by reading our health report here.

Lindab International (OM:LIAB)

Overview: Lindab International AB (publ) is a company that manufactures and sells ventilation system products and solutions across several countries including Sweden, Denmark, and the United Kingdom, with a market cap of SEK15.64 billion.

Operations: Lindab International AB generates revenue from two main segments: Ventilation Systems, which accounts for SEK10.18 billion, and Profile Systems, contributing SEK2.99 billion.

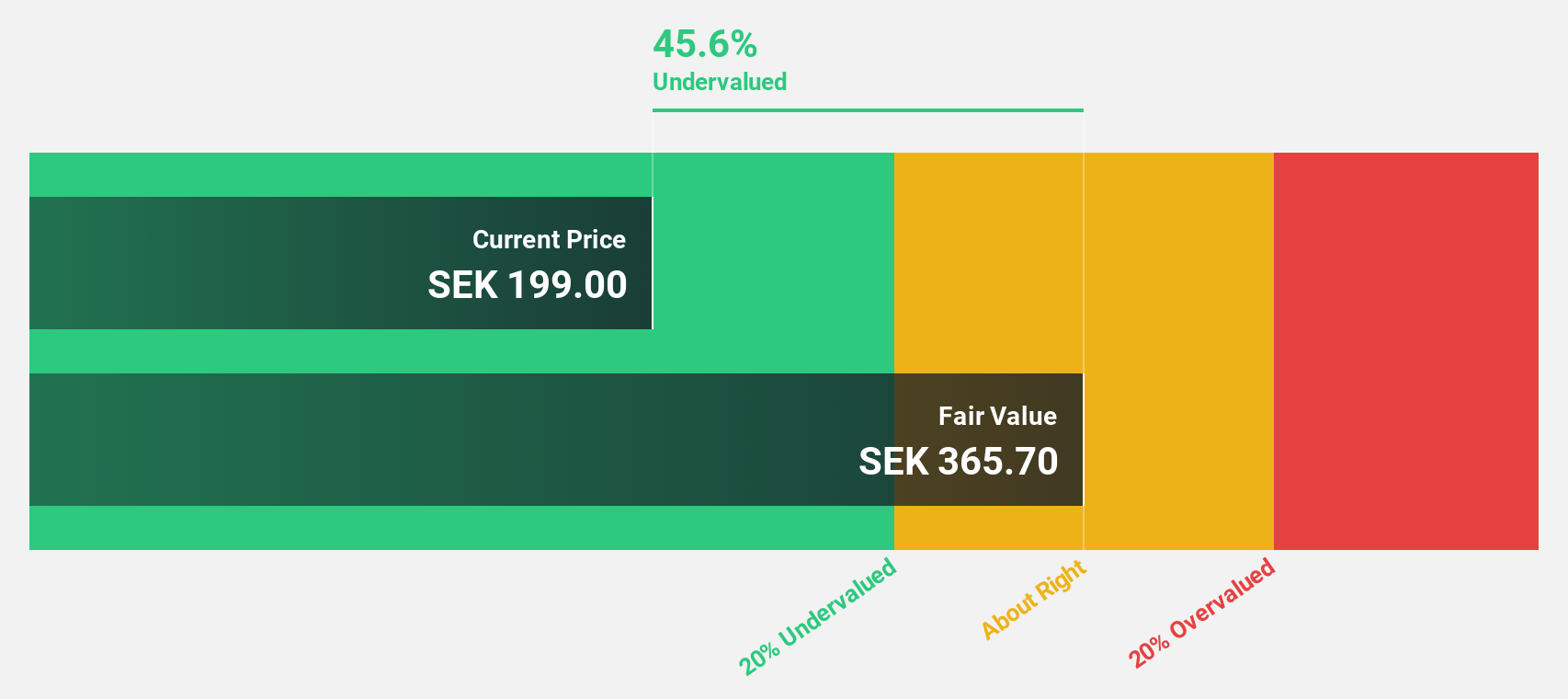

Estimated Discount To Fair Value: 33.2%

Lindab International is trading at SEK203, significantly below its estimated fair value of SEK303.98, highlighting potential undervaluation based on cash flows. While revenue growth is expected to outpace the Swedish market, profit margins have decreased from 5.8% to 2.3%. Earnings are forecasted to grow significantly at 41.1% annually over the next three years, yet the dividend yield of 2.66% is not well covered by earnings and large one-off items impact financial results.

- In light of our recent growth report, it seems possible that Lindab International's financial performance will exceed current levels.

- Dive into the specifics of Lindab International here with our thorough financial health report.

CD Projekt (WSE:CDR)

Overview: CD Projekt S.A., along with its subsidiaries, focuses on developing, publishing, and digitally distributing video games for PCs and consoles in Poland, with a market cap of PLN25.67 billion.

Operations: The company's revenue primarily comes from its CD PROJEKT RED segment, generating PLN812.26 million, and GOG.Com, contributing PLN205.97 million.

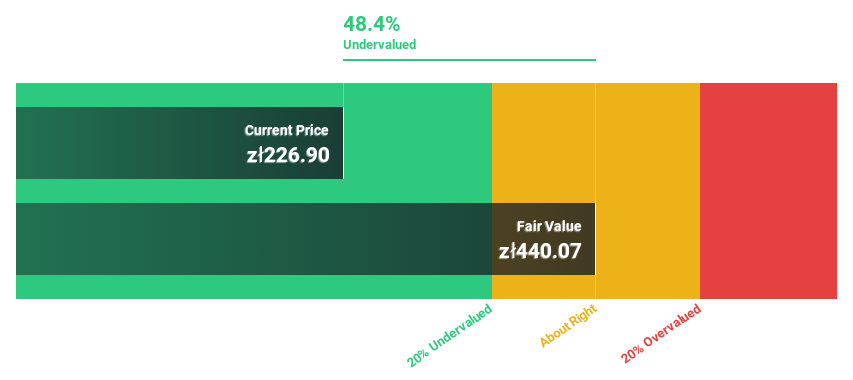

Estimated Discount To Fair Value: 34.1%

CD Projekt is trading at PLN256.9, considerably below its estimated fair value of PLN389.91, indicating potential undervaluation based on cash flows. Despite a slight dip in recent net income, revenue growth is projected to significantly exceed both the Polish market and 20% annually. Earnings are expected to grow substantially at 41.6% per year over the next three years, supported by high-quality earnings and a robust forecasted return on equity of 35.4%.

- Insights from our recent growth report point to a promising forecast for CD Projekt's business outlook.

- Delve into the full analysis health report here for a deeper understanding of CD Projekt.

Key Takeaways

- Unlock our comprehensive list of 215 Undervalued European Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:SANOMA

Sanoma Oyj

Operates as a media and learning company in Finland, the Netherlands, Poland, Spain, Belgium, and internationally.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives