Subdued Growth No Barrier To Impact Coatings AB (publ)'s (STO:IMPC) Price

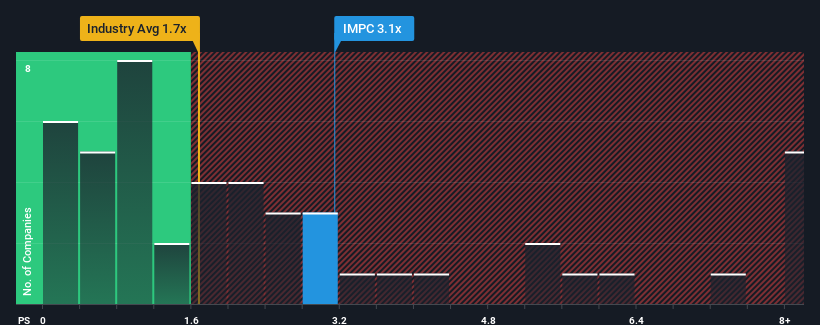

When you see that almost half of the companies in the Machinery industry in Sweden have price-to-sales ratios (or "P/S") below 1.7x, Impact Coatings AB (publ) (STO:IMPC) looks to be giving off some sell signals with its 3.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Impact Coatings

How Has Impact Coatings Performed Recently?

Impact Coatings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Impact Coatings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Impact Coatings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 45%. The strong recent performance means it was also able to grow revenue by 163% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 4.4% over the next year. That's shaping up to be similar to the 3.9% growth forecast for the broader industry.

With this information, we find it interesting that Impact Coatings is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Impact Coatings' P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Given Impact Coatings' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

It is also worth noting that we have found 2 warning signs for Impact Coatings that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:IMPC

Impact Coatings

Provides physical vapor deposition (PVD) surface treatment solutions used in hydrogen and metallization applications in Sweden, Europe, North America, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives