- Sweden

- /

- Industrials

- /

- OM:IDUN B

Idun Industrier (OM:IDUN B) Earnings Growth Surges 33%, Challenging Concerns Over Premium Valuation

Reviewed by Simply Wall St

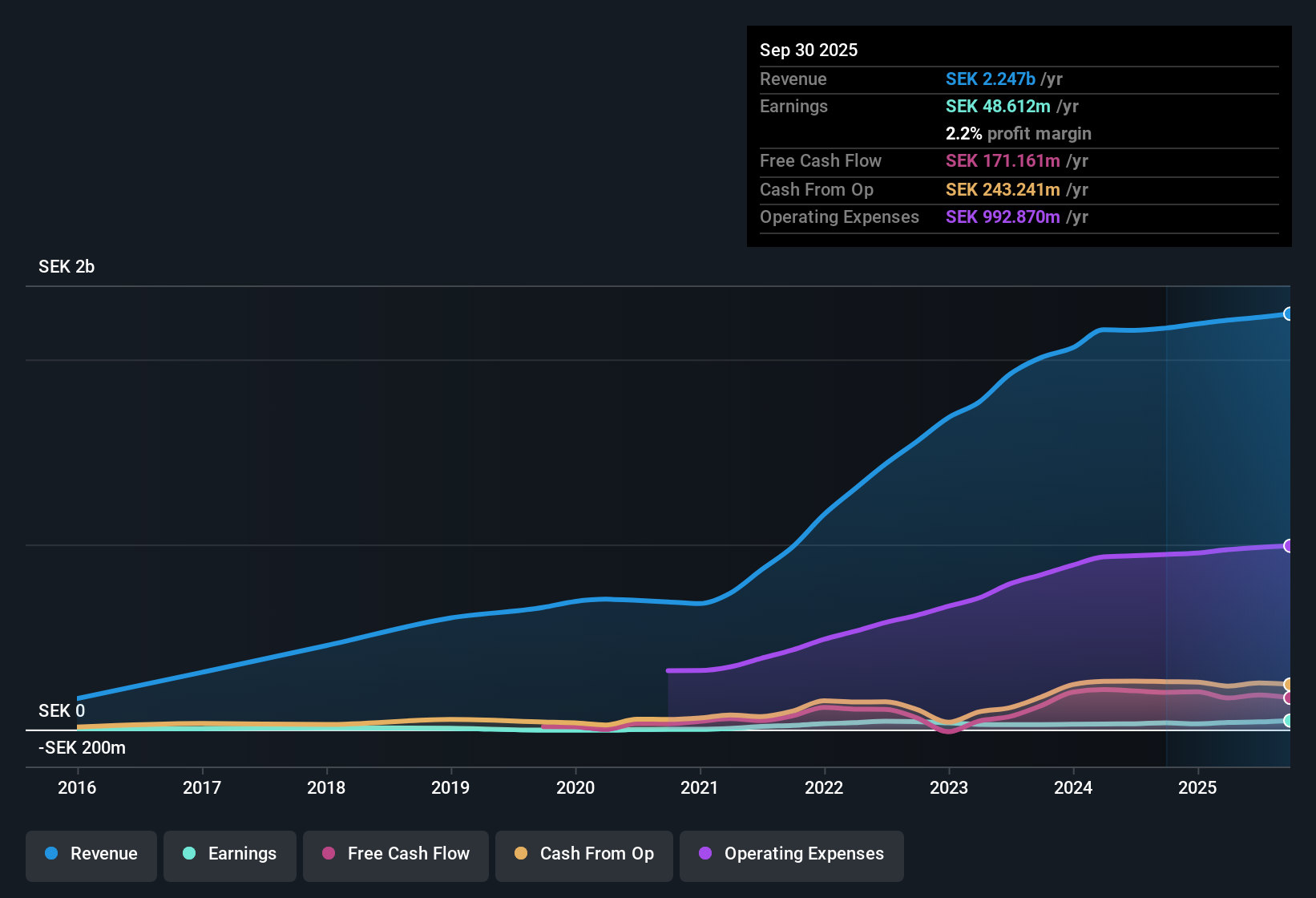

Idun Industrier (OM:IDUN B) delivered a standout year, with earnings surging 33.2% and profit margins improving to 1.9% from 1.4%. This performance easily topped the company’s five-year average annual earnings growth rate of 20.2%. Future guidance points to continued, if more moderate, expansion with earnings expected to rise 10.9% per year. With revenue projected to outpace the wider Swedish market, these results set a strong tone for investors considering the company’s growth story.

See our full analysis for Idun Industrier.Next, we’ll put these results in context by weighing them against the dominant market narratives and community perspectives around Idun Industrier. We will highlight where the latest numbers back up the story and where they might raise new questions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Edge Higher Against Five-Year Trend

- Profit margins improved to 1.9% from 1.4% over the last year, moving above IDUN B’s five-year trajectory and suggesting the company is squeezing more out of its recent growth cycle.

- The prevailing view underscores that stable earnings quality and incremental margin gains set a solid backdrop, with:

- Consistent cash-generation highlighted by an average annualized earnings growth rate of 20.2% over five years. This supports bullish sentiment that underlying profitability remains resilient.

- However, the moderation in forward earnings guidance compared to this historical pace prompts investors to question if margin improvements can continue to offset slower top-line expansion.

Premium Price Tag vs. DCF Discount

- IDUN B trades at a Price-To-Earnings ratio of 96.5x, far above the peer average of 27.1x and industry average of 22.5x. Yet, its SEK348 share price still sits 11% below the DCF fair value of SEK389.51.

- Analysis highlights a market caught between two valuation signals:

- The sizable P/E premium suggests confidence in sustained future growth even as guidance points to a slowdown, with the share price discount to DCF fair value drawing attention to potential upside for investors who focus on cash flow fundamentals.

- This contrast spotlights a debate: Is current pricing overlooking the risk of higher multiples in favor of narrative-driven upside, or could patient buyers benefit if margins and growth stability persist?

Financial Position: Key Risk to Watch

- IDUN B’s main flagged risk is its relatively weak financial position compared to peers, noted even as earnings and revenues have trended positively over recent years.

- Commentary centers around balancing the appeal of proven growth with caution about the company's ability to weather shocks:

- While solid earnings quality and outperformance of the Swedish market (4.5% revenue growth forecast vs. market’s 3.9%) are strengths, the flagged financial position risk prompts questions about long-term durability in less favorable environments.

- Investors must weigh whether a premium valuation is justified if that financial leverage risk becomes more pronounced during sector or economic shifts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Idun Industrier's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust earnings and margin gains, Idun Industrier’s weaker financial position raises concerns about its resilience if economic or sector conditions become challenging.

If you want to put financial health first, check out solid balance sheet and fundamentals stocks screener (1975 results) to uncover companies with stronger balance sheets and better long-term security for investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:IDUN B

Idun Industrier

An investment holding company, engages in the manufacture and sale of glass fiber reinforced fat- and oil separators in Sweden.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives