Here's Why We're Watching Impact Coatings' (STO:IMPC) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should Impact Coatings (STO:IMPC) shareholders be worried about its cash burn? For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Impact Coatings

How Long Is Impact Coatings' Cash Runway?

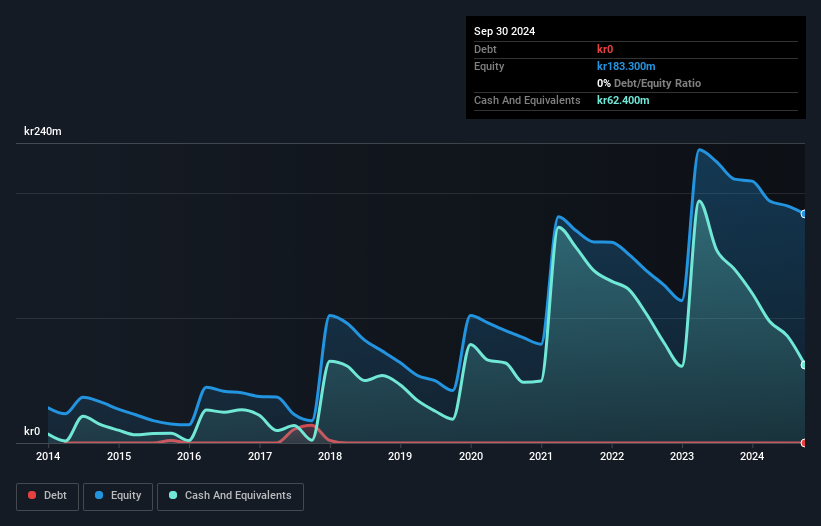

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. When Impact Coatings last reported its September 2024 balance sheet in October 2024, it had zero debt and cash worth kr62m. Looking at the last year, the company burnt through kr65m. That means it had a cash runway of around 12 months as of September 2024. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. We should note, however, that if we extrapolate recent trends in its cash burn, then its cash runway would get a lot longer. Depicted below, you can see how its cash holdings have changed over time.

How Well Is Impact Coatings Growing?

We reckon the fact that Impact Coatings managed to shrink its cash burn by 25% over the last year is rather encouraging. And considering that its operating revenue gained 45% during that period, that's great to see. It seems to be growing nicely. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Impact Coatings Raise Cash?

Even though it seems like Impact Coatings is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Impact Coatings' cash burn of kr65m is about 16% of its kr399m market capitalisation. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Impact Coatings' Cash Burn A Worry?

On this analysis of Impact Coatings' cash burn, we think its revenue growth was reassuring, while its cash runway has us a bit worried. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Impact Coatings' situation. An in-depth examination of risks revealed 3 warning signs for Impact Coatings that readers should think about before committing capital to this stock.

Of course Impact Coatings may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

If you're looking to trade Impact Coatings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:IMPC

Impact Coatings

Provides physical vapor deposition (PVD) surface treatment solutions used in hydrogen and metallization applications in Sweden, Europe, North America, Asia, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives