Some Impact Coatings AB (publ) (STO:IMPC) Shareholders Look For Exit As Shares Take 25% Pounding

Impact Coatings AB (publ) (STO:IMPC) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 15%.

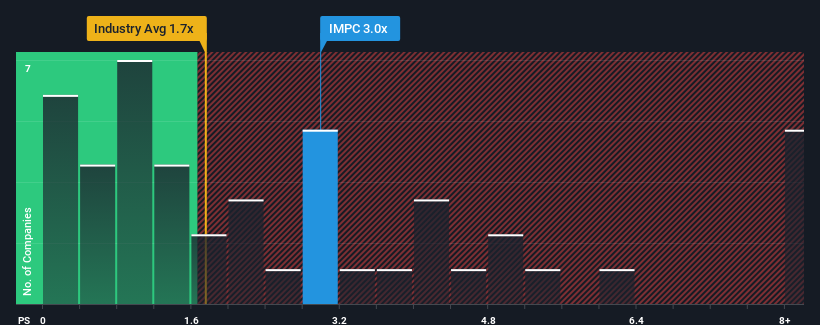

Even after such a large drop in price, when almost half of the companies in Sweden's Machinery industry have price-to-sales ratios (or "P/S") below 1.7x, you may still consider Impact Coatings as a stock probably not worth researching with its 3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Impact Coatings

What Does Impact Coatings' Recent Performance Look Like?

Impact Coatings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Impact Coatings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Impact Coatings?

Impact Coatings' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 45% gain to the company's top line. The latest three year period has also seen an excellent 163% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 1.8% as estimated by the lone analyst watching the company. That's shaping up to be similar to the 3.2% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Impact Coatings' P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Impact Coatings' P/S

Despite the recent share price weakness, Impact Coatings' P/S remains higher than most other companies in the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Impact Coatings currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

Plus, you should also learn about these 3 warning signs we've spotted with Impact Coatings.

If you're unsure about the strength of Impact Coatings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:IMPC

Impact Coatings

Provides physical vapor deposition (PVD) surface treatment solutions used in hydrogen and metallization applications in Sweden, Europe, North America, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives