Indutrade (OM:INDT) Margin Decline Challenges Growth Premium in Market Narratives

Reviewed by Simply Wall St

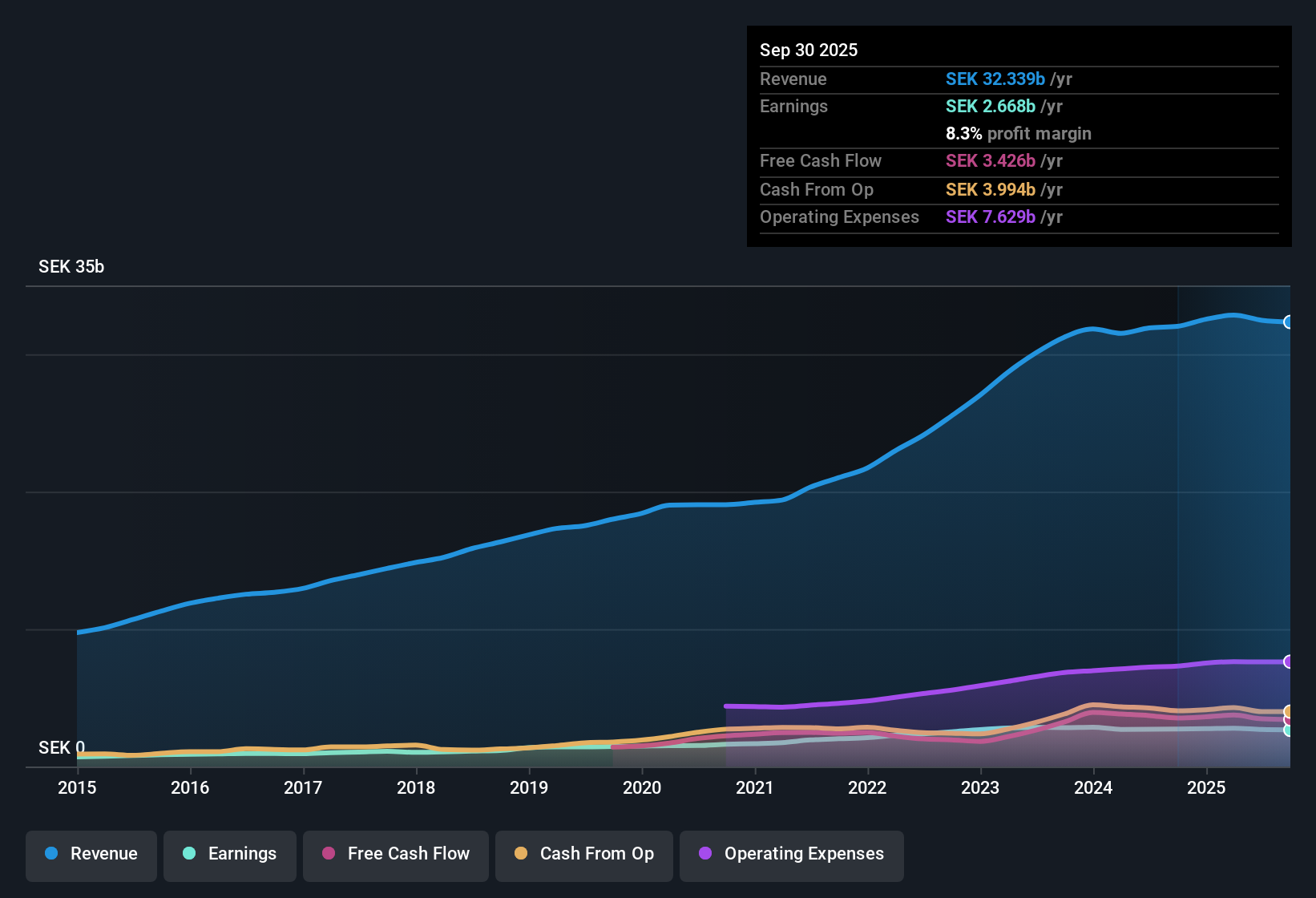

Indutrade (OM:INDT) reported a net profit margin of 8.3%, slightly lower than last year’s 8.5%, as earnings growth slowed in the most recent period. Despite the near-term dip, forecasts point to earnings growth of 14.6% per year, beating the broader Swedish market’s expected 12.5% annual growth rate, with revenues also on track to grow 7.8% per year compared to the market’s 3.3%. Over the past five years, Indutrade’s earnings have increased by 9.6% per year, giving investors a mix of recent margin pressure and strong longer-term momentum.

See our full analysis for Indutrade.Next, we’ll see how these performance figures hold up when placed alongside the narratives that shape investor expectations and debate in the market.

See what the community is saying about Indutrade

Acquisition Pipeline Powers Margins

- Indutrade’s pipeline for acquisitions remains strong, with management and analysts both highlighting that these planned deals are expected to boost gross and net profit margins. Gross margin was at a record high in Q1, and consensus sees profit margin rising from 8.3% to 9.8% over the next three years.

- Analysts’ consensus narrative emphasizes potential margin growth from strategic deals and cost management but notes that:

- Recent EBITA margin improvement was supported by one-off items, so the challenge is sustaining higher core margins as the company scales.

- This supports the expectation of future growth, as high operational cash flow and low net debt position the business to fund both acquisitions and organic expansion.

- If Indutrade can consistently achieve these margin targets alongside its acquisition strategy, it would reinforce the consensus view that profit growth could outpace peers. See how this stacks up in the consensus narrative for more details. 📊 Read the full Indutrade Consensus Narrative.

Valuation Stands Above Peers

- Indutrade trades at a price-to-earnings ratio of 34.8x, significantly above both the Swedish Machinery industry average (23.6x) and its peer group (22.8x), even as growth forecasts are higher than the market and earnings quality remains high.

- Consensus narrative concludes that this premium valuation is justified by expectations for faster profit and revenue growth relative to the sector, but highlights two tensions:

- With current profit margins down from last year and recent year-over-year earnings contraction, investors are paying up for projected results, not recent performance.

- While the share price of 255.0 SEK sits close to DCF fair value (257.92 SEK), the analyst consensus target of 275.0 SEK suggests 7.8% potential upside if forecasts are realized.

Sector Growth Outpaces the Market

- Consensus points out a 7.8% projected annual revenue growth rate for Indutrade, compared to just 3.3% for the broader Swedish market. This gap reflects the company’s focus on high-growth sectors like MedTech and pharmaceuticals, as mentioned in the filing.

- Analysts’ consensus narrative connects this advantage back to Indutrade’s push for organic growth and product innovation but flags:

- Growth is not uniform. While revenues are strong in Asia and MedTech, sales slid in North America, highlighting ongoing geographic risk.

- Consensus case depends on sustained sector tailwinds and successful execution of both organic initiatives and margin-accretive deals.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Indutrade on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a fresh angle on the results? Share your take and shape your own story in just minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Indutrade.

See What Else Is Out There

Indutrade’s premium valuation stands out in light of recent profit margin pressure and a dip in near-term earnings, meaning investors are paying for hoped-for growth rather than consistent results.

If you prefer steadier, proven performance, use our stable growth stocks screener (2089 results) to find companies consistently expanding revenue and earnings, even when others stumble.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:INDT

Indutrade

Manufactures, develops, and sells components, systems, and services to various industries worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives