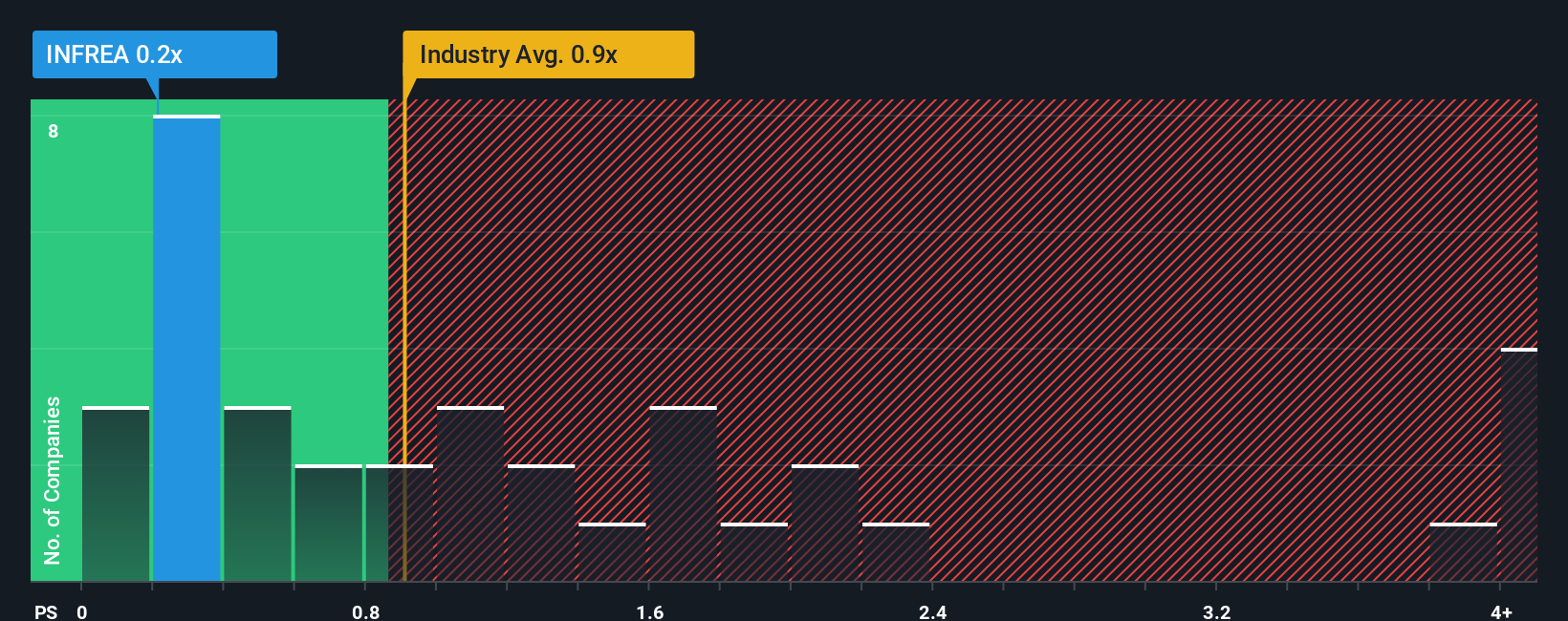

When close to half the companies operating in the Industrials industry in Sweden have price-to-sales ratios (or "P/S") above 1.6x, you may consider Infrea AB (STO:INFREA) as an attractive investment with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Infrea

What Does Infrea's Recent Performance Look Like?

Infrea's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Infrea.Is There Any Revenue Growth Forecasted For Infrea?

Infrea's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.6%. This was backed up an excellent period prior to see revenue up by 61% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 3.1% during the coming year according to the lone analyst following the company. With the industry predicted to deliver 5.1% growth , the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Infrea's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Infrea's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It looks to us like the P/S figures for Infrea remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Infrea that you need to be mindful of.

If these risks are making you reconsider your opinion on Infrea, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:INFREA

Infrea

Engages in maintaining, improving and expanding infrastructure in Sweden.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success